Guests have many choices in hotels and a variety of resources that provide information on benefits and property reviews—which means brand loyalty is more important than ever if you want to stand out. But how do you get—and keep—loyalty?

Guests have many choices in hotels and a variety of resources that provide information on benefits and property reviews—which means brand loyalty is more important than ever if you want to stand out. But how do you get—and keep—loyalty?

One of the biggest problems isn’t just the rise of competition—the overall landscape of loyalty has changed. “There is almost nowhere you can go in this world—getting gas, going to the movies, traveling—where someone doesn’t ask you to join a loyalty program,” said Noah Brodsky, SVP of worldwide loyalty and engagement, Wyndham Hotel Group.

Thom Kozik, Marriott’s VP, loyalty, agreed. “Points are no longer the point,” he said. “When points are as ubiquitous as air, that won’t create the right motivations for consumers.”

It’s easy to understand why everyone has rewards—loyalists spend more and do it more often. Brodsky said that since Wyndham Rewards revamped, “We have added more members than ever before—our members pay more per stay than non-members and that’s significantly outpacing RevPAR growth industry-wide.”

According to Brodsky, what guests want boils down to simple, generous, attainable and aspirational. “They want a loyalty program they can understand because there are too many programs and too much complexity; they want generosity [with]rewards; those rewards need to be attainable—you can’t have to wait years to get them; and they want those rewards to be aspirational because people dream about using their points in exciting ways,” he said.

“We’re seeing an increased desire for unique experiences, authenticity and transparency,” agreed Aaron Glick, Hilton HHonors VP. “To that end, we engage with our guests on the platforms they use most in order to gain insights into their needs. We also work to understand how to interact with them on the channels they are most accustomed to, like Instagram and Snapchat, which are natively mobile.”

Marriott Rewards reunited Friday Night Lights cast members—Taylor Kitsch, Zach Gilford, Aimee Teegarden and Minka Kelly—for the Spartan Super Race in Richmond, IL, earlier this year. They joined with members of the loyalty program on race day as part of the Marriott Rewards team

Kozik noted that Marriott looks at next-generation experience seekers, who come in all age brackets. For example, he remarked that when it comes to Millenials, it’s not that they aren’t brand loyal—they develop those loyalties a little later than we’ve historically seen. However, he said, “When they develop them, there’s counterbalancing data that shows they’re even more fiercely loyal than has historically been the case.”

One difference though—which brands need to take into account—is Millennials want brands to reflect their identity. Kozik pointed to companies such as Apple, Harley Davidson and Starbucks. “Once you get it right, you can find all kinds of ways to provide personalized incentives that have more meaning to people because it fits their identity,” he said. “You end up in a much stronger relationship.”

According to Liz Crisafi, head, loyalty & partner marketing, IHG, Americas, “What members want from their loyalty program is to feel a part of something special. Recognition is the best reward—rewarding members with experiences that are personally relevant to them is something a member feels and appreciates much more than points.”

So how are hotel rewards programs responding to this change in the loyalty landscape? Instant and easier-to-redeem rewards, more personalized perks and a more sophisticated understanding that not every guest is the same are just a few tactics.

“Our fundamental goal is to deliver a more personalized experience, more value and more benefits to show our loyalty back to our members,” said Glick. For example, he said, consumer research says WiFi is the most important amenity to members, so Hilton made it free for those who book direct. Room selection was another addition, which enabled guests to have “more control of their stay.”

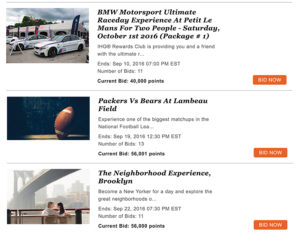

According to Crisafi, IHG’s Accelerate promotion—in which members receive personalized offers and once the offer has been achieved, points are earned automatically— has “encouraged non-members to join and enjoy the wide range of benefits we offer.” In 2015, IHG Rewards Club registrations were up 35% YOY driven by Accelerate.

