At midyear 2022, the U.S. lodging industry is putting its own spin on the traditional three Rs. While readin’ (that contract), ’ritin’ (that loan) and ’rithmatic (figuring that P&L) are still part of the mix, it’s RevPAR, Recovery and that potential minus factor, Recession, that are all part of the equation for the next six months.

The strength of the industry at this point owes a lot to support gained across some key metrics in the first half, which surprised some and restored faith in others, with any number of hospitality players categorizing the overall recovery as swift.

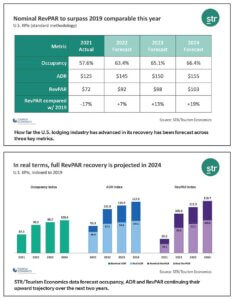

“The industry has outperformed projections, not so much in demand and occupancy, but in pricing power and ADRs being achieved on a nominal basis. This led us to revise our ADR forecast upward for the full year,” said Amanda Hite, president/CEO, STR. “What is more astonishing, inflation-adjusted ADR has been at or above 2019 levels for the past two months with June also trending in the same direction.”

Interestingly, at the beginning of 2022, it was the coronavirus pandemic that held a prominent place among forecasters’ outlooks, the uncertainty of what the virus would do next a key concern. Now, although the pandemic continues, it’s being referenced largely by what it has done, not what it might do.

“At the present time, the U.S. lodging industry has made a surprisingly quick recovery from the depths of its recession caused by the pandemic and the strain it placed on travel,” said Cindy Estis Green, cofounder/CEO, Kalibri Labs. “While commercial travel, broadly defined as the combination of group and corporate business, has not fully recovered, the unprecedented strength of leisure travel propelled overall performance, as measured by RevPAR, [and]has begun to approach 2019 levels.”

Similarly, Rachael Rothman, head of hotels research and data analytics, CBRE Hotels, said, “The U.S. hotel industry has seen strong gains over the first half, led by record ADRs on a national basis and increasing occupancy and demand. The recovery in demand has been driven by growth in leisure travel, improvements in group and individual business travel, an uptick in inbound international visitation and increased workplace flexibility. Pricing has benefited from pent-up demand, elevated inflation and the industry’s short-term lease structure.”

Hite noted as spring began, the industry’s top-line recovery ramped up, continuing its momentum into early summer in spite of national economic challenges.

“As seen throughout the pandemic, recovery continues to be led by leisure and weekend travelers,” she said. “However, data in May and early June has shown encouraging momentum building in the top 25 markets and central business districts as well as during mid-weekdays—traditional business travel days.”

STR is projecting RevPAR on a nominal basis “to surpass the pre-pandemic comparable this year. When adjusting for inflation, the projection for full recovery–as well as full recovery in the major markets and CBDs–will come after 2024.”

The executive concurred the largest demand gap persists in the corporate and group segments, but noted there has been substantial improvement. “For example, in May, higher-end hotels sold 7.5 million group rooms, which was only one million group rooms below the 2019 comparable,” said Hite. “There also has been positive development in monthly P&L data, with profitability levels trending ahead of the 2019 comparables during both March and April.”

From the CBRE perspective, Rothman tagged ADR as having made a “full recovery” on a national basis, with room rate fully recovered in most markets. “Demand and occupancy, on the other hand, are not expected to recover fully to 2019’s levels until 2023 and 2025, respectively,” she said, adding, “Incremental demand will largely be driven by continued improvements in inbound international travel [which she termed a key driver], as well as increased group and individual business travel.”

However, as shown in Hotel Business’ Outlook 2022 in January, not all markets are recovering at the same pace.

“There is always the caveat that these are national averages,” said Hite. “Recovery is not playing out the same everywhere, and there are hotels still behind in the timeline depending on property type and location.”

That timeline might grow even longer if, as observed by Kalibri Labs’ Partner/Senior Advisor Mark Lomanno, there’s a slowdown in room-rate growth.

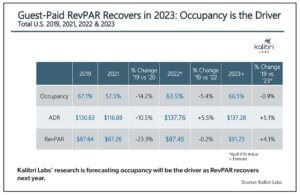

“Since the recovery from the pandemic began, the industry’s improvement has been driven by strong ADR performance,” he said. “In fact, for most segments and the industry as a whole, room rates have been above 2019 levels.” However, he noted more recently that acceleration of room-rate growth “has begun to slow and appears it may plateau for the remainder of 2022 and into 2023. As such, we believe that the U.S. [lodging]industry’s continued recovery into 2023 is going to have to rely more on increased demand than on accelerating ADR growth.”

Current AAHOA chairman Nishant (Neal) Patel, principal of Round Rock, TX-based Blue Chip Hotels, which operates largely in the economy segment, characterized the first six months “as very positive for the industry.”

Patel indicated he was not surprised by the performance strength of many of the segments in the first half, particularly economy/limited-service and midscale properties, the bulk of which (approximately 70%) are owned by the association’s nearly 20,000 members.

“Even during COVID, they were going over the long-run average regarding occupancy; 2022 numbers do not surprise us,” he said. “We expected this, and it’s continued to increase.”

With reports coming in to her from members, AAHOA’s new President/CEO Laura Lee Blake said she’s encouraged ”that they were anticipating this [positive performance],” she said. “When I was not in this role, and simply traveling as a guest, I was surprised by how strong everything was coming back, how many people were at the airport, and the hotel rates. I hope it will continue.”

That’s something the overall industry is in accordance with and how fundamentals will play out over the next six months will depend on a variety of influences on both the national and international levels.

Positives

While positive influences often get overshadowed by headline-grabbing negatives, there are some plusses in the second half, such as an anticipated increase in inbound international travel following the Biden administration’s lifting of COVID-19 testing requirements, as well as robust domestic travel during the summer months.

Right now, the industry is on “solid footing” and recovering faster than expected, according to STR’s Hite, which—barring unforeseen disrupters—bodes well for hospitality’s KPIs.

