From the outside, it might appear the U.S. lodging industry “is back,” with second half rife with stories of how the pent-up consumer demand for travel burst over the summer, flooding hotels with occupancy. A quick check of the recently ended holiday season could suggest the same, as travelers in numerous cases battled often extreme conditions and circumstances to get where they were going, determined to make their seasonal treks.

But what’s it look like from the inside? According to the lodging industry’s major stats-and-trends trackers, the outlook for 2023 appears positive—albeit peppered with forecast words like “unusual” and “challenging”—building on the gains made in surviving the impact of the ongoing coronavirus pandemic and other disruptive influences.

“[The] U.S. hospitality industry has seen a tremendous bounce back over the past three years, and with 2022 ending short of 100% recovery, there is room for continued year-over-year growth even with a recession on the horizon,” said Amanda Hite, president/CEO, STR. She noted room demand was “just below” 2019 levels, while year-end occupancy was “slightly further behind the pre-pandemic comparable” due to supply growth. ADR was “well ahead of 2019 levels” and was continuing to advance in line with inflation.

“This puts the industry in a position of strength even if the wider economy begins to slow, and it provides additional wiggle room even in a slow-to-no-growth GDP environment,” said Hite.

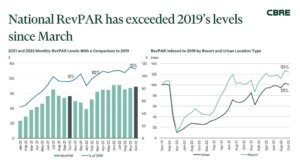

From a “purely top-line perspective,” Rachael Rothman, head of hotels research and data analytics, CBRE Hotels, asserted the U.S. hotel industry has never been stronger, noting the positive real GDP growth in Q3 2022, coupled with high inflation rates, led to record nominal RevPAR levels. “At the national level, nominal RevPAR has exceeded 2019 levels since March 2022 and based on the latest data available through October 2022, nominal RevPAR levels are 111% of 2019’s levels. As of October 2022, adjusting for inflation, and using 2019 as a base, real RevPAR was still down 4%,” said Rothman. (See chart above.)

A year ago, much of the industry focus was on the damage the pandemic would continue to do in terms of overall recovery. By midyear, those concerns were supplanted by fears of a recession and how deep a cut that could make. Indeed, Hite observed the biggest change to STR’s forecast between the first and second halves was the assumption of a recession. “Back in mid-2022, we factored in some economic slowing, but [with]continued GDP growth and the slowing likely not touching our industry. By late-2022, that thinking had shifted, and we penciled in a mild recession for 2023.”

She added this assumption was “somewhat unique” as far as forecasts go “because generally you don’t forecast a recession. So, it’s been an unusual forecast situation because we ended 2022 with very strong actualized performance and no signs of a slowdown in our industry, but economic factors are strongly suggesting that this year might be challenging.”

CBRE Hotels Research expects RevPAR growth to slow to 5.8% in 2023 (despite its Economic Advisors’ forecast for a 0.3% decline in GDP) from 29.4% in 2022, primarily due to the economic slowdown and high inflation levels. ADR growth year-over-year and occupancy growth are forecast at 4.2% and 1.6%, respectively.

“We expect 2023 RevPAR growth to be front-end loaded, particularly in Q1 2023,” said Rothman. “Our RevPAR forecast for Q1 calls for 15.6% growth, followed by growth in the 2% to 4% range over the balance of the year. Our Q3 2022 forecasts call for a full recovery in ADR and RevPAR in 2022, followed by a recovery in demand in 2023.”

STR is expecting hotel demand recovery this year, with “record-high demand” in 2024. Hite noted, however, “We’ve been slightly more cautious when it comes to demand growth in [2023]. Persistently high inflation, rising interest rates and a slow reduction in excess savings will constrain consumer spending [this]year, and that’ll modestly impact our industry.”

Coupled with that is “extremely strong” pricing power, with the industry continuing to outperform expectations, Hite added. “We are expecting rate growth to continue into 2023 and beyond but expect the pace to start moderating back into single-digit growth year over year,” she said.

From his perspective, Mark Lomanno, partner/senior advisor, Kalibri Labs, suggested that—as with any annual predictions—there are many positive and negative factors to consider in assessing what lies ahead this year for the lodging industry.

Among them he cited inflation, the state of corporate travel in the wake of “massive” layoffs, the potential for a recessionary environment, as well as continued strong leisure-travel demand.

That demand, perhaps the pandemic’s only silver lining that saw COVID-concerned consumers in the air and on the road the minute they thought it was safe to travel, also has put rate in a new light, Lomanno observed.

“One of the things that we have learned from 2022 performance is that the current lodging consumer is much less resistant to price increases than they have been historically,” he said. “Of course, it is always possible that consumers may not have always been as price sensitive as the industry may have perceived them to be.”

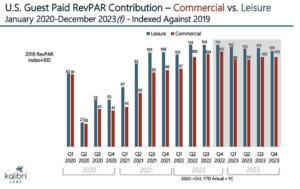

Kalibri Labs’ data indicates U.S. guest-paid RevPAR will recover this year, with occupancy predicted at 65.7%, up 1.9% over 2022 (forecasted); ADR at $142.53, ticking down 0.7% from $143.45 last year (forecasted); and RevPAR at $93.63, up 1.2% from $92.48 in 2022 (forecasted). (See chart above.)

Lomanno noted Kalibri Lab’s occupancy forecast is generally in line with other hotel industry prognosticators, but described its ADR forecast as “a bit more conservative” than others. In addition to some of the influencing factors he cited, Lomanno said Kalibri Labs saw “unusually strong ADR growth” in the fall and early winter of 2022. “In fact, when comparing ADRs in September, October and November to those same months historically (excluding 2020 and 2021) and comparing them to ADR levels in the summer months, we have seen outsized growth,” he said. “The question is whether this is an anomaly or the new normal? Only time will tell, but for now, we would like to see a few more months of data before retooling our forecasting methodology.”

