the results of Fall 2022 Industry Outlook Survey from the Hospitality Asset Managers Association (HAMA) are any indication, the hotel industry is going to finish the year better than was expected.

“The results aligned with the industry stats that the recovery is coming along nicely,” said Larry Trabulsi, past president, HAMA and managing director/EVP, CHMWarnick. “A good chunk of hotels are exceeding their expectations for this year… The outlook for next year is cautious optimism. The majority of folks are saying better, but still not quite at 2019 levels. I think that is the general state of the industry at this point.”

Approximately 60% of respondents believe most of their portfolios (75%+) will exceed 2022 budgeted RevPAR, while nearly half of participants expect 75%-100% of their portfolio to exceed 2022 budgeted GOP.

Both Trabulsi and Matthew Arrants, president, HAMA and principal, The Arrants Company, said that the recovery is a market-by-market situation. “At a high level, and even at a lower level, even within the resort world, Florida hotels recovered faster than other markets,” said Arrants. “They didn’t see the same level of continued growth that other markets did in 2022.”

He said that there is also a shifting of segments. “We saw leisure recover,” he said. “Group is in the midst of recovery and people are watching nervously for business transient to come back as the next thing.”

While the results of the survey were quite bullish, at the organization’s 2022 Annual Fall Meeting, where the results were presented, Arrants noted that the economists weren’t so optimistic about the near future. “We listened to all of the economists tell us about the doom and gloom on the horizon,” he said. “It is an interesting disconnect. While we are watching the broader macro-economics situation, what we are seeing at a more micro-level is more bullish.”

Both Arrants and Trabulsi pointed out that some things have changed a bit since the survey was originally conducted in August and September, and some ofthe results might be different now, especially the 80% of respondents who said they were “actively pursuing acquisitions.”

Roughly 60% of HAMA members surveyed believe most of their portfolios (75%+) will exceed 2022 budgeted RevPAR.

“I think folks may still be looking acquisitions,” said Trabulsi. “Again, it varies market by market, but we’re probably lining up for a scenario where the bid-ask spread between folks who are looking to buy just so money on the side, but sellers may not be there. We may be here for a period of kicking the tires, but not a lot of transactions.”

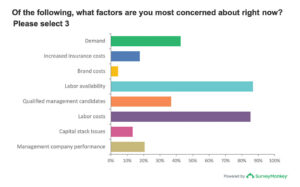

Unsurprisingly, the labor situation remains a major concern for asset managers, with 86.76% concerned about labor availability and 85.29% worried about labor costs.

When it comes to labor, Arrants said the industry needs to attract talent. “We laid off so many people during COVID and lost so many of them to other industries,” he pointed out. “Now, in this unemployment environment, we are competing with a lot of other industries”

The HAMA Conference had a panel that focused on attracting talent. “[It] focused on recruitment and changes to the work environment and really trying to get creative, to make work more compelling and make our industry more attractive to labor.”