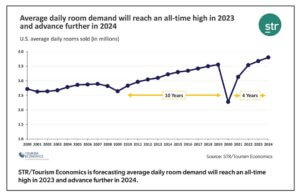

“Room demand levels have been at an average of 98% of 2019 comparables over the past three months,” she said. “Occupancy is a bit further down from 2019 levels, but that’s because supply is up by 3% from May 2019 to May 2022. ADR, not adjusted for inflation, was $11 higher, and RevPAR was just about $1 off the prior peak.” And just to add what she termed “a bit more color” to the demand side, in April and May, room demand in each month was the second highest ever recorded by STR, and at press time June was on track to set a record for that month’s demand and the fourth highest demand for a single month. “If July follows a similar pattern, it would be the highest demand for any single month since STR began tracking industry data,” said Hite.

In addition, the expectation over the next several years is average daily room demand will reach an all-time high in 2023 and advance further in 2024. (See chart on page 6A)

The STR executive noted expectations were already high for summer travel because of the pent-up demand remaining from the earlier part of the pandemic “as well as this being the first summer in three years with the entire country completely ‘open.’ The administration’s decision to lift international testing requirements adds to the excitement and will be especially important for the major gateway cities—like New York, Chicago and San Francisco—that had lagged in their comebacks and are heavily reliant on international, long-haul leisure and overseas corporate travelers.”

Challenges

What current challenges and yet-to-be-felt influences might impact hospitality’s KPIs are under the microscope by hospitality’s leading data-crunchers and industry leaders who, while enthusiastic for recovery, remain pragmatic.

“While the impact of the pandemic on travel has begun to wane,” noted Kalibri Labs’ Estis Green, she asserted a whole new set of economic variables have begun to appear. “Specifically, a significant rise in inflation, especially as it relates to fuel costs, has placed a small question mark on travel for the remainder of 2022,” she said. “Despite that, we believe occupancies will continue to improve in the second half of this year and end the year just under 64%, still a bit below 2019 levels. It is our expectation that occupancies will continue to improve in 2023 and end that year only marginally below pre-pandemic levels.”

From her perspective, STR’s Hite hasn’t seen rising costs creating “a significant hit” on demand, but acknowledged there are pressures on operations and profit margins due to many hotels servicing more guests with fewer staff. “That is where effective revenue management comes into play with properties willing to sacrifice occupancy to keep expenses down while maintaining rate,” she said.

While applauding the “enormous resilience of hoteliers and hotel emloyees over numerous months,” Chip Rogers, president/CEO, American Hotel & Lodging Association (AHLA), sees this period as one of transition for the industry, trading in one set of challenges for another.

“Just as Americans are becoming more comfortable traveling in the age of COVID-19 and the pandemic is releasing the stranglehold it had on travel demand, a new set of challenges has emerged in the form of record-high gas prices and historic inflation,” said Rogers. Still, the industry’s nearly rapid recovery so far this year has him feeling “relatively optimistic.”

And that “feeling” is based on fact, according to the AHLA, which is crunching its own numbers to share as part of its Midyear State of the Industry report, updating data from an earlier, similar report.

“In January, we and Oxford Economics predicted that room revenues would get to within 1% of 2019 levels by the end of 2022,” said Rogers. “But we’re revising that upward as part of our [midyear report}, which will forecast that room revenues will be up more than 11% from 2019 levels by the end of the year. That’s mainly driven by an outpouring of leisure travel, though we’re seeing some positive signs about business travel now as well.”

The CEO noted the figures are on a nominal basis, “and when you adjust for inflation, we don’t expect full RevPAR recovery until 2024.” (For more on AHLA industry forecasts and research, go to ahla.com/ahla-research-reports).

“There’s a travel forecast indicating all sectors are projected to be very strong in the short term,” said AAHOA’s Blake. “But, experts are anticipating that things could change in the upcoming months. So, from my perspective, and the fact that we are traveling a lot, it does appear that the travel sector is very strong. The airports are busy, hotel rates are strong.”

That said, there’s good busy and bad busy. The lodging industry’s key partners in travel—the airlines—are in their own recovery universe, dealing with the pent-up demand lodging is so grateful to welcome through its doors and into its guestrooms and meeting rooms. In contrast, media reports, especially during getaway holiday weekends, are chronicling the woes of travelers whose fights have been delayed, overbooked or outright canceled. The souring of the travel experience at the airport also trickles down to the hotel level, as many of these passengers have room reservations in place awaiting their arrival.

If and when hotel-bound guests can get to their rooms has become increasingly important for hoteliers, particularly in light of some Kalibri Labs’ research. According to Lomanno. leisure guests have dominated the demand pool since summer 2020, delivering an incremental benefit for hotels in that such guests tend to stay longer.

“In 2019, the average length of stay at hotels had been just under 1.9 nights, meaning that the overwhelming number of hotel stays were 1 night,” he said. “Since March of 2020, the average length of stay has risen to almost 2.2 nights. Interestingly, this rise in stay patterns has been almost exclusively in middle- and lower-tier hotels, with virtually no change in upper-tier properties.”

So, industry observers note, what’s happening at the airport—your anticipated guest’s plans have gone sideways—can skewer room reservations and, depending on hotel cancelation policies, expected revenue. Offered one source: “Yes, on any given day, the planes are full [good busy]but they can’t take everyone who wants to go [bad busy]. It’s tantamount to being one of five hotels with a citywide coming back to your area after three years, everyone’s coming in, all your rooms are booked and your lobby is filled with people looking for you to accommodate them. Not pretty.”

“It will be interesting to see how long they can continue having consistent flight delays and if that will change people’s opinions,” said AAHOA’s Blake, citing a recent flight of hers that was delayed, then canceled as an example. “By the time I left the hotel room in the morning, I could have driven from northern Michigan to Atlanta in 12 hours, compared to the 18 hours it finally took me to fly back. So, maybe the mode of travel will change. People will still demand hotel rooms because they want to travel.”