Whether a glitch or a given, STR tags ADR growth as “strong and stable” across all segments of the chain scale universe that includes economy, midscale, upper-midscale, upscale, upper-upscale and luxury hotels, which together with independent properties, make up the U.S. lodging industry.

Similarly, Rothman observed while performance varies by month, CBRE has seen continued improvements in top-line performance at all chain scales relative to 2019, with only the luxury chain scale remaining below 2019 levels (at 98% of 2019’s RevPAR in October).

“We expect all chain scales to show improvement in 2023, but the resumption of international travel, higher inflation and increases in group demand to most benefit West Coast cities; group travel destinations with a leisure component; and luxury hotels,” said Rothman.

Interestingly, and in a departure from recent years, Hite said there isn’t one top-line KPI that will be the key driver in 2023. “Both occupancy and ADR are expected to increase by roughly the same amount year over year,” she said, “which is yet another signal that we’re finally returning to normal performance patterns.”

What’s normal?

If there’s anything the industry has been craving it’s “normal,” whether it’s new or not. The tricky part has become figuring out what passes for “normal” nowadays, wherein just having the ability to run a business without always having to cope with the rollovers of any number of butterfly effects tops many a hotelier’s wish list. That said, over the past few years, the industry’s players, from first-time newbies to seasoned seen-it-all CEOs, have become increasingly nimble in addressing the issues that arise. Part of that agility stems from the support and guidance offered by hospitality’s membership groups, including the American Hotel & Lodging Association (AHLA), AAHOA and the Latino Hotel Association (LHA). In assessing what the new year might bode for the industry overall and its memberships, each of the associations’ leaders pointed to the increased performance robustness generated during 2022 and the surer footing it is providing this year as opposed to the uncertainty felt in January 2022.

“Hotels continue to make significant strides toward recovery,” observed AHLA President/CEO Chip Rogers, who tagged 2022 as having one of the “strongest summer-travel seasons ever, pushing hotel leisure travel revenue over 2019 levels,” with business travel trend lines also moving “in the right direction” throughout the year.

However, Rogers indicated this year would once again be a mix of positives and negatives for the AHLA’s more than 30,000 members nationwide and the industry in general. “In 2023, hotels will continue to meet or exceed certain performance metrics on a nominal basis, but when inflation is taken into account, hotels likely won’t see full recovery until 2025,” said the executive. He added 2023 also could see hotels begin a “new normal” in operations. “One where challenges such as staffing shortages and economic factors like inflation replace COVID as top operational concerns.”

In agreement is Laura Lee Blake, president/CEO, AAHOA, whose nearly 20,000 members—many of whom own and operate branded, franchised hotels concentrated across the economy to upscale segments—represent in excess of 34,000 member-owned hotels with more than one million employees.

“The industry has made significant strides in recovering from the impacts of the pandemic, but there are hefty headwinds going into the new year,” said Blake. “Inflation remains stubbornly high; the industry is confronting persistent workforce shortages and higher costs for labor, utilities and supplies; and there are signs that this year’s pent-up demand for travel may be easing as consumers confront high rates of credit card debt and lower personal savings.”

She added the industry also has to acknowledge “the possibility of a recession in 2023—likely to be mild—or at least continued sluggish growth.”

Lynette Montoya, president/CEO of the 500-member LHA, indicated the industry’s performance has been “better than expected” from a year ago. “Owners [are]maintaining ADR and still working toward better occupancy; RevPAR numbers are good. We are still in recovery but expect to be firing on all cylinders over the next few years as business travel ramps up,” she said, adding, “This is a general outlook. There continues to be issues with lack of employees.”

Challenges

Labor, a perennial concern for the industry, is just one of the challenges being wrangled, with most tied to—what else?—money.

“High inflation and the rising interest rates meant to subdue them will constrain consumer spending and business investment and that, in turn, will pressure leisure and corporate demand,” observed STR’s Hite, noting, “The appreciation of the U.S. dollar incentivizes outbound demand and makes it more expensive for Europeans to visit the U.S.”

On the upside, both ADR and RevPAR recovered last year, according to STR, and are expected to continue improving in both the short- and longer-term; however, Hite stressed inflation-adjusted ADR and RevPAR will take longer to recover. “In 2022, strong demand helped keep rate growth in line with inflation, as high as it was. This year, we expect that while rate will continue growing, inflation will grow faster, and so inflation-adjusted ADR and RevPAR will take a few more years to reach full recovery,” she said.

Rothman ticked off similar economic negatives/positives, citing CBRE Economic Advisors’ outlook for a 0.3% decline in GDP this year as a near-term headwind to demand growth, a tight labor market expected to pressure margins and elevated interest rates that could make it difficult for those looking to refinance or renovate.

“That said, the GDP decline comes at a time when international boarders, particularly in Asia, are easing for the first time since the pandemic began, household checkable deposits are at all-time highs, and group and FIT business travel continue to improve. All these factors should drive positive mid-single-digit RevPAR growth in 2023,” she said. [Editor’s Note: At press time, China announced it would drop COVID-19 quarantine requirements for international arrivals and allow the resumption of outbound travel for Chinese citizens, which previously had been banned due to the pandemic. It was unclear if outbound group and package travel, reportedly banned since late-January 2020 by China’s Ministry of Culture and Tourism, also would be allowed to resume.]

LHA’s Montoya agreed inflation is on everyone’s mind. “Yes, inflation is a concern, but in the hotel industry, we are a great hedge against inflation because we can change rates daily,” she asserted, suggesting, “There is only so much expense you can push onto the traveling public.”

