NATIONAL—The appeal of the boutique segment is it provides a wide range of opportunity for hoteliers and developers. It can have a brand/referral group affiliation, be independent, come to fruition via ground-up construction or be an adaptive reuse of a historic property ready for reinvention as a hotel.

An industry observation is boutique properties most often skew toward a certain lifestyle, although all lifestyle hotels are not boutique. So, while owners, developers and franchisors have embraced the segment, some also are hedging their bets by tandeming the boutique moniker with lifestyle, blurring the lines and also helping advance the cause of soft brands proffered by leading hotel chains looking to capture market share.

According to Bruce Baltin, managing director/consulting, CBRE Hotels, in addition to generally being small, boutique hotels also have high degrees of character, personalization and service.

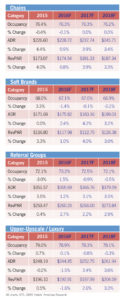

The executive sees the boutique segment as growing, although not currently overcrowded. “If you take a look at the occupancy levels [see accompanying charts], they’re all pretty healthy, as are the ADRs. And with the interests of the millennials to find something new, different, authentic, local, etc., which we hear about all the time, boutique hotels certainly fit that parameter very well. Furthermore, with the ability to get information about a hotel online, both in terms of social media reviews and information about the hotel, the hotel can really show itself pretty well online, which makes booking boutique hotels easier than it ever was.”

Baltin said from a standpoint of feasibility studies, for example, CBRE is getting “a lot of interest” from developers in doing boutique hotels and hotels being developed “in markets where it wouldn’t have been done before.”

Key for those looking to get in the boutique game is to be authentic, suggested Baltin. “Find a storyline about the hotel. Then develop and operate the hotel in conjunction with that storyline,” he said, noting delivering on the property’s service promise also is critical.

Key for those looking to get in the boutique game is to be authentic, suggested Baltin. “Find a storyline about the hotel. Then develop and operate the hotel in conjunction with that storyline,” he said, noting delivering on the property’s service promise also is critical.

The boutique/lifestyle segment tiers across four levels: chains (e.g., Kimpton, Andaz), soft brands (e.g., Ascend Collection), referral groups (e.g., World Hotels, Magnolia Hotels) and upper-upscale/luxury (e.g., Joie de Vivre, Ace Hotel), utilizing information from the Boutique and Lifestyle Lodging Association (BLLA) and data from STR and CBRE.

Baltin noted the major chains are beginning to make headway in the segment and have got into it “in a big way.”

“They all understand it’s a growing trend and something they want to participate in,” said Baltin, citing such entries as Hilton Worldwide’s Curio and Hyatt’s Unbound.

“The chains have adopted the boutique segment by getting into soft brands, but we’ve also seen some of the chains adopting the characteristics of the boutique segment even within the core brands by making them less standardized and more personalized. Even big-box chain hotels that get renovated, there’s more attention paid to style and design and locality, etc. We’re seeing that across the board, which I think is a very good thing for the industry,” said Baltin.

Lenders also have embraced boutique more strongly than in the past, which also has contributed to the segment’s proliferation of hotels, he observed.

The choice to go boutique or more cookie-cutter often comes down to location. “It’s hard to take the hotel industry and make a universal statement about it; this is a better chain or this is a better type of hotel. It’s really market specific,” said the executive.

What all of the data seem to show, said Baltin, “is the boutique/lifestyle segment is really operating at pretty healthy levels compared to the industry as a whole and has certainly established itself as a significant sector in the mainstream hotel industry.” HB