While it’s hoped time will ameliorate the current situation with the airlines, much of it goes back to lack of labor (e.g., pilots), something the lodging industry can empathize with as a continuing key challenge for itself.

Labor

One consistent industry challenge that escalated to major proportions since the start of the pandemic has been labor, or rather, the lack of it.

Concerning the industry’s workforce, AHLA’s Rogers indicated the association predicted in January that hotels would end the year down 166,000 jobs compared to 2019. Now, AHLA is revising that as part of its midyear report.

“[It] will forecast that hotels will end 2022 down more than 387,000 jobs compared to 2019,” said Rogers. “This is obviously due to the fact that we’re enduring one of the tightest labor markets in recent history, which is why AHLA and the AHLA Foundation remain focused on expanding the hotel industry’s labor pool and talent pipeline.”

During the NYU International Hospitality Industry Investment Conference last month, Lynette Montoya, CEO, Latino Hotel Association, observed everyone is being affected by the labor shortage. “What we’ve seen in the Latino community is there’s a great desire to work in hotels, but at the same time they’re also looking at other opportunities,” she said. “Latinos who are in the U.S. feel like they have had to work extra hard to get where they need to go. So we want to make them welcome and give them opportunity for advancement.”

Montoya noted with the rapid growth of the Hispanic population outpacing other groups, the industry could look to Gen Z and millennials to fill employee slots not only in hotels per se, but also on the ownership side, as well as allied industries such as construction.

For its members, AAHOA is looking at various options, according to Blake. “One is on the advocacy front,” she said. “We were part of the efforts to increase the age to get H-2B visas to bring in temporary or seasonal workers.” Another option is for members to consider encouraging their hourly wage employees to consider hospitality as a career path.

According to the association’s chairman, while labor shortages and supply-chain challenges over the past three years have impacted hotels’ ability “to offer guests the customer service we would normally provide,” there has been an upside of sorts. “The pandemic significantly helped more hoteliers adopt technology into their business operations,” said Patel.

Labor is not a new challenge for hoteliers, but it’s nowhere near the same game of previous decades, thanks to the pandemic and its “Jobbus Interruptus” effect. Now added to the task of finding qualified candidates is the cost of escalating wages and the ability of industry players to not only sustain larger paychecks for their labor force but meet or exceed “better offers” from outside industries.

So, is there any light at the end of the tunnel?

“The challenges around labor aren’t going away anytime soon,” said Hite. “In response, hotels have gotten creative and more efficient in the way they staff their properties and have been able to counter rising costs with an effective mix of occupancy and rate. A disciplined focus on driving revenue is what will allow the industry to sustain a prolonged period of rising costs.”

She cited the success of AHLA’s efforts at lobbying the White House for more temporary work visas, calling them “crucial” to resort operators during the summer.

“In the long run, comprehensive immigration reform would help provide the steady labor pool that industries like hospitality need,” said Hite.

Labor may still be the top concern for most hoteliers, but at midyear, light is beginning to filter into the end of the tunnel, according to Rogers. However, some observers might note it needs to be seen first—and comprehended.

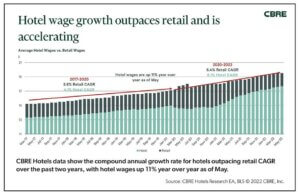

“For one, national average hotel wages have increased from $18.74/hour before the pandemic to $22.05/hour in March 2022, an increase of nearly 18%,” said Rogers. “Over the same period, the average wages of all U.S. occupations have only increased 11%. But it’s more than just record pay rates. The sheer amount of opportunity in the hotel industry right now is historic. You can start today, and if you’re willing to work and educate yourself, you can be in a management-type role almost overnight. It happens rather quickly with very good pay and benefits.”

Rogers stressed the industry is offering higher wages, more benefits and more flexibility than ever before, and the AHLA Foundation has embarked on a national campaign to highlight “the quality jobs and hundreds of career opportunities available in our industry,” he said.

Dubbed “The Hotel Industry: A Place to Stay,” the campaign aims to help job-seekers discover more about being part of hospitality.

Such efforts to attract workers may prove worthwhile in bulking up the labor force but it’s unlikely the wage war for workers will cease anytime soon.

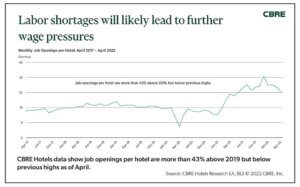

“The hotel industry, along with many other industries, is contending with reduced labor-force participation, low unemployment, workers who transitioned industries during the pandemic and what to date has been continued economic expansion,” said CBRE’s Rothman. “In our view, assuming the economy holds steady, hotels should expect wage growth to continue to outpace national averages given hourly wage rates below retail and below the U.S. overall.”

Recession

Right about now, some observers may be channeling Liza Minnelli and Joel Grey singing ‘Money, Money” from “Cabaret,” and while it, indeed, “makes the world go around,” the world may start to spin a little slower if the threat of recession turns real in the months ahead. The R word has been uttered from any number of CEOs’ lips—inside and outside the industry—during the past six months and raises the question if hospitality and allied industries should be hedging against such a possibility.

According to Rothman, the general thought is it is always wise to budget and forecast using a range of scenario analyses and a range of estimates. “Although CBRE’s base case view does not call for an economic recession, it does call for a slowdown in GDP growth of just above 0% in 2023,” she said “Slowing GDP, along with elevated inflation, rising interest rates and geopolitical risks, makes it imperative that the full range of potential outcomes are considered.”

Specifically, the executive said CBRE estimated GDP growth will decline from “a brisk” 5.7% in 2021 to 2% this year and 0.2% next year, and added this headwind is likely to present “the biggest risk to continued RevPAR gains.”

STR and its forecast partner, Tourism Economics, anticipate any recession at this point “to be less severe than the Great Financial Crisis,” offered Hite. “With strong household finances and returning business travel, there should be enough demand to mitigate light recession impacts on lodging right now.”