Closer in, her key concerns are with potential property-level issues, such as the U.S. Department of Labor’s Wage and Hour Division’s “Notice of Proposed Rulemaking, Employee or Independent Contractor Classification under the Fair Labor Standards Act” [87 FR 62218 (RIN: 1235-AA43)] that would change existing policy [known as the 2021 IC (Final) Rule]and which AHLA also opposes, along with a plethora of Chambers of Commerce, associations and businesses. As presented, the proposal “would make it even harder for hotels to quickly hire contract employees, resulting in an overwhelming number of vacancies,” Montoya contended.

The proposal has received strong support from other quarters, including The Leadership Conference on Civil and Human Rights, the Economic Policy Institute and numerous leading Democrats.

AAHOA’s legislative priorities include addressing the labor shortage challenge via expanded visa programs and expedited visa-processing times, noted Blake.

Business travel

While leisure travel has gained ground, one of the key industry concerns has been the resurgence of business travel, which, according to STR’s Hite, continues to be an “interesting conundrum.”

“Consumer sentiment is still fairly negative—our traveler survey still shows net propensity for business travel down double-digits on pre-pandemic sentiments—but we have seen continued improvement in weekday demand since late-2022. And then anecdotally, there’s a lot of enthusiasm surrounding business travel,” she said.

While business travel hasn’t fully recovered from STR’s perspective, Hite indicated more improvement should come. “The rapid rise of group demand from mid-2022 has given us a lot of confidence in the future of corporate demand. Anecdotally, we’re hearing that calendars are completely stacked this year and some hotels are having to turn groups away because demand is so high,” she said. She also cited the impact of post-pandemic work-from-home policies. “[This] could open new avenues to attract corporate demand when remote work teams meet in person or remote workers take advantage of flexible working policies to extend leisure or business trips. Another key insight from our traveler survey is the obvious popularity and propensity toward ‘bleisure’ trips,” said Hite.

In addition to the swiftness of the U.S. hotel industry’s recovery in 2022, CBRE’s Rothman suggested there could be another upside twist this year. “That the industry could fully recover, on average, without a full return to office and without a full recovery in the FIT business traveler. In our view, we believe continued growth in group travel, particularly corporate group, association and convention travel, will be material growth drivers in 2023. We also expect continued improvement, albeit more modest, in the more traditional FIT business travel,” she said. Rothman noted the disconnect between forecast GDP and RevPAR growth this year will be advanced by the continued reopening of in-bound international travel, increases in group demand “and a modest uptick in traditional business travel.”

Although robust leisure demand may slow this year, it will continue to outpace commercial demand growth, according to Kalibri Labs’ Lomanno.

“Looking at 2023 from both a commercial and leisure standpoint, we believe both broadly defined segments will have fully recovered to 2019 levels,” he said, noting since Q3 2021, leisure demand has remained strong and, combined with aggressive pricing by hotels, has resulted in RevPAR levels that “far exceed” pre-pandemic levels.

“While we believe that leisure demand will plateau a bit next year, those levels will remain at historically high levels,” said Lomanno. “Commercial demand, while continuing to rebound, will lag the growth experienced by the leisure segment. However, strong ADR growth across all industry segments will propel RevPAR growth for commercial business in 2023.” (See chart above.)

Interest rates

If it seemed like a lot, it was. “It” being the number of times the Federal Reserve raised federal funds rates last year—seven in all—in its quest to tamp inflation. The most recent came mid-December with a raise of half a percentage point, a departure from each of the four previous consecutive raises of 75 basis points, and delivered a targeted range between 4.25% and 4.5%, putting it at its highest level since December 2007.

In Hotel Business’ Midyear Outlook 2022, lodging industry players and aligned companies already were concerned about what the U.S. Central Bank was doing following two rate raises in the spring that, combined, were equivalent to one of the subsequent boosts (March/25bps; May/50bps).

Now, with the specter of more hikes this year, how much it will affect hoteliers vis-a-vis financing, leisure and corporate demand, consumer discretionary spending, etc., remains to be seen.

STR’s Consumer Insights research shows personal financial situations currently are the top barrier to travelers, ahead of any continued COVID concerns, and about half of the survey panel expected their financial situation to deter or prevent travel in 2023. “Price or value for money is also a key driver when booking accommodations, so financial considerations are very much top of mind for leisure travelers this year,” said Hite. “For companies, the considerations will be similar: ‘Should that meeting be held over Zoom?’ ‘Do we send one person or five to that conference?’ We expect that it’s not so much the rate hikes themselves, but rather the impact on the wider economy that’ll affect hotel performance [this]year.”

Expansion could also suffer. “Higher interest rates will be an incremental headwind to new development,” said Rothman. “CBRE expects supply growth to slow from the long-term historical average of 1.8% to 1.1% over the next five years. The slower supply growth should bolster RevPAR growth longer-term.”

Still, the escalating cost of doing business is unlikely to seriously deter the current crop of hoteliers who survived the worst of the pandemic and are determined to thrive in 2023 and beyond.

“Our members are bullish on the industry and they want to invest,” said AAHOA’s Blake. “Of course, increased borrowing costs are a factor. Many of our members are small business owners and are already confronted with higher costs for construction materials and labor, as well as operating costs. Higher interest rates affect them just as they do homeowners, but our members are committed to the industry, and it shows.”

She cited the positive trend among members who are buying hotels with plans for upgrading and boosting values, which might include rebranding, increasing room counts or using underutilized spaces for new F&B options. “AAHOA members are looking for new opportunities to expand their portfolios and value-add investments are allowing them to do so in the face of the higher costs for brand new developments,” said Blake. She noted pressing to increase the loan limits for SBA loans also is on AAHOA’s radar this year.

