Coming into the year, questions abounded about how the industry would fare. Would the boom in travel continue, with RevPAR near or exceeding 2019 numbers? Would inflation continue—and with it, rising interest rates? Will business travel come back?

Now that we have reached the midway point of the year, it seems like a tale of two industries. On the operations side, travel is booming in general, with many industry metrics showing phenomenal numbers. On the other side, transaction rates have dropped precipitously, and interest rates are rising.

“Overall, people feel pretty good about the operating performance for hotels,” said Andrew Broad, managing director, RobertDouglas. ““I think the angst in the room is that interest rates, cost and availability of capital, and loan maturities are putting some pressure on the industry—and certainly beyond hotels, extending to commercial real estate in general.”

“We’re at an interesting inflection point,” said Kevin M. Davis, CEO, Americas, JLL Hotels & Hospitality. “If you look at the fundamentals, they continue to be incredibly strong. From an ADR perspective, we are about 117% of 2019, and from a RevPAR perspective, we’re about 113% of 2019. Occupancy hasn’t quite come back. We’re still at 96%, but we’re looking at all-time highs in ADR and operating performance from a nominal basis. Yet, at the same time, the capital markets continue to be incredibly challenging.”

Operating performance

“Things have played out better than anybody thought, no matter what people say,” said R. Mark Woodworth, principal, R.M. Woodworth & Associates. “We got back to 2019 levels much faster than what most people were thinking. Obviously, back at the beginning of the pandemic, we literally had no history to look back to to try and learn from, so it was very much a guess at that point. I think that most people underestimated the impact on the economy and then, ultimately, inflation with all the stimulus that we went through. Obviously, that’s what we’re paying for now in the form of high inflation and slowing economy. But it got better more quickly than we thought it was going to be.”

Rachael Rothman, head, hotels research and data analytics, CBRE Hotels, said that this is the fastest recovery she has seen in her nearly 40-year career. “Yes, occupancy is still down slightly, but room nights sold has actually made almost a full recovery,” she added. “It’s just that we’ve had some supply growth over the last three years, so that dilutes it a bit.”

One reason for the fast recovery is that hotel industry did a “tremendous” job of holding rate. “I think it’s one of the lessons that they learned, which is if there isn’t demand, incentivizing purely on rate may not be the best strategy,” Rothman said. “Why not hold rate? Take the guests who want to be there and are willing to pay. That will protect your cash flows. And now we’re seeing that demand is coming back. It’s helping them hold these rates.”

While things are doing well, it is not all sunshine, lollipops and rainbows. “Top-line growth remains positive on average,” said Rothman. “What you have is certain markets performing very well, other markets experiencing pockets of weakness and then some markets that were 30%-50% above 2019 levels beginning to normalize just a bit.”

Some markets are doing better than others. “In terms of the softer markets, they would be something like San Francisco, San Jose, New Orleans,” she added. ““In terms of a market that had maybe reached a peak and is still doing very well, but where you’re seeing a normalization and trends, that would be something like Miami. It hit the 50% above 2019 and then maybe is off 5%-15%, but again, still 30% above where it had been. And then you are starting to see a recovery in midweek travel, group travel and traditional business travel, particularly in smaller businesses. So not necessarily large corporate travel, but smaller business travel. It is healthy, but it is hard to paint it all with a broad brush.”