For its part, said AAHOA’s Blake, the organization would look “to help our members prepare for a possible economic downturn.”

Interest rates

Still humming that “Money” song? Best leave it there as another challenge comes from the Federal Reserve Bank, which in June raised the interest rate by .75%—the largest hike in almost 30 years—after boosting it a half-point in May, and on top of a quarter-point raise in March. delivering a higher cost of capital for anyone who needs a loan or has to use a credit card.

Implemented to help slow the rate of inflation as consumer demand for goods stresses the supply side, thereby pushing up prices, AHLA’s Rogers sees the move having impact on the industry. “Certainly the biggest benchmark interest rate increase since 1994 is going to slow the amount and pace at which investors are borrowing to fund new developments,” he said.

How this will play out over the next several months remains to be seen, not only for the industry directly in terms of deals, new-builds, renovations, re-fis, etc., but on the consumer/guest side as well, where discretionary income once earmarked for travel may now go to pay off higher debt.

However, STR’s Hite observed, “Financial conditions to this point have remained fairly accommodating,” but added, “As there is more tightening, the flow of credit and overall confidence in the development community would likely weaken in the short-term.”

She said STR already has reported a steady decline in hotel construction activity and roughly 70,000 rooms below the peak of 2020, adding, “At the same time, planning activity has been on an upswing, so the pipeline will be especially interesting to watch over this next year.”

“Longer-term, a higher cost of capital will result in continued declines in supply growth and increased pricing power for existing assets,” posited Rothman. “It will increase the cost of remodels, encouraging hotels to raise rates to bolster returns. We expect less of a direct headwind from higher interest rates on demand; however, those with floating-rate mortgages will spend more on housing and continued increases in rates in some markets could ultimately temper lodging demand growth.”

But not right now. As summer 2022 unwinds, “going somewhere” seems at the top of millions of Americans to-do lists.

A sizzling summer

“Pent-up demand for travel‚ otherwise known as revenge travel— is number one,” affirmed AHLA’s Rogers. “People are ready to get out and see and do many of the things they missed during the pandemic. Hotels are obviously benefiting from that.”

A recent survey conducted by Morning Consult and commissioned by AHLA showed 68% of Americans agree they have a greater appreciation for travel because of missed experiences during the pandemic and 60% say they are likely to take more vacations this year compared to 2020-21.

“This is great news, of course, but it comes under the specter of high gas prices and inflation, which are now more of a factor in many Americans’ travel decisions than COVID, according to AHLA research,” said Rogers. “So far, these issues haven’t had a huge negative impact on travel demand and we hope it stays that way.”

CBRE expects the summer travel season to set records overall. “The bulk of the summer travel was booked, and often paid for, well in advance,” said Rothman, perhaps easing a certain amount of consumer concern regarding travel expenses.

There’s also the growing trend of “bleisure,” in which travelers are mixing business and leisure trips. An AHLA-commissioned survey found 82% of business travelers would be interested in extending a trip by a day or two for leisure purposes.

“So this is one trend that started during the pandemic that we hope sticks around,” said the association’s Rogers.

International travel

While it may seem obvious U.S. hoteliers want to keep Americans traveling and booking throughout the 50 states, an increased desire by consumers to visit other countries is likely only a matter of time, especially as travel restrictions forced by the pandemic become fewer and fewer.

In June, the Biden administration dropped the COVID-19 testing requirement for inbound international travelers. including U.S. citizens, that had proved onerous for many. The downside may be increased outbound travel for Americans, but the upside is clear.

“Domestic leisure has set the pace to this point in the recovery, but we’re not projecting much more demand growth from that segment, with levels set to peak this summer and international outbound travel becoming more of an option with [fewer]restrictions globally,” said STR’s Hite.

Commenting on the move by the White House, AHLA’s Rogers noted public policy “plays a huge role in getting travel levels back to where the industry needs them to be…This was a policy change AHLA lobbied hard for, as international travelers tend to stay longer, spend more money and visit destinations where hotels have been hit hardest, like major cities.”

Location/Markets

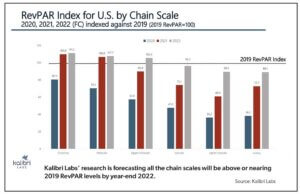

As noted earlier, the pace of the recovery for domestic hotels varies by location and market, as might be expected. When forecasting for five location types—Large Metropolitan Area, Mid-Size City, Resort/Destination, Rural Area/Interstate, Small City/Town—Kalibri Labs’ research indicates only one, Large Metropolitan Area, will not be either above or close to 2019 RevPAR levels.

“At the end of 2022 these markets collectively will still have RevPAR levels that will be more than 15% below pre-pandemic levels,” said Lomanno. “With the dominant share of their demand base coming from corporate business travel and groups, it is no surprise that hotels in the biggest markets are the slowest to recover.”

“Fortunately,” said STR’s Hite, “group and business demand are making noticeable gains with more improvement on the way.”

For gateway cities like New York and San Francisco, the lack of international travelers also has added to the slow nature of their recovery, said Lomanno, adding, “It’s now our expectation that it will be late-2023 before these markets fully recover.”

While too soon to tell, it’s anticipated the newly lifted COVID-19 restrictions will spur greater numbers of international inbound travelers, potentially moving up the timing on those particular markets’ recovery.

Lomanno maintained the speed of the industry’s recovery across the U.S. will continue to be “extremely uneven,” as it has from the start. “This is evident from the location-type performance but becomes even more apparent when we examine submarket performance and forecasts,” he said. “This will be especially true for submarkets within markets including urban and airport locations, which remain mired in a downturn, while some suburban submarkets will return to more historical occupancies and room-rate patterns. In fact, our submarket forecasts anticipate around 45% of our 975 submarkets will be at or better than 2019 RevPAR levels. Another 51% will have recovered to anywhere between 70% to 100% of pre-pandemic levels, leaving only 4% of submarkets [that]will not have recovered to 70%.