LHA’s Montoya felt the interest rate hikes have affected the industry regarding all real estate and expects transaction volume to slow over the next 12 to 18 months based on a shift to a buyer’s market. “This is not what sellers had in mind. New development may fill in the gaps for hotels that have converted to housing; however, tightening credit has made it harder to get renovation, acquisition loans and development projects are being put on hold because of rising labor and materials cost,” she said.

Labor

As anyone in the hospitality industry can attest labor (and the lack thereof) continues to be a crucial concern, although some industry experts are citing positives that have emerged from this particular challenge.

“From a P&L perspective, we finally saw labor costs per available room outpace 2019 levels in October,” said STR’s Hite. “While that’s not amazing news from a cost perspective, it does highlight the continued growth in hospitality staffing, which is great news.”

CBRE’s Rothman observed despite the forecasted economic slowdown, the labor market remains tight overall, specifically for hotels. “On a national basis, for all industries, there are over two job openings per job seeker in the U.S., and in the hotel industry there are currently more than 25 FTE [full-time equivalent] job openings per hotel.”

She added, “Wages have been increasing at a 5% CAGR [compound annual growth rate]since the start of the pandemic and increased 5.1% year over year in November. Wage gains in the hotel industry have been even stronger, increasing at an 8.4% CAGR since the start of the pandemic and 7.4% year over year in November.”

“Recruiting enough workers continues to be the top challenge for many hoteliers,” concurred AHLA’s Rogers, who stressed the upside is that this is leading to historic career opportunities for hotel employees. His group and the AHLA Foundation have been working to grow the industry’s talent pipeline and retain workers through events like National Hotel Employee Day, ad campaigns like “A Place to Stay,” and nationally recognized hospitality apprenticeship programs.

“All of these efforts will continue to grow the hospitality talent pool into the future, but there is still more to be done,” said Rogers. “That’s why AHLA affiliate Hospitality is Working recently launched the Workforce & Immigration Initiative. The effort is aimed at urging Congress to address workforce shortages with bipartisan solutions to incorporate more immigrants into the American economy.”

In late December, Rogers touted the passage of the Fiscal Year 2023 Omnibus Appropriations bill as containing a “a number of important wins for AHLA members,” including maintaining the Department of Homeland Security’s authority to double the yearly allocation of H-2B visas.

“AHLA will continue to impress upon lawmakers the critical importance of significantly increasing the cap on these visas to help hotels meet staffing needs. The lodging industry looks forward to working with lawmakers and the Biden administration to help hoteliers grow their businesses and create jobs when the 118th Congress convenes [this month],” Rogers stated.

In mid-December, the DHS and the Department of Labor had announced the availability of an additional 64,716 H-2B temporary nonagricultural worker visas for fiscal year 2023 on top of the 66,000 H-2B visas typically available.

It’s still not enough, according to AAHOA’s Blake.

“It might sound like a lot and it will certainly help the hospitality industry ahead of next summer’s peak season, but unfortunately, the total number of available visas does not come close to the estimated 1.5 million open jobs in the hospitality industry,” said Blake.

“Americans are starting to travel in even higher numbers than before the pandemic, but worker shortages are straining the ability of the hospitality industry to keep up. So far, lawmakers’ actions to address this problem only amount to a drop in the bucket,” she said.

For its part, AAHOA has engaged on multiple fronts to support the workforce, including supporting expanding workforce visa programs and funding for workforce training and development. “We are steadfast in our federal coalition efforts and partnership with state and local hospitality groups moving into 2023,” said Blake.

Echoing her peers, LHA’s Montoya stressed, “Immigration is key to our industry. Labor shortages have been a growing concern and there needs to be a change. Congress needs to step up and create real immigration reform to bring back work visas and day laborers that have always filled entry level and manual jobs.”

To help ameliorate the labor situation, LHA suggests its members examine ways to promote from within, find and retain good talent and provide competitive benefits to staff. “All of this is going to be more important than ever,” said Montoya.

Changes and chain scales

Industry prognosticators like CBRE Hotels Research, Kalibri Labs and STR each utilize a proprietary methodology when examining the industry’s performance, ergo their statistical perspectives may vary, albeit usually only slightly. At the top of 2023, however, the pragmatic statisticians agreed that the human element has played a key role in pushing the recovery envelope for the industry.

“First and foremost is the human tendency to want to be together, collaborate and have fun,” said Rothman. “Beyond that, there is the increased flexibility in work arrangements, the continued easing of travel restrictions in Asia, strong pricing power, improvements in group demand and an uptick in FIT business.”

STR’s Hite observed since the onset of the pandemic, it became increasingly clear people wanted to be around each other and “explore,” which helped shaped the industry’s leisure side and further push the growth it’s been enjoying for decades. “We believe this trend will continue as individuals explore new experiences, and the hotel industry is uniquely positioned to shepherd and guide it,” she said.

Hite concurred the rise in remote work also will be a boon. “Individuals are not tied to an office Monday through Friday,” she said. “They can work from their hotel room anywhere, which is essentially a new form of business travel even though traveling funds may come from the individual themselves. Regardless, this will boost travel and use of hotels.”

Economy

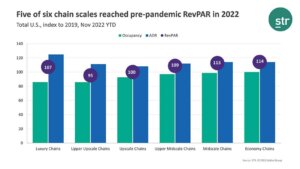

When it comes to U.S. chain scales, STR data indicates five of the six segments reached pre-pandemic RevPAR in 2022 with economy the leader with a RevPAR Index of 114, just squeezing out midscale with a RevPAR Index of 113 (against 2019). This was followed by upper-midscale (109), luxury (107) and upscale chains (100). At 95, upper-upscale did not hit the mark. (See chart on page 7A.)