When Wyndham revamped its program, it made it so that guests could stay free at any hotel for 15,000 points Simplicity was the biggest factor. “Over time, programs have gotten so cluttered and complicated,” said Brodsky.

Glick agreed. “Hilton HHonors members expressed the need for simpler, asterisk-free promotions. So we launched the Double Up Promotion, which has no caps, restrictions, blackout dates, nor any strings attached,” he said.

Wyndham Rewards recently added four member levels. Brodsky noted that the reason behind member levels was to help front-desk staff more efficiently identify the road warriors. “There’s a small group of people who travel way more than anyone else and we’ve got to make it simple for our hotel owners and front-desk associates to quickly identify them,” he said. “Everybody gets perks like free WiFi, and if you stay a little more frequently, we’ll give things like early check-in and late checkout and dedicated concierge services.”

One change Wyndham has made is focusing on travel. “We no longer encourage people to go redeem for a gas card. That’s taking the hotel’s money and giving it to Exxon,” said Brodsky. “We want our best customers to go back to our hotels, so we’ve made a huge effort to amplify the excitement around vacationing, and the impact has been tens of millions of dollars that we’re no longer giving out to gas stations and web retailers. We moved away from awards that don’t reinforce what we’re all about—travel and memory making.”

“One of the challenges with traditional loyalty programs is you get into this business of finding new ways to throw piles of points at members to get them interested, when the reality is those consumer interests are right out there for us to see,” said Kozik. “It becomes a very virtuous circle if you focus more on the experience and the forms of engagement. That could be as simple as what email did you open? Did you watch any of our short films from our content marketing team? All of those things build that picture of your engagement with us and personalize the program for you.”

It’s also not just about looking at how a guest has interacted with a brand—it’s also about how the guests view themselves. “In some cases, we have tremendous brand loyalty to brands they’re not even staying at,” said Kozik. “They may identify with a luxury brand but they’re not giving the Ritz-Carlton a large share of their travel yet. But that’s how they see themselves. When they inform us of that, that becomes a wonderful way to build on that relationship.”

Understanding that guests are different is also why more flexible rewards are necessary. “Most of us as consumers are already incentivized. How do we develop those incentives that really engage people?” asked Kozik. “Not every customer is the same nor should the kind of benefits I get out of a loyalty program or my involvement with a loyalty program look the same.”

“There are people of every demographic who like instant gratification and people of every demographic who want to save up for a once-in-a-lifetime award,” said Brodsky. He noted that Go Fast, a way to redeem a stay using 3,000 points and cash, was designed for those guests who aren’t likely to save up for that free trip quickly.

Kozik agreed, noting that Marriott has a similar program, Cash + Points. “Some people want instant gratification because they know their travel pattern is such that they’re never going to save up for that dream trip to the South Pacific, whereas other people are road warriors who know another six months of just doing my job and I’m going to get that dream trip,” he explained. “Those two expectations live side by side, and you need to architect a program that recognizes they have equal value. That person who wants immediate gratification—that’s today. There’s any number of factors that will change those expectations over time and the program has got to be flexible enough to adjust. Cash + Points was a way to solve that instant gratification piece. Why should they be penalized to not have the benefit of the program?” Other launches designed to be flexible include points sharing and Points Advance.

Because life events dictate travel, you have to recognize how the customer journey can change. “You have a child and you won’t travel as much. Or your job changes. You’re a loyal customer; you just can’t travel right now and the program should accommodate that,” said Kozik, noting that’s why Marriott has the Experiences Marketplace. “You’ve got a bunch of points and can’t travel? Go to a concert locally or take advantage of an NFL game. These are things you can use your points for that don’t necessarily involve a hotel stay.”

Glick agreed. “Travelers are loyal to brands that enable exclusive experiences. Through the Hilton HHonors Auction Platform, we’ve given members access to memorable events, like Live Nation concerts or private dining or meet & greets with their favorite band.”