As mentioned, the majority of submarkets whose recovery will continue to lag are disproportionally in urban large markets.

“Again, the major factor will be their reliance on commercial business,” said Lomanno. “As we are not forecasting a full commercial business recovery at the national level until the third quarter of 2023, it will not be until 2024 that the industry experiences a full year of growth in commercial demand.”

On the leisure side, following a plateauing of demand during H1, Kalibri Labs expects every quarter from Q3 this year through Q4 2023 to exceed 2019 levels, with the combination of rebounding of both travel segments to result in a full RevPAR recovery in 2023, said Lomanno.

As analysis of where, when and how the industry is recovering goes on, AHLA’s Rogers said it is important to keep in mind that hotels across the country are continuing “to dig out from a two-year period in 2020 and 2021 when they lost a collective $111.8 billion in room revenue alone…so regardless of performance this year, hotels still have a long way to go to regain what we lost during the pandemic.”

The troops

All sorts of plaudits have been heaped on those in hospitality who have made it from

the start of the pandemic to midyear 2022 it’s been a tough journey. However, the road ahead appears to be a smoother one for the largely branded hotel segments—economy, midscale, upper-midscale, upscale, upper-upscale, luxury—that together with independent properties, make up the American lodging industry.

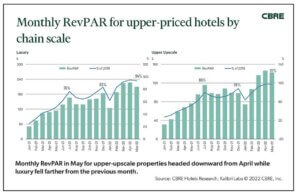

Since benchmarkers like CBRE Hotels Research, Kalibri Labs and STR/Tourism Economics each have a proprietary lens through which they view the industry’s performance, their statistical perspectives may vary, albeit usually only slightly. At midyear, however, each of the organizations indicates the segments are improving, although there are some concerns upper-upscale and luxury will be outpaced in the climb back to pre-pandemic levels.

Lower-priced hotels

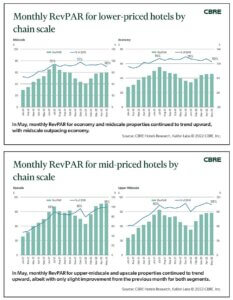

When looking at the forecast by chain-scale category, Kalibri Labs executives expect the lower-priced chain scales (KL includes economy, midscale and upper-midscale in this tier) to end 2022 above 2019 levels.

Economy

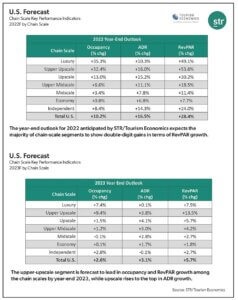

STR/Tourism Economics are forecasting the economy segment will have the least amount of KPI growth among the chain scales and independents at year-end 2022, anticipating only a 0.8% improvement in occupancy and a 6.8% gain for ADR, leading to a 7.7% increase for RevPAR. By the end of 2023, occupancy (+0.1%) and ADR (+1.7%) growth slow, pumping the brakes on RevPAR (+1.8%). (See charts on 12A)

“The economy segment is one we are watching closely because its occupancies, which never dropped to the level of the other chain scales, are pretty much plateauing,” said STR’s Hite. “If we, indeed, get to the point where consumers are contemplating having a vacation at all, it could price the typical economy guest out of the market.”

Out on the West Coast in Eugene, OR, owner Pascoal Barreto and his wife, Bebiana, also have keen eyes on an economy property: theirs.

Barreto came into the segment three years ago, running the 24-room property as a Rodeway Inn before reflagging to a Signature Inn in April 2021, very much aware of the effect the pandemic was having on the industry. (Editor’s Note: STR classifies Signature Inn as midscale; franchisor Sonesta International Hotels Corp. “super defines” it as upper-economy)

While he may have been girded for challenge, Barreto said the scenario at the two-story, exterior-corridor hotel was positive. “I would say my first month was OK because we had just started,” he said. “After that it was above my expectations compared to what I was before as Rodeway Inn.”

Much of that can apparently be traced to the hotel’s retro look, designed to recall the glory days of American travel across the country, which in 2022 seems to be back in focus given pent-up demand. “We did a lot of renovations like changing the floors, furniture, amenities, painting the interior and exterior; everything is redone,” said Bebiana Barreto.

The return to travel also has done well by the Signature Inn, which is seeing both business and leisure demand. “In business, there are a lot of ups and down, but we have been doing good,” said Barreto.

The property is a short drive from both the Willamette National Forest and the University of Oregon. and the area hosts a variety of sports events such as the National Collegiate Athletic Association Outdoor Championships, which help contribute to visitors.

The hotelier also has perspective on the current challenges within the segment, with almost two decades in the idustry, starting out as an operations manager in Saudi Arabia before moving to the U.S., where he managed hotels and motels.

His concerns at midyear include finding qualified staff, especially housekeepers and front-desk personnel, as well as making the numbers pencil.

“Since the pandemic we have been trying to boost our occupancy/ADR,” said Barreto, something he will continue to do in the months ahead. “We have been trying to push rate and occupancy because the [cost of]cleaning supplies for the rooms has increased and we have to be extra careful now with the cleaning.”

There are no plans right now to expand the portfolio—Barreto noted the recent hike in interest rates affected growth plans—however, he remains confident in the economy segment and lodging overall, driven by a “panedemic-proof” philosophy.

“The hotel industry has been my passion always,” he said. “Give the guests what they need; make the guest feel at home. Think positive. Do not look back.”

From his viewpoint as principal of Bluc Chip Hotels, AAHOA’s Patel chimed in about the segment, noting the pandemic has forced many hoteliers to embrace technology that they might not have considered before.

“For example, I have installed a kiosk at our front desk, costing me only $8 an hour,” he said. “We’re providing excellent customer service to the guest because I wouldn’t have anyone working [under these]circumstances. The kiosk can print keys, take cash or credit card payments, and give change. It does almost everything my team members would do.” However, he did add: “Of course, there’s a lack of human contact. But because times are tough right now, we have to go with what we have. We have to adapt to the situation and make the best of it.”

