NEW YORK—Manhattan’s hotel market has hurdled many obstacles over the years. While many impediments still lie ahead, the market remains ready and willing to face them head on—including restrictive regulations, increasing labor costs and supply challenges.

“Over the past few years, there’s been a confluence of events,” said Stephen Chan, principal at Eagle Point Hotel Partners, a Manhattan-based hotel investment firm. “On the demand side, there has been a strong dollar, which has been a headwind to foreign tourism, as well as the Trump effect. On the corporate side—financial services employment wasn’t quite the same after the downturn, and retail has been going through a massive realignment due to the internet. That said, this is New York City; thus, tourism and other industries (such as tech) have picked up the slack and then some.”

For the first half of 2018, ADR grew 3.3% across the island, according to PwC’s most recent Manhattan Lodging Index. “Room rate growth is finally starting to take a front seat in the revenue growth picture for hotels in Manhattan,” said Warren Marr, managing director at PwC, a multinational professional services network headquartered in London. ADR was down 1.6% in 2017, 2.9% in 2016 and 1.4% in 2015.

“In addition, demand for hotels has more than kept pace with the increases in supply through the first half of the year, with demand in Manhattan up 5.2% against a 3% increase in supply of new hotel rooms,” he said.

In Manhattan, during the same time frame, RevPAR jumped 5.5%. Year-over-year, RevPAR increased 4.3% (going from $255.53 to $266.46).

“Based on the metrics [I stated], it was the return of the business traveler,” Marr said. “Over the past several years, the strong occupancy levels in Manhattan have been driven by the leisure customer. Of the three segments of demand in any market (individual business traveler, group/convention attendee and leisure guest), the leisure guest is typically the most price sensitive. With the current year-to-date resurgence of the business traveler to Manhattan, pricing has increased.”

All five Manhattan submarkets posted an increase in RevPAR during Q2, according to PwC’s data. With a RevPAR increase of 7.6%, Midtown East experienced the largest RevPAR increase. The Midtown East submarket also posted the largest growth in ADR at 7%. Out of the island’s five submarkets, only Upper Manhattan experienced a decline in occupancy year-over-year (1.4%). With a RevPAR increase of 1.8% (the lowest RevPAR growth of the quarter), Upper Manhattan saw an increase of 3.2% in ADR for Q2 2018.

“Looking at [NYC] historically over the long term, it is one of, if not the most, resilient markets in the country—perhaps the world,” said Maki Bara, president and co-founder of The Chartres Lodging Group, a hotel investment and asset management company. “And when an economic recovery occurs after a downturn, NYC is typically the market leader (it bounces back first). Also, when it bounces back, it typically reaches nominal ADR levels that are higher than previous peaks.”

In Q2, the number of hotel transactions in Manhattan doubled from Q1 (three transactions closed in Q1), according PwC’s data. Relative to Q1 2017, this represents a significant increase—only two properties changed hands during the same time period. Recent transactions include The Quin, sold for $174.5 million; Hotel Deauville, sold for $19.5 million; Riff Hotel, sold for $19.2 million; Westgate New York City, sold for $50 million; The Maxwell, sold for $190.3 million; and Riff Hotel Chelsea, sold for $27.5 million.

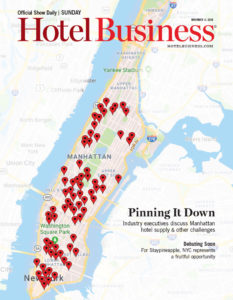

The following properties are expected to open in Manhattan by year-end 2018: Park Terrace Hotel; The Times Square Edition; The Artezen Hotel; TownePlace Suites New York Manhattan/Times Square; Moxy NYC Chelsea; and FiDi Hotel. In Q1 2019, the following properties are expected to open on the island: Walker Hotel Tribeca; a SpringHill Suites & Fairfield Inn; Renaissance Hotel New York Chelsea; Residence Inn by Marriott; and Sister City. Two Courtyard by Marriott hotels are supposed to open during the period, too.

“Our pipeline shows a significant number of hotels still planned for Manhattan over the next several years,” Marr said.

Supply continues to be a concern. “It has become increasingly difficult to build a hotel in Manhattan,” Marr said. “Recent plans to implement a more stringent M1 zoning amendment would make hotel development in these areas require a special permit.”

That being said, some developers will still find ways to develop on the island.

“The most prolific developers—like McSam and the Lam Group—will continue to get deals done, but other developers will have to get more creative to offset the headwind of construction costs, tariffs and higher construction financing costs,” Chan said.

New York City still remains the most expensive place to build in the world, with an average cost of $362 per sq. ft., according to Turner & Townsend’s 2018 International Construction Market Survey. Also, the average cost for labor—including travel costs, health insurance, pensions and other benefits of employment—in the city is $98.

“The future state of our global economy, increasing labor costs, and, potentially, more restrictive building regulations for hotel developers will all have a significant impact on what the future holds for the Manhattan lodging market,” Marr said.

To overcome increasing labor costs, operators are doing their best to be creative. “Hotel executives are continuing to look for ways to lessen the year-over-year increases that in many cases exceed the percentage increase in revenues,” Marr said. “Some of these include modifying housekeeping services (allowing guests to opt out of daily housekeeping in exchange for loyalty points or a coupon for a drink in the lobby bar, etc.).”

With new projects, there are cost-saving opportunities for developers to consider.

“When designing a new full-service hotel (or significantly renovating an existing one), streamlining the F&B offering can be a focal point,” he said. “This includes designing the bar to be the central focal point of the lobby, with a limited number of tables surrounding it. This outlet becomes the sole F&B offering in the hotel, with a simplified menu and reduced labor costs.”

Manhattan has always been a labor union stronghold, which complicates things. “These unions typically support the most onerous rules and regulations,” Bara said. “For example, if you own—even as an affiliated company—or manage a union hotel in the market, all other hotels you own or manage can and will become unionized—even clawing back to non-union hotels you had prior to affiliating with a new union hotel.”

Lastly, finding help has also been a challenge in Manhattan. New York City’s seasonally adjusted unemployment rate averaged 4.2% in Q2, representing an 8.6% decrease year-over-year, according to the New York State Department of Labor.

As for the future of Manhattan’s hotel market, there’s optimism among leaders. “Just a few years ago, folks in the industry were saying the market wouldn’t begin to recover until about 2020 or 2021, but we were seeing how resilient NYC is—the sky isn’t falling, but it’s also not shooting up to the moon either,” Chan said. “It will continue to be a tug of war between supply and demand. If the economy holds and supply abates—like it’s looking—NYC will plateau for a while with modest RevPAR growth.”

“The RevPAR velocity data shows NYC is absorbing the recent influx of new supply, and I believe will continue to absorb the new supply to come,” Bara said. “The market will continue to be the financial center of the world, as well as a political and cultural center.” HB