Finance and transactions

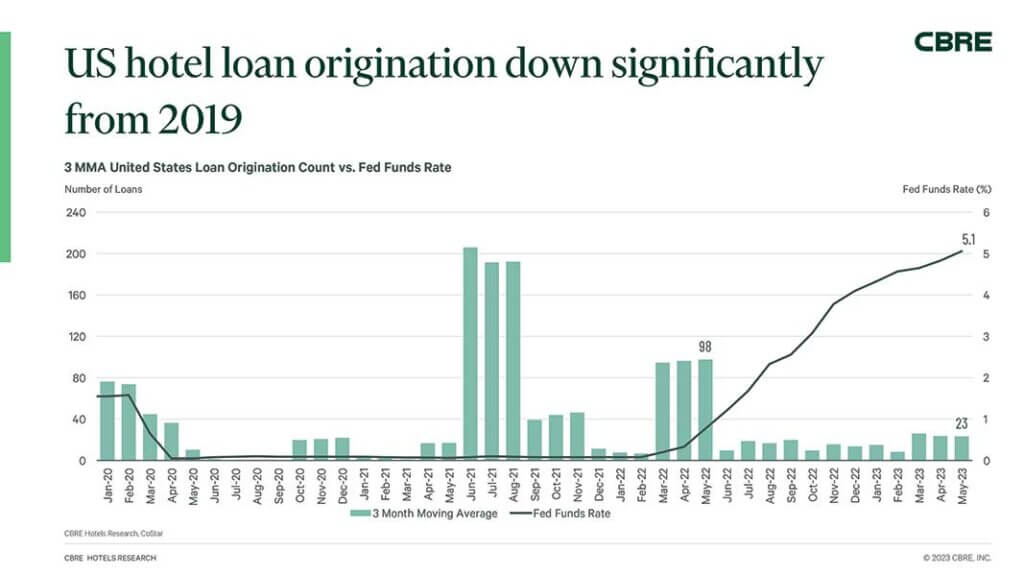

The one area where there seems to be the most uncertainty is the financial sector. STR reported that total transaction volume was around $3.5 billion in this year’s second quarter, a 70% decline from 2022’s second quarter. That is a 49% decline from the second quarter of 2019.

The decline largely has to do with rising interest rates, as the Federal Reserve boosted rates to stave off inflation, with 10 increases from March 2022 to May 2023, with more possible.

“I think the market is coming to realize, and maybe come to accept, that this is not a short-term event,” said Broad. “If the Fed came out and said, ‘We are going to stop moving rates, and this is where we are going to be for a while,’ I think the market would accept it and learn to live with it. If we saw some stability in the debt market, we would probably see the availability of capital improve and spreads compress, and you could end up having a functional debt market.”

What also did not help the situation was the failure of three banks in the first half of the year, as well as Credit Suisse being purchased by UBS. “That was a shock to many, and it really slammed the brakes on lending,” said JP Ford, principal, Lodging Econometrics. “Nobody saw that coming. However, my thoughts on that right now are that the fears have largely eased as well, and it does not seem to be a financial emergency ahead.”

He continued, “Nevertheless, even though people aren’t already anticipating another bank failure, lending is still more difficult nowadays because of the bank failures that have happened, and it takes a while for that to leave your mind and get back to regular lending. It’s still out there and still in the mind of lenders. Everyone’s being cautious, looking at things three different ways—redoing designs, taking another look at cost structures for hotels to build them. And looking at those budgets.”

With these higher interest rates, owners are facing tough decisions when it comes time to refinance at rates significantly higher than their original deals. Many owners held off on refinancing several months ago because they were hoping that rates would start to come down.

“The decision to refinance actually has some implications,” said Davis. “The first of which is you will see owners who are unable to refinance their existing debt with new debt. They can’t replace dollar for dollar, which, as a result, will force them to invest equity in an asset, bring in a third-party equity partner or, in some cases, sell an asset. So the wave of refinancing that we’re starting to see will trigger investment sales transactions and low recapitalizations.”

He also said that, in some cases, the refinancing process will produce sub-optimal results and force owners to then renegotiate with their lenders looking to extend or modify the existing debt.

He added that owners may decide to give the keys back to the lender. “You may see owners who either know that there’s no equity value above the debt, or perhaps after running a process in anticipation of a refinancing, realize that there’s no equity value above the debt. In those cases, you may see owners giving back the keys.”

He continued, “A crystallization of where we are from a rate perspective is triggering a wave of refinancing, which will trigger subsequent activity.”

The higher interest rates, and what Davis sees as slowing fundamentals, have caused properties that were previously on the market, to lower their asking prices.

“The net result of this is you’re starting to see a bridging of the bid-ask gap that exists between buyers and sellers,” he said. “We’re at the very beginning. I want to be super clear: We’re not saying capitulation; we’re not saying sellers are giving in, but I think we’re starting to see a little bit of movement based on the fact that the rate environment is pretty clear. And I think people have realistic views on where operating performance will be.”

Construction and renovations

While finding the right financing might be difficult now, Lodging Econometrics’ Ford reports that projects at the end of the first quarter of the year were only 6% shy of the all-time high. “By the end of the first quarter, there were 5,545 projects in the pipeline,” he said. “The all-time high is 5,883.”

The reason for this is that the many projects that were put on hold because of the pandemic are active again.