Midscale

Moving up to midscale, STR/Tourism Economics at year-end 2022 anticipates occupancy growth for the segment at 3.4%, ADR at 7.8% and RevPAR advancing 11.4% compared to 2021. Next year, however, the forecast for midscale puts occupancy growth in negative territory (-0.1%), while ADR and RevPAR growth are almost on par at 2.8% and 2.7%, respectively.

According to STR’s Hite, midscale demand has exceeded 2019 levels since June 2021 and, like the upper-midscale and economy chain scales, midscale demand reached a record-high in July 2021.

“This June’s demand is estimated to be the highest of the year thus far and the fifth highest ever recorded for the segment going back to 1987,” said Hite. “Nominal ADR has been above 2019 levels for more than a year and above $100 for the past two months, including our June 2022 estimate, which will likely be the highest nominal ADR ever recorded for the chain scale. Real ADR was above 2019 in the second half of 2021 and has skirted that level for most of 2022. June 2022 real ADR is estimated to be about 1% higher than in 2019.”

During his quarter-century in hospitality, Manoj Morar has dealt with the cyclical nature of the industry as well as the impact of outside influences not of its doing. So, given the disruptive nature of the ongoing pandemic, the managing partner/VP-operations of Focus Hospitality LLC has found first-half 2022 not what he expected.

“The first half of 2022 have been a pleasant surprise,” he said. “We were expecting 2022 to rebound somewhat, but the Nashville market has rebounded with comparisons to 2019.”

The city is home to Morar’s Red Lion Inn & Suites Nashville Airport, a 120-room midscale property he’s owned and operated for slightly more than two years. The company also owns and operates two Holiday Inn Express & Suites, which Morar considers part of midscale, although STR tags the brand in the upper-midscale category.

Like Barreto, the industry veteran found leisure demand outpacing what he had forecast for this year. “Before 2020 our company used to have a split of 70% business to 30% leisure; however, in 2022 the split at our properties is more like 25% business to 75% leisure,” he said.

As an airport property—the Red Lion Inn & Suites is about four miles from Nashville International—the flip in the guest mix is something the hotelier anticipates will shift in time, depending on future economic events. “If there’s no reccession and no more increase in interest rates, [it]could [encourage]the business community to start to travel again,” he said.

The two biggest concerns for the company, he added, “is the out-of-control inflation, which we believe could lead to a recession,” and the lack of viable candidates in the Nashville market to work at the properties.

Such concerns also are putting the brakes on any expansion plans Focus Hospitality was contemplating. “We are not growing the number of properties because of the interest rates, the uncertainty of business travel and the threat of a recession,” said Morar. “In 2022, we are in the process of building our capital reserves for the future.”

That said, Morar is having his properties “push ADR as much as possible” due to the high inflation rate. “This is not ideal as historically, we would always push for occupancy,” he said.

Morar at midyear still sees the glass half full, noting in terms of recovery, “The midscale segment normally returns the quickest; this year—so far—has been no different.”

Mid-priced hotels

CBRE Hotels Research teams upper-midscale and upscale properties within its mid-priced hotels statistical coverage, which includes a wide range of property types. Recent data compiled with Kalibri Labs show monthly RevPAR for category properties continuing to trend upward, albeit with only slight improvement from the previous month for both segments.

Upper-midscale

Upper-midscale in 2022 is anticipated by STR/Tourism Economics to advance occupancy growth by 6.6%, with ADR expected to move ahead 11.1% and RevPAR 18.5%. For 2023, the segment’s occupancy growth is forecast to slow, increasing only by 1.2%, while ADR will see a positive 3% change. RevPAR is forecast to show a 4.2% gain, according to the companies.

“These hotels have been above 2019 levels for the past six months,” said STR’s Hite. “June will also surpass 2019 comparables. Keep in mind that this segment set a demand record about a year ago in July 2021. Nominal ADR has been above 2019 since July 2021, with real ADR just 2% below.”

Five of the 21 hotels in the Raines Company portfolio sit in the upper-midscale segment, according to VP/Operations Dan Paola, and he, like others at midyear, has been “pleasantly surprised” at how positive their performance has been.

“We knew we would see improvement from the last couple of years but we weren’t sure when it would start,” said Paola. “We had a lot of questions. We had seen COVID numbers rising at the end of 2021 and had some trepidations about how that would affect the beginning of 2022. We weren’t sure if business travel would return and what impact that would have on occupancy and ADR. Specifically in this segment, several of the properties have continued to outperform others in their comp set and other Raines hotels in their markets.”

The 20-year industry veteran termed business as “strong,” owing to pent-up demand and so-called “revenge travel.”

“Twenty-nineteen was supposed to be the benchmark, like the greatest year ever in hospitality,” he said. “We are seeing new records for RevPAR at these properties, breaking internal and external goals. These properties are interstate locations and if you’ve driven anywhere lately, there’s a lot of people on the road. Even the high gas prices haven’t seemed to slow any of it down.”

Coming to the properties is a mix of leisure, “a good amount” of business and those increasingly sought-after bleisure travelers.

While the picture seems rosy there’s still the labor-shortage blues and other concerns that are coloring the midyear outlook from Paola’s and Raines’ viewpoint.

“Staffing and supply challenges are something we will continue to be concerned about. We know the toll inflation has had and we have to be concerned with any possible recession,” said the VP. “I see every day another company is doing layoffs. What will this mean for leisure and corporate travelers for the rest of the year? I’m not sure. I’m confident these properties will continue to do well through the summer and fall months but will be paying close attention as we head toward winter.”

Paola said he’s hopeful H2 would see a return to work not only at corporations, but in the hospitality industry in particular. The upper-midscale properties Raines has “are well-positioned to take advantage of all travel segments and we are fortunate enough to be in markets that recovered early and continue to stay strong,” he said. “We will continue to look at technology in an effort to maximize efficiencies and reduce workloads where we can.”

