The near-term future of the industry is looking good for members of the Hospitality Asset Managers Association (HAMA), according to the results of the association’s Spring 2022 Industry Outlook Survey released at its 2022 Annual Spring Meeting, held at the Margaritaville Beach Resort & Spa in Hollywood, FL.

The semi-annual report collected the opinions, experiences and predictions of nearly 100 hotel asset managers concerning the hospitality industry since the beginning of the pandemic through today. The survey also addressed the future of the industry.

“Fundamentals have continued to improve since February, when the impact of Omicron took the wind out of the sails of the last upward [2021] trend,” said Larry Trabulsi, EVP, hotel asset management, CHMWarnick, and a member of the HAMA board.

All of the respondents report that their hotels are currently forecast to exceed 2022 budgeted RevPAR and GOP, with about 60% expected to exceed it by more than 50%. Nearly 90% of full-service and above hotels are forecasted to exceed 2022 budgeted GOP.

“The recovery is starting to be felt in more markets, including urban markets, which were slow to recover,” he said. “The recovery, however, is uneven. Certain markets are already performing better than 2019 (primarily due to ADR increases), while others may not recover until 2024-2025.”

Trabulsi said that he was pleased to see that only 5% of respondents expect distressed or forced sales, or to hand the keys back to the lender. “It seems most owners are on somewhat solid footing with the lenders,” he said.

Almost 90% of respondents also said they are seeking acquisitions. “We have seen an abundance of capital ready to pounce on opportunities in the lodging sector,” he added. “Resorts and select-service assets are in high demand.”

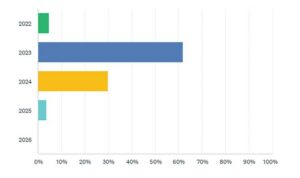

When it comes to when respondents expect to return fully to 2019 RevPAR for the entirety of the U.S., 60% indicated 2023. Interestingly, respondents believe that the top 25 markets will not recover as quickly as the rest of the country, with 53.5% looking to 2024 for recovery for the top 25 and more than 63% believing that other markets will recover in 2023.

“It varies by market,” said Trabulsi. “Some markets—resorts, the South—are already back above 2019 levels for RevPAR. Other markets—NYC, San Francisco, parts of the Midwest—are lagging in the recovery, but the slope of the line is dramatic. For urban hotels, the return of business travel is key. Hotels in urban areas that relied on midweek corporate demand should be keenly focused on return to office patterns of their 2019 top accounts and need to find new accounts if those prior top accounts do not return.”

While optimism abounds, when asked about RevPAR versus 2019 numbers, many believe they will see an increase. Nearly 70% expect to see a decline of less than 25% compared to 2019.

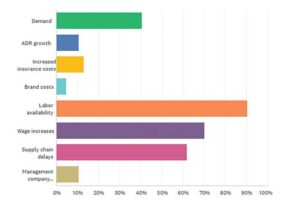

Not surprisingly, more than 90% of respondents viewed labor availability as one of their top three concerns. “Coming back from two weeks on the road visiting numerous hotels of different types in all markets, the response is the same: we need people for this industry,” said Trabulsi. “While operating models have been tweaked in response to the labor situation (i.e., different F&B options), a full recovery may be impacted by the labor shortage.”

Trabulsi noted that, coming out of the pandemic, asset managers need to be more focused on mid- to long-term positioning and strategies for their hotels. “With business recovery ongoing and cash balances hopefully improved, asset managers need to be focused on where hotels will be in 2023 and beyond,” he said