According to Hite, economy was the only chain scale to outperform the 2019 comparable in each of the three key top-line performance metrics: occupancy (+0.2%), ADR (+14%) and RevPAR (+14.2%). “The economy segment has shown resilience throughout the pandemic and 2022 was no different, with occupancy coming in above 60% for eight consecutive months from March through October,” she said.

“Of all the chains, economy might just be the most unique,” said Hite. “While economy hotels were least impacted by the pandemic and fastest to recover due in part to the preponderance of extended-stay rooms in the segment, there was a net decline in rooms. Permanent closures in the segment outpaced new rooms for six of the 10 years leading up to the pandemic, and then from 2020-2022. A modest decline remains on the roadmap for 2023, before new development finally reaches the market.”

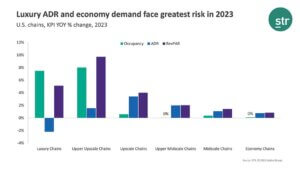

She noted in an up cycle, slow development leads to increased compression and higher occupancy, but economy chains tend to see the biggest demand declines in downturns, putting 2023 demand growth at risk for the segment. (See chart above.)

“Budget-conscious travelers are more likely to be impacted by a recession and the rising cost of living and the interest rate hikes meant to subdue it. Responsivity to downturns also makes economy chains one of our bellwethers for an economic downturn, and we’re monitoring demand trends within this segment closely,” said the CEO, who added despite the cautious demand outlook, economy RevPAR will continue to improve, although growth will be subdued.

Two years ago, Nikul Patel—his wife Monal by his side—decided the right move was to take on the 45-room Americas Best Value Inn & Suites in Kingwood, TX, where, as owner and managing member of Guru Deva Datta LLC, he could—they could—pursue a dream.

And it’s been an interesting one for Patel, whose “day job” is as a full-time employee at CRO company ICON plc, where he manages global first-in-human clinical trials. “You must be wondering what am I doing in the hotel business. It’s all about your dream. What you are passionate about. What gives you happiness,” he said. And having weathered the crux of the pandemic, he also concedes it’s important to prepare for the worst.

“The question that arises now is how to adapt to the factors that are shaping the future of the hospitality industry especially in the economy segment… It is going to be very volatile to operate [an]economy franchise in coming years with increasing supplies costs, high payroll, increase in utilities/legal fees, spike in property insurance premiums and loan interest rates, and considering no significant growth of ADR,” said Patel, noting a lot of factors that impact the business are “out of our control.”

“What we all can control is how we offer guests a unique quality experience… Every hotel should make engaging customers its primary goal, because fully engaged guests—those who are emotionally attached to a brand—provide a financial premium, regardless of market segment,” he said. “Focus on 3 Cs—Customers, Company and Competitors—and you are on your way to greater differentiation, incremental revenues and to gain a sustained competitive advantage.”

Toward this, Patel’s main focus this year is to increase RevPAR, offer a better guest-service experience and evaluate the local market. “If [your]market has a lot of competitors, you have to make sure you provide the best guest-service experience to gain a competitive [advantage],” he said, contending economy guests are the least likely to be fully engaged. “To achieve sustainable, long-term growth, hoteliers must develop a deep understanding of the type of clientele they want to attract, then offer an experience that is personalized to that specific group. Ultimately, increasing online presence and engaging customers through targeted marketing can help hotel owners to maximize the number of bookings they generate and the revenue they bring in,” he said.

Given the economic landscape, Patel said he has no plans to invest or build this year, adding, “The hospitality market is still suffering and without knowing what 2023 will bring, it’s a risk I am not willing to take… Not to mention, saturating the market with more rooms in this economy is a huge risk for economy properties.”

That said, Patel is “fairly confident in the economy segment due to comparatively less financial risk and [an]easy-to-operate model… Another advantage is we tend to get a mix of clients (locals, business and leisure travelers, contractors, families looking for an extended-stay options, etc.) throughout the year due to competitive rates and affordability. It all comes down to money, guest engagement and the service experience… My confidence lies in how my staff and myself treat the guests.”

Also concerned about the segment’s dynamics is Kishan Anilkumar Patel, whose 36-room Signature Inn in San Francisco’s SoMa District is one of five economy properties held within a 10-plus hotel portfolio overseen by UMI Hospitality, of which he is a partner. (Editor’s Note: STR classifies Signature Inn as midscale; franchisor Sonesta International Hotels Corp. “super defines” it as upper-economy.)

The second-generation hotelier—parents Anil and Ranjan Patel are 35-year industry veterans—cited the industry’s overarching concerns, e.g., labor, inflation, supply-chain issues, layering them over the Bay Area market that at any given time is not known for being inexpensive.

“Inflation has caused the cost of living to go up, from gas prices, to renting an apartment or owning a house, to the prices of groceries. This makes it difficult to find employees…as economy hotels are typically not offering the pay scale and benefits that an upper-scale hotel would provide its employees. Therefore, we lose employees to these bigger players in the market who have the ability to provide more,” said Patel. “On top of that, costs ranging from constantly increasing minimum wage to hotel supplies to other necessary items needed to run a hotel on a daily basis are continuously rising, creating a tighter margin and lower bottom line.”

He added this has made it “rather difficult” to reinvest back into the property, which opened in 2018 as the brand’s first franchise, and suggested if supply-chain issues could resolve this year it could be “huge” for economy properties.