In the months ahead, Raines will continue to try and drive rate as “the occupancy is there.”

“We’ve seen a historic increase in wages and the cost of goods so when we measure flow-through from a cost-per-occupied-room standpoint it’s more expensive to run a hotel than it’s ever been,” said Paola. “The only way to maintain or increase profitability is to drive rate when we can and keep finding ways to help our teams be more efficient.”

Raines also plans to grow its portfolio of upper-midscale hotels.

“During the entirety of the pandemic, our strategy has been about growth. We love this segment and are actively looking to add to our portfolio,” he said. “We do have some new-construction projects that are taking off, but we have put a real focus on adding upper-midscale properties through third-party management.”

Paola is one executive who does not see the recent interest rate increases as a negative in the months ahead. “Not at all,” he said. “In fact, we are hoping that the rising interest rates will slow some of the building that has been going on and drive some of our material and labor costs down. We want to use this to our advantage as we continue our strategic growth.”

He said confidence in the segment remains strong entering the second half.

“We know this segment of hotels is really positioned well to cater to anyone,” said Paola. “From baseball teams and wedding blocks to corporate guests and groups, the upper-midscale properties can offer what just about any guest really needs. These properties can be nimble enough to adapt to changing market conditions and have really served us well through the entirety of the pandemic…The markets we choose to operate these properties in also give us confidence moving forward.”

For Rajendra (Raj) Patel, H1 didn’t spool out as he expected either, in this case fueling concern for H2 and his upper-midscale properties. Patel is assessing the midyear landscape from two perspectives: He is the managing owner of Manek Enterprise LLC, which owns six properties—three in upper-midscale, including the Red Lion Hotel & Conference Center Cheyenne in Wyoming, and also serves as EVP of Galaxy Hotels Group, a management and development firm with some 15 properties, 10 in upper-midscale.

“I expected a moderate recovery and normal feeling to the business; however post-2021, I felt a slow-down trend and it made me worry for the first half of 2022,” said Patel. “As we began the year, I was feeling energized, but at mid-March I felt we needed to be prepared for another year of crunch [due to]the gas pricing, the war [in Ukraine]and fear about COVID-19 cases up and down in different parts of the country. Tourism is another [revenue generator]we depend on and it’s not ramped up as we expected.”

Asked what about all the pent-up demand that’s talked about, Patel contended it’s specific to “a certain segment of the market but certainly not in the Cheyenne/Midwest market.” Still, he considers the market 80% recovered to the same period in 2019 and is hoping to have full recovery next year.

Patel’s concern right now is the labor shortage, particularly in light of his Red Lion’s 245 guestrooms, 23,000 sq. ft. of conference space and a full-service restaurant and bar. And it’s not for lack of trying to staff up. “[We’re] hiring three people and in a couple of weeks, we had two people quit,” he said.

Another concern is supplies. “Even though we are paying [an]average 20%-30% more, the brand supplies are not coming on time and sometimes [have been]three to four months delayed,” said Patel.

In H2, the 20-year industry veteran would like to see “help on subsidizing incentives for hiring labor” as well as for existing employees to encourage them to remain.

Patel is planning to push occupancy first, then rate in the months ahead. “I [also]would increase awareness [of]my food and beverage areas and promote the banquet facility, which will bring in occupancy as well,” he said.

He also remains bullish on the segment and is looking at a new-construction acquisition. “Upper-midscale properties are always a good investment,” said Patel.

Upscale

Upscale is forecast by STR/Tourism Economics to close out 2022 with a 13% increase in occupancy growth and a 15.2% change in ADR. RevPAR, meanwhile, is expected to show a strong 30.2% change. Next year, occupancy is forecast to improve 1.5%, while ADR growth slows (+4.1%), yielding a less-impressive 5.7% gain for RevPAR.

“Upscale hotels have been above 2019 levels for the past three months, with June trending in the same direction,” said STR’s Hite. “It should be noted that May 2022 demand in the sector was the fourth highest ever recorded, just 388,000 behind the top level from July 2019. Nominal ADR is also ahead of 2019 with real ADR about 6% less.”

Ishan Patel has had nothing but the past six months to judge how his new upscale property has been doing. While the president of Sai Galleria LLC has more than 10 years in the industry and eight hotels, it was on Dec. 31, 2021, that he took ownership of the 93-unit Sonesta ES Suites Houston Galleria.

With upscale and other brands from major chains, Patel said that he was “a bit concerned when I decided to choose Sonesta,” citing it as “a new brand.”

What was new for Sonesta International Hotels Corp., whose roots go back to 1937, was four months earlier in September it started franchising 12 of its 16 brands in the U.S. and Canada, including Sonesta ES Suites, which debuted in 2012.

(Interestingly, during the NYU International Hospitality Industry Investment Conference, Sonesta executives announced the company had added 50 new franchise hotels with Sonesta brands since the start of 2022.)

At midyear, Patel was content with his choice. “I am doing amazingly well compared to my competition,” he said.

As an extended-stay product, the guest mix is coming from a variety of sources, and Patel said he is looking to push higher occupancy. “I would like to make the most of it,” he said. “That means I would like to sell as many rooms as I can, which can generate revenue for me.”

Patel said he plans to expand his portfolio and is “absolutely” looking at acquisition, noting he would remain careful given increased interest rates and inflation.

“But if a deal comes through, absolutely we are looking at purchasing,” he said.

Upper-priced hotels

Tucking three chain scales under the upper-priced hotels umbrella, Kalibri Labs’ Lomanno said upscale hotels will almost make it back to their highs of a few years ago, while it will be well into next year before upper-upscale and luxury hotels return to levels achieved two years ago.

“The sluggish recovery at the high end of the market is almost totally the result of the still-nascent recovery of both corporate and group business,” said Lomanno. While he acknowledged both sectors recovered “a great deal” over the past 18 months, “they still are only at about 85% of 2019 levels.”

Still, there’s apparently good news on the horizon, observed the executive. “That recovery will continue to slowly improve but it is likely to be into 2024 before a full recovery will become evident,” said Lomanno.