Crisafi added that member events are another way to make guests feel special. “These events were created as a way to say thank you to our most loyal members,” she said. “It also allows them to share rewards with the people who matter most to them. And those are truly the rewards that matter most.”

“Hilton HHonors offers truly once-in-a-lifetime experiences like dinner before a music check with the Barenaked Ladies, access to an intimate Jason Derulo concert in one of our premier properties, drum lessons with your favorite musical artist, or sporting events, like McLaren Racing,” added Glick.

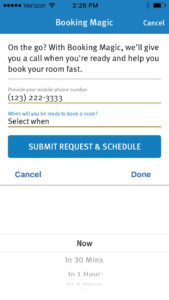

Of course, you can’t talk about loyalty programs without talking about loyalty apps. Creating utility on apps—whether through keyless entry, check-in and checkout, the ability to make requests—all makes it likelier that travelers will want to use your app and interact more with your brand. “Technology has completely altered how brands relate to consumers,” said Crisafi. “It has changed the way people relate to other people, and how they make choices and share experiences.”

“The number-one ask is for technology that makes travel easier,” Glick said, agreeing. “We’re becoming more reliant on our mobile phones—it’s vital that hotel loyalty programs take this into consideration. That’s why we’ve worked to make the Hilton HHonors app our members’ personal remote control for their stay.”

“We feel that ease-of-use and simplicity are vital to increasing guest loyalty,” he added. “Over the coming years, Hilton HHonors will continue to look at points redemption via the mobile channel. There are some innovative opportunities for guests to use points in more flexible ways.”

Crisafi noted the highest users of IHG’s app are IHG Rewards members, and mobile revenue is up more than 30% in the first half of 2016. “It’s one of the key touchpoints to engage, recognize and reward loyal customers,” she said, noting mobile redemption is a priority, whether that be for reward nights, merchandise, digital rewards or auctions. “We are aiming to have virtual assistance integrated into the IHG App by end of year, which will handle general inquiries, information about reservations and IHG Rewards Club accounts. For guest requests while staying on property, we are testing the messaging feature in the IHG App at a number of hotels, with plans to expand to more in 2017.”

Wyndham—seeing that the majority of its app users are searching for hotels in their current location—added Booking Magic, in which users request a call from Wyndham for help booking a stay, “We’re seeing continual growth in that feature,” said Brodsky. Of course, this isn’t a feature every brand necessarily has to have—it’s about knowing your customer. “The uses of an app are going to be different from luxury to full-service to limited-service. Certainly, we are tailoring an app that will be functional for everybody, but that’s cognizant that needs are different at a roadside economy than one of our luxury resorts.”

Kozik called apps a never-ending arms race. “We’re focused on improving our app in ways that make it more of a personal travel tool,” he said, noting that the company is in the process of adding Bluetooth beacons in hotels to help interact better with guests by sending them offers based on location and preference. “We learned who you are and we send you the appropriate messages at the appropriate time,” he said.

Brodsky cautioned against the devaluation that loyalty has seen in the airline business. “I’m in the loyalty business for a living and I can barely understand it—all of these different types of tier status points,” he remarked. “It’s completely opaque.”

Looking to the future, Kozik noted that hotel loyalty programs have opportunities that others don’t. “Think about how we all interact on social media when our friends post that picture on the beach or say I’m going to San Antonio; everybody dog piles with a like or a suggestion of places to check out,” he said. “We love, as a society, to engage in discussion around travel even when we have no travel of our own intended. How do you then shape a loyalty program, which has been traditionally based on you staying in a hotel, to one that engages with you even when you’re not traveling? That’s the key transition. Because travel is such a visceral topic for people, we’ve got an advantage to differentiate and change to a program that has a relevancy even when you’re not on vacation.”

And while travel is important now, Crisafi said this would increase. “In 2020, the number of trips this generation will take is predicted to reach 320 million, a 47% increase from 2013. Millennials are challenging some of the norms of travel with flexible working patterns, seeking more personalized experiences and being more open to using the sharing economy,” she said. “All of this is a great reminder to plan for where your customers are headed, not just what is important to them today. The biggest mistake anyone can make is not to evolve or be afraid to lead to change needed. The most important thing we can do to ensure the value of our loyalty program is to listen to our guests.”