Managing costs to boost the bottom line will be a key focus this year, said Patel. “We are constantly looking into alternative suppliers to see who can provide the best price. Additionally, we have secured contracts to add solar panels to multiple properties to take advantage of California’s tax credits to lower our electricity bill. With a healthier bottom line, we are able to reinvest in our product for our customer’s satisfaction, hire additional employees to address the labor shortage and retain our current staff by providing them company-sponsored lunches, raises, bonuses, etc.,” he said.

Patel said from his perspective, the Bay Area has not experienced the rebound in ADR and occupancy to pre-pandemic levels, citing the loss of several large annual conferences, coupled with the majority of employees of Silicon Valley companies still working from home. “So, the large number of business travelers we used to see on a weekly basis from various parts of the country and world are still missing here at the end of 2022,” he said.

As far as expanding the portfolio, which also includes Red Lion and independent properties, Patel said UMI Hospitality is looking to “dive deeper into the midscale-and-above space, but [is]on the fence about acquiring properties in general in 2023” given a variety of risk factors. “Therefore, we are going to be monitoring the interest rates, lending space and labor issues first and foremost, before we start being aggressive in acquiring additional properties.”

Midscale

Midscale chains posted a November year-to-date occupancy that was in line with the comparable 2019 period, down just 1.2% below the pre-pandemic level, according to STR data, with the metric reaching the 60% mark for five consecutive months (June through October) last year.

“Similar to the other chain scales, midscale ADR came in above 2019 levels, resulting in a November year-to-date RevPAR level that was also higher than the pre-pandemic comparable,” said STR’s Hite.

The CEO noted midscale chains also were one of three to reach pre-pandemic demand levels last year. “However, above-average supply growth means that like upscale chains, midscale hotel occupancy is expected to remain below pre-pandemic levels in the long run,” she said, adding, “Like economy chains, midscale demand growth is modestly more at risk than the other chain scales due to their reliance on lower-rated leisure travelers, who are more likely to feel the downturn’s pinch on their pocketbooks.”

Starting out in operations 10 years ago, Gary Singh (aka Gurbir Sandhu) is now the managing member of Ignite Hotels with a half-dozen properties in the Northwest, all of them in the midscale segment. And his lodging roots are giving him a distinct perspective regarding the industry’s outlook.

“The operating environment today is the toughest it’s ever been. Every single line item of a hotel’s expense budget has increased dramatically, while revenues are still playing catch-up,” said Singh. “While the one-time pent-up leisure demand broke records during summer, the return of business and group convention demand is still uncertain.”

Ignite’s Red Lion In TriCities, WA, did see the summer’s pent-up demand but Singh wondered if the “exceptionally high” seasonal demand will return this year “since it will not be ‘pent-up’ anymore.” Neither has he seen business travel, group and banquets return to pre-pandemic levels. “While we were hopeful these [would]return to previous highs, these sources of demand are being financially conservative in their planning as the economy heads into a potential recession,” he asserted.

In charting a course for the year ahead, Singh cited several paths. “We need to meet guest expectations and provide value to our clientele,” he said. “Our clientele at the midscale level generally consists of value-seekers looking for a safe, reliable stay. We need to play catch up on preventative maintenance that may have been neglected or delayed during the pandemic to ensure we’re providing this consistency to our guests. We also need more robust technology and tools to better enable our operational teams to deliver on our guest expectations.”

Technology also is aiding on the metrics side. “Through adopting modern revenue management systems the brands offer, we are looking to push a balance between rate and occupancy; it is unsustainable and short sighted to focus only on one metric,” said the Ignite Hotels executive.

Right now, there are no specific plans to grow, although if the “right opportunity” presented itself the company would be interested. “We don’t believe every opportunity is right for us. We are selective with the projects we do to set up our team for success,” said Singh.

Nonetheless, the hotelier remains confident in the segment. “The midscale segment is where many everyday Americans stay [and]the desire to travel is resilient. We may enter a correction in the economy in the near term, but have faith in the long run the demand will eventually return; we just need to get to the other side of this odd economic climate.”

Upper-midscale

Upper-midscale chains saw November year-to-date occupancy (66.7%) just below the pre-pandemic comparable (68.7%) although the segment saw three months (June, July and October) with occupancy above 70%, according to STR data. At the same time, ADR came in higher than the 2019 comparable, boosting RevPAR above the pre-pandemic level as well. The segment chains enjoyed RevPAR above $100 only in July.

Lexington, KY, is home to PMVS Hospitality Inc. and where the group’s operating partner, Viren Patel, serves as general manager of the recently renovated 56-room GuestHouse Inn & Suites.

As 2023 unfolds, the eight-year industry veteran said labor shortages have made it tough to keep properties fully staffed and inflation has pushed up operating costs in each department, making it a challenge to produce a greater profit share.

Right now, the focus is to keep the property up to date with current standards, anticipating demand will increase if the product has been renovated and kept at satisfactory levels. In addition, Patel felt keeping the property satisfaction-rating high along with marketing the property with better incentives on third-party platforms would allow the brand to be further recognized.

“This year we [also]will be pushing toward increasing market share in our comp set as events occur locally…but would like to gain more occupancy on non-event days,” he said, noting the area is “saturated” with competition, largely owing to local attractions like Rupp Arena, Keeneland Race Track, the Kentucky Horse Park as well as the University of Kentucky.

Patel acknowledged business overall increased in 2022, with targeted revenues met, although demand has slackened.

Any plans for expansion are on a back burner. “We are focused on growing our numbers at our current location as it has been a tough few years along with the pandemic. In the future, once the market situates, we would be interested in new acquisitions when [they]arrive on the market. Currently, the GuestHouse brand has worked well for us,” said Patel, adding, “The brand and overall revenue year by year—minus the pandemic year—has given us the confidence to be confident in our product.”