Upper-upscale

Upper-upscale at year-end 2022 is forecast by STR/Tourism Economics to grow occupancy by 32.4%, with ADR growth half that at 16%. It’s anticipated RevPAR will show a positive 53.6% change. Next year, the segment’s occupancy growth is expected to slow considerably at 9.4% with ADR doing the same with a 3.8% change, according to the companies. The outlook for RevPAR growth at year-end 2023 at 13.5%, is a fourth of this year’s anticipated advancement.

“The upper-upscale chain scale projects the most growth this year and next because it fell the furthest during the pandemic,” said STR’s Hite. “This, of course, is the segment with the heaviest reliance on traditional groups and business travel, and demand from each sector is beginning to normalize. For example, in May of this year, higher-end hotels sold 7.5-million group rooms, which was only one-million group rooms below the 2019 figure. Despite a slower recovery due to the dearth of group travel earlier this year, these hotels are now seeing a resurgence with demand 8% below 2019 levels in April and May. June demand thus far has been just 5% below 2019. ADR also has been strengthening and is 10% higher on a nominal basis. In real terms, ADR is 3% lower.”

Independents

According to STR/Tourism Economics’ forecast for independents at year-end 2022, the segment will display an 8.4% gain in occupancy, a 14.3% increase in ADR and 24% positive growth in RevPAR. Next year, growth slows for the three metrics, with occupancy at 2.8%, ADR going negative (-0.1%) and RevPAR forecast at 2.7%.

Luxury

At the top of the chain scale, luxury is forecast by STR/Tourism Economics to show the greatest increase in occupancy growth among the segments at year’s end, advancing 35.3%. However, at 10.3%, ADR will only outpace midscale and economy. Meanwhile, RevPAR is expected to have a 49.1% increase, second only to upper-upscale. In 2023, occupancy growth will slow significantly to 7.4%, as will ADR at 0.1% growth. RevPAR is expected to hold its second-place position behind upper-upscale with 7.5% growth.

“Luxury pricing power has been [a]notable development over the last year with more travelers willing to pay a premium for greater amenities,” said STR’s Hite. “There is still room to grow occupancy further, but we are projecting rates in the sector to plateau as the balance of travel shifts from high-paying leisure guests and higher-priced leisure groups to incentive groups and higher-end corporate travelers.”

Kalibri Labs’ Lomanno noted another influence will be the increased opening up of international travel. “After two years of being ‘U.S. trapped,’ luxury travelers may again more frequently travel abroad, thereby reducing luxury demand and subsequently ADR,” he said.

Through mid-June (and including April and May), Hite said demand for luxury hotels has been strong, averaging 94% of what it was in the same period of 2019 and ADR has been well above 2019 levels in both nominal and real terms.

From his position as CEO of global management firm Pyramid Global Hospitality, Warren Q. Fields can get a bead on any number of hotel segments that stretch across the 236 properties contained in the Boston-based company’s portfolio.

That focus got a bit sharper at midyear when, in June, the entity rebranded from its previous iteration, opting to get more specific in how it addressed its assets, notably via distinct verticals that concentrate on brands in the Americas, European hotels and independent properties within its luxury/lifestyle portfolio.

In assessing the current outlook, Fields noted there is a general expectation that upper-upscale will continue to lag other segments, including upscale and luxury. However, he pointed out soft-brand growth is anticipated to remain strong within upper-upscale. “We have seen above-market performance across all segments within our portfolio both domestically and internationally,” he said. “This is due to solid operating performance by our property management platform.”

Observing that there’s strong growth for independent hotels, particularly in the 3.5-to-5-star quality levels, Fields expects to see “outstanding growth” for Pyrramid Global Hospitality in this space domestically, but possibly more so internationally.

“Given the increased operating flexibility of this property type, we are seeing more owners consider the viability of the independent option,” he said. “Since the start of the pandemic, the performance of our independent hotels has been outstanding due to their stronger leisure focus and our ability to manage the middle of the P&L.”

Pyramid Global’s independent and upper-upscale properties have presented a mixed bag in terms of performance expected at the beginning of 2022. “Our independent hotel performance has been as expected although this continues to be at levels materially in excess to 2019 from a revenue perspective,” said the CEO. “With a modestly more aggressive resurgence in business and group travel, our urban and upper-upscale hotels have performed significantly above initial expectations for the first half of 2022. Both our independent hotels and upper-upscale hotels have outperformed in profits.”

At the top of the chain scale, luxury revenue and profit performance YTD 2022 have been strong relative to expectations, said Fields, adding, “Our leisure business in this segment has been and remains strong [and]is now bolstered by the return of business and group travel. Luxury performance also is meaningfully outperforming 2019 in revenues and profits driven by the strength of leisure.”

As H2 gets underway, Fields’ concerns echo his peers: Inflation, potential recession, labor shortages, the supply chain and any exacerbation of COVID-19. “All these issues create a giant shadow over the continued rebound of the fragile pandemic recovery,” he said. “These issues might be modestly more focused toward upper-upscale, but they are present regardless of the segment.”

The CEO suggested several factors that over the months ahead could help improve some of the recovery challenges facing the upper-tier segments and independents. “A full return of business travel (both domestic and international), including airlines adding more flights; a return to office; and a more-aggressive return of business- and association-supported group travel could all meaningfully advance the recovery in the next six months,” said Fields. “Our expectation for luxury is still positive for the balance of 2022, particularly as business and group travel continue to improve.”

Also during that time he expects Pyramid to have robust growth in the upper-priced tier and independents via third-party management contracts and co-investments. Asked whether there also would be a push to “grow” rate or occupancy between now and year’s end, the 30-year industry veteran delivered an interesting response that could well overlay the midyear outlook for the entire industry.

“We are looking to drive positive customer experiences,” said Fields. “Consumers are becoming more particular in their choices and a wonderful experience will enable us to win both the occupancy and rate game.”