And where loyalty goes is important. “People are going to start making decisions; there will be winners and losers,” said Brodsky. “We’ve seen this proliferation of programs and we’re going to reach a tipping point that we haven’t gotten to before where people start saying, ‘No thanks.’ Some of the research is showing you’re starting to see in some groups that [the number of loyalty programs they’re in]have started to drop. When that happens, you want to be somewhere that has true loyalists.” HB

What’s the impact of loyalty member book-direct rates?

NATIONAL REPORT—One major way the hospitality industry has tried to entice guests is through offering member-exclusive rates to those who book direct. Companies like Choice Hotels International, Marriott International, Hilton Worldwide, InterContinental Hotels Group and Hyatt Hotels Corporation have implemented measures with a strategy of reducing the cost of customer acquisition and increasing brand exposure. (At press time, Red Lion Hotels Corporation was the only hotel company to offer loyalty rates on an OTA website via a partnership with Expedia Inc., in which guests are also provided a direct sign-up to Hello Rewards.) But what effect will these measures have?

Thom Kozik, Marriott’s VP of loyalty, said thus far, member rates have been successful. “We’re pleased with the progress and we’ll continue to see how we can grow the program and the benefits,” he said. “Direct booking isn’t just about saving a few dollars here and there—it’s about deeper engagement.”

Hilton HHonors VP Aaron Glick added, “This is the most effective way for us to ensure a more personalized and memorable stay. We launched ‘Stop Clicking Around’ to educate consumers on the misconception that booking via third-party sites is cheapest. In the weeks following, we’ve seen the highest Hilton HHonors enrollments, the highest level of web activity and the most downloads of our app in several years.

Liz Crisafi, head, loyalty & partner marketing, IHG, Americas, agreed, noting that OTAs remain an important partner for driving incremental revenue. “We are driving material increases in revenue contribution for new and existing members. Enrollments are significantly up, as are return stays and points’ redemptions—a strong sign that members are engaged with the program. Since the launch, we have seen a material two points shift in growth rate to direct web from OTA,” she said. “We are not seeing any ADR decrease as our revenue management systems adjust to account for Your Rate as part of business mix at each hotel, but we will monitor performance to address any concerns that may arise.”

In a webinar about Q2, Katie Moro, director, Demand360 data partnerships for TravelClick, which provides analysis of hotel booking data, noted, “In brands that are participating in book-direct initiatives, we are seeing growth from a brand.com standpoint and we are seeing flat in OTA.” In those not participating, TravelClick is seeing the reverse. “Is that OTA business from the brand going to the independents or is it going to brand.com? I don’t know but there’s definitely a shift happening.”

John Hach, senior industry analyst, TravelClick, told Hotel Business that the company tracks bookings made by loyalty members. For Q2 of 2016, the presence of the loyalty number was in 58.7% of reservations. “We started tracking loyalty a couple of years ago, and it’s gone up from 56%, but growth overall has been slow.” Hach noted that the major loyalty pushes only began in Q2 so it’s still early days.

Hach agreed that loyalty can’t just be about discounts. “All of the brands are looking at this: How do we engage, attract and increase frequency? It’s not just rate alone that creates conversion. It’s a combination of rate and added value. There are other major drivers—such as WiFi and F&B—that get people to stay at a hotel with more frequency than hotels that don’t have similar offers.”

“Our campaign may have brought in new members, but our program overall is what encourages retention year-after-year,” commented Glick.

Hach agreed that initiatives such as this can help get people in the door, but then the hotel has to offer more to get them to come back. “There’s three major initiatives every marketer wants to achieve: recency, frequency and high monetary value.

“The hotels have done a good job correlating a reasonable [member]discount with an incremental stay. But as demand continues to decelerate, will they become more aggressive? You have to balance discounting with added value inclusion,” he said.

—Nicole Carlino