Upscale

While improving throughout the year, upscale occupancy for the first 11 months of 2022 came in below the 2019 comparable (-7.5%), although upscale chains saw seven consecutive months (April-October) of occupancy above the 70% mark, with the highest level recorded in June (75%), STR reported. Additionally, ADR for the segment was 8% higher than the pre-pandemic comparable, while RevPAR was slightly above 2019.

From where she sits, Paulette Padron feels basics like efficiency and customer service could help upscale properties improve their recovery from the economic impact of the ongoing pandemic, inflation and any number of disrupters.

“Properties can make operations more efficient without losing sight of customer service, making it a win-win outcome that both guests and investors can share,” said Padron, VP/sales and business strategy, OPB Capital Group, which owns the 176-room Regency Miami Airport by Sonesta, among others.

In tandem with that, she felt incorporating tech into operations and the guest experience equally important this year. “The technological advances we have seen these past years have shaken the hospitality industry in not only getting up to speed with the ‘outside world,’ but also introducing some best practices in terms of efficiency, effectiveness, guest relations and reporting that can help the staff, management and operators truly understand and pinpoint their areas of development,” said the executive.

She noted OPB Capital has been proactive in its trek along the industry’s road to recovery. “The path to get there is through ongoing TLC to the property and its staff, great service and incorporating technology to enhance the experience and operation,” she said. “This will drive the demand through your value propositions, which will be highlighted through user-generated content and reviews. These are the key ingredients for an ideal opportunity to push rate, balance occupancy, to ultimately increase your RevPAR.”

She continued, “That is what we have been doing these past months. By early mid-2023, Regency Miami Airport by Sonesta will have gone through a complete renovation, soft-brand acquisition and a new management company partnership. All these elements have been analyzed and strategically executed to ensure the best and most genuine Miami experience for our guests, as well as a brighter future for the business.”

When asked if OPB Capital was looking to grow its number of upscale properties this year, “Of course” was her emphatic reply.

“Our goal this past year has been to take the time to reevaluate and optimize for quality scalability. It’s not a matter of ‘how many,’ it’s a matter of how you scale in a healthy, qualitative manner—and that is what we strive for,” said Padron. “We are looking into new territories, new opportunities, but never losing sight of our main goal—having great brands/partners and properties that offer a great experience to those that chose us amongst any other place to live their experience away from home.”

STR’s Hite characterized the upscale and upper-midscale chain scales as somewhat unique given their strong demand growth in 2022, “so much so that both chain scales surpassed pre-pandemic demand with ease. However, these chains also have been extremely popular with developers, with both historical and forecast supply growth more than double the national level.”

She explained while upper-midscale chains will manage to push occupancy ahead of pre-pandemic levels in 2025, upscale occupancy is expected to remain below pre-pandemic levels in the long term, even as demand growth rises more than 20% ahead of 2019 levels.

“It’s that strong demand that will help both chain scales continue to push short- and long-term ADR even in the face of incoming supply,” said Hite. “Demand for upscale and upper-midscale chain scales is well-balanced, as smaller groups, business transient guests and leisure travelers all flock to the select-service segment, and the multitude of segments these scales rely upon will help grow demand through a downturn.”

Upper-upscale/independent

For the upper-upscale segment, occupancy for the first 11 months of the year was 14.3% below the pre-pandemic comparable, according to STR, with occupancy the lowest in the first month of year (41%) but remaining above 50% every one thereafter. Occupancy was above 70% in June and October.

RevPAR also remained below pre-pandemic levels (-4.6%), while the ADR level for the same time period was higher than the 2019 comparable (+11.2%), STR reported.

“Upper-upscale hotels, with their reliance on group and corporate demand, were most affected by the pandemic and have been slowest to recover. As business travel picked up over second-half 2022, however, these hotels finally found some momentum,” said Hite, who noted similar to luxury chains, upper-upscale hotel demand will recover in 2024, and occupancy one year later.

Unlike luxury hotels, upper-upscale chains will continue to improve ADR in 2023 “as business-travel patterns continue to normalize and a packed group calendar provides a stable demand base for the segment once more,” said STR’s CEO. Upper-upscale chains also can look forward to the strongest year-over-year RevPAR growth this year, she added.

With more than 1,500 hotels across the globe, any number of factors could play into Aimbridge Hospitality’s outlook for this year. However, for its approximately 150 properties in the upper-upscale segment and more than 75 independent hotels, the view appears more positive than not.

“Upper-upscale is a fast-growing market segment both in the industry and Aimbridge’s current pipeline,” said Rob Smith, divisional president/full-service division. “Post-pandemic ADRs and guest demand for higher-end experiences and F&B offerings have been strong.”

Upper-upscale performed very well in 2022, according to Smith, who said, “Increased leisure demand from pent-up travel segments coupled with stronger rate growth has led to these results.”

Industry veterans—Smith is one—will recall the upper-upscale segment was carved out during the 1990s to better categorize independent and chain hotels that weren’t quite at the luxury level, but were a distinct step above upscale properties. While the segment descriptor still covers independents, their KPIs are separately tracked.

Toward this, Smith indicated independent hotels also have seen growth, “as distribution and online marketing have become more mainstream, coupled with rising brand costs.” The executive shared the majority of independent opportunities Aimbridge is pursuing are in the upper-upscale segment.

“We see most of our growth coming from these segments both domestically and in the Caribbean. The majority will be existing assets as well as ground-up new-builds. Our largest organic growth right now is new assets from existing owners,” said Smith.

Like others, Aimbridge has been working to mitigate impact from existing and potential challenges to the segment. For example, Smith said last year the company’s greatest challenge was bringing back all facets of its F&B operations, from both a cost-to-serve and staffing basis. “These challenges are just about behind us at this point,” said the executive.

This year, Smith said the biggest concern about being in the upper-upscale/independent space “is a downturn in the economy leading to a mild recession that could soften the strong leisure demand we have seen for almost 18 months. While supply has improved, the continued rise of inflation is a concern. We’re prepared for this—we’ve become leaner and more efficient and have plans in place to continue to unlock value and protect margins.”

As 2023 progresses, the company will be looking forward to a full return of business travel, according to Smith. “Leisure travel has led our recovery, followed by group travel, but business travel is still off 15%-20%…,” he said. “November 2022 was the first month since the pandemic that we exceeded 2019 business-travel levels, and those headwinds continued into the first two weeks of December, which we look to as the beginning of a trend. The December holiday function cycle is certainly higher than we have seen since the pandemic began, and per-person spend is up more than 20%. We are, however, still behind 2019 in overall revenue.”

Smith also expects 2023 will be a “staging year” for 2024 PIPs and renovation schedules, noting reserves were depleted during the pandemic and owners are looking for stabilization of balance sheets.

Luxury/resorts

At the top of the chain scales, the luxury segment through the first 11 months of 2022 saw improving occupancy but an overall level still below the 74.3% recorded during the comparable 2019 period, according to STR, with April and October the strongest months with 70.2% occupancy each. ADR was 24.8% higher and RevPAR was up 7.2% when indexed to 2019.

STR’s Hite observed recession impacts tend to be felt most on the highest and lowest end of the chain scales. “Historically, luxury hotels have reported the greatest ADR elasticity in a downturn, with rates declining more in the highest-rated chains than in the other five. We’ll see that with luxury ADR this year, as it’s the only chain scale expected to post ADR declines in 2023,” she said. “The good news is that those declines are modest and given how strong luxury rates have grown over the past few years, we still expect ADR to retain double-digit growth on 2019 levels.”

Luxury hotel demand is expected to show continued growth this year and fully recover by 2024, with occupancy following one year later, she added.

Just like the properties that occupy it, the luxury resort segment has proved a serene space for Hospitality Ventures Management Group (HVMG) as it looks ahead.

“The segment has exceeded our expectations in 2022,” said COO Richard Jones. “Late 2020 and all of 2021 was an absolutely exceptional period of strong demand which resulted in ADR and profit performance that far exceeded expectations. As the pandemic recovery progressed, we expected travelers would look beyond resort destinations and pursue other opportunities that were not available to them in 2021. We planned for a very good year of growth, but the actual 2022 performance far exceeded expectations driven by strong leisure traveler [demand]and the robust return of group business in Q3 and Q4.”

Independent and branded resorts represent approximately 15% of HVMG’s 56-property portfolio. Jones said the company has a long track record of success operating resort properties and sees building on that record as a prime opportunity for future portfolio growth. “Guests are constantly looking for new experiences and to maximize the return on their travel investment, so resorts will naturally always be high on the list of options for both individual leisure guests as well as corporate planners looking for experiences that create opportunities for teams to be productive as well as bond and build relationships around activities,” he said.

Lest anyone think rolling with resorts is the segment-equivalent of a spa treatment, Jones stressed it remains a very competitive space in terms of both market share and talent, particularly given the outlook for labor.

“We are investing heavily in our ability to attract, retain and develop our talent that will make our resort experiences stand out for our guests, as well as continue to deliver superior financial performance to our owners,” he said. “One of the biggest challenges we face is finding ways to maintain and grow our performance coming off of the pandemic years. No one wants to go backwards, so our challenge is to find new revenue streams, operating strategies and markets that will build off of this new baseline of performance.”

Resorts rely heavily on the loyalty of repeat guests, both individuals and families that make visits a tradition, as well as corporate and association groups for their annual meetings and incentive trips, noted Jones. “So, staying relevant by refreshing our amenity offerings and F&B concepts is something we need to be doing.”

For example, at HVMG’s beach resort Plunge in Lauderdale by the Sea, FL, the team there is adding business productivity amenities to what was a purely leisure design and guest experience. “They are enhancing data and power connectivity and reprogramming guestrooms and public space to give guests the ability to flex between Zoom meetings and dedicated work spaces versus family gathering spaces,” said the COO.

HVMG completed several renovation and expansion projects last year and has some repairs to damage done by Hurricane Ian to complete in 2023.

“From a revenue point of view, we will do all we can to hold our ADR gains and grow top-line performance at a rate that increases our market share,” said Jones.

A 30-year industry veteran with nine years at HVMG, Jones has perspective on all sorts of headwinds that have blown against the industry across decades, and offered some suggestions on things that over the next six months could help resort properties improve their recovery from the economic impact of the pandemic and other factors.

“Addressing deferred maintenance issues is a must,” he said. “Most resorts have been so busy since mid-2020 that they need to step back and ensure that the right measures are being taken in the near-term to maintain assets for the long term. It may require making some short-term sacrifices to get access to the rooms or the outlets or meeting spaces. Resorts have many moving parts that require constant attention. F&B concepts, resort amenities and service delivery need constant re-invention to stay competitive, creative and relevant versus the competition. We need to get above the day-to-day, be strategic and look ahead to ensure we are taking steps that will differentiate us from our competition and deliver a guest experience that keeps our guests loyal and coming back.”

HVMG expects this year to grow its resort offerings via management contracts and JV acquisition opportunities, particularly building on its Florida/Southeast oceanfront portfolio.

“The resort experience will continue to expand,” said Jones, “and the winners will be the operators that can lead with innovation and creativity and constantly adapt their property and team to deliver new experiences.

And if optimism counts for anything, here’s Jones’ take on 2023: “We remain bullish on the demand side of the equation and are looking forward to another excellent year.”

Amen.