“There are a lot of deals that are getting signed, but they’re moving through the pipeline slowly,” he said. “There are a ton of projects that are in early planning and there are a ton of projects that are going to start in the next 12 months. And the whole idea is that as you progress through the pipeline, you ultimately get down to construction, but moving towards ‘under construction’ is a little slower now than what it has been. A lot of that is tied to lending and interest rates. And a lot of that has been tied to inflation, although inflation seems to be easing. Those are pretty big factors.”

When it comes to renovations and conversions, Ford said they are about as high as he has ever seen them, adding, “Some of these renovations are associated with conversions and others are associated with brands mandating PIPs, which were simply put on hold during COVID, but now those PIPs need to be completed.”

Going forward, he believes the pipeline will continue to grow. “I think you’ll begin to see more projects move toward the under-construction stage,” he said. “I would suspect that given the new brand announcements, you are going to see more signings. I do expect the pipeline to grow, although probably incrementally, over the next couple of quarters, but then really gaining momentum after that.”

Groups and meetings

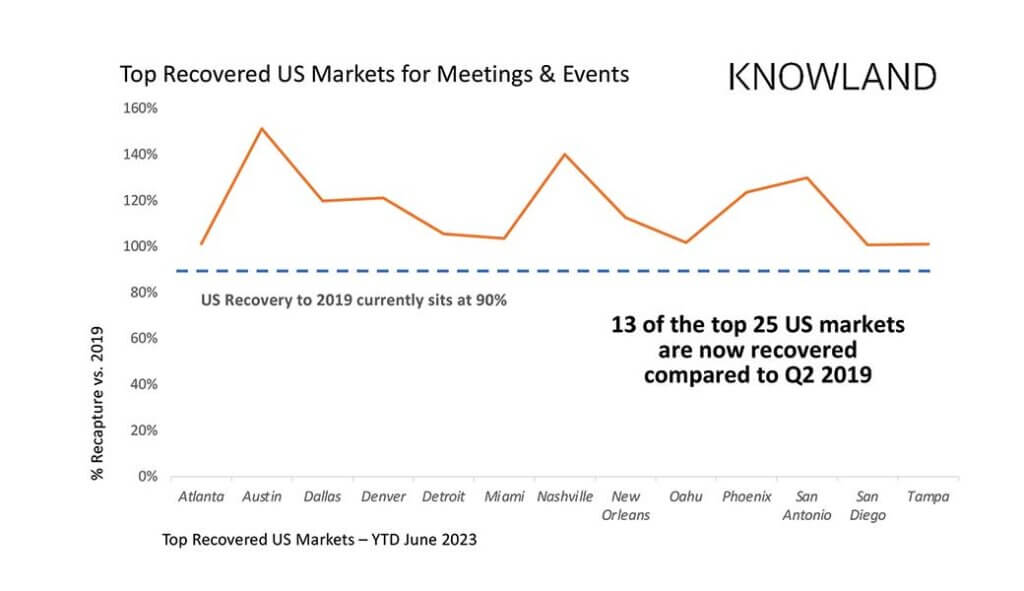

Jeff Bzdawka, CEO, Knowland, said that the group and meeting sector is thriving this year. “2023 has turned into the year of group and 2024 is positioned to be the same,” he said. “As transient travel begins to plateau and the make-up of business travel continues to evolve, group and event business has come back quite strong and continues to build.”

Knowland’s data shows that, overall, the U.S. is nearly 90% recovered when compared to pre-pandemic levels. “We project that by year-end, the U.S. marketplace will outpace levels experienced in 2019,” he said, adding, “Thirteen of the top 25 group markets have already surpassed 2019 volumes, while event volume doubled from 2022 to 2023 in 12 of the top 25 markets.”

Bzdawka believes group travel is doing well for a number of reasons. “Group is an important stabilizer of profitability and occupancy when there is uncertainty in leisure and/or business travel,” he said. “It is human nature to come together and share common experiences, learn from each other and enjoy human connections. This is why we are seeing group flourish. And with the rapidly evolving work environment, group events are being used to build culture, create bonds, learn and stimulate innovation.”

Like many others, he didn’t expect the industry to recover as quickly as it has. “The industry’s pace of recovery, especially that of group and events, has intensified more quickly than we anticipated,” he said. “To keep up this pace, the industry needs to continue to focus on supplier collaboration and cross-technology partnerships, leveraging robust data to facilitate decision-making and guide commercial strategies. Change is the only constant for the coming year, and collectively we can make the adjustments needed to continue profitable growth.”

Looking ahead

For the rest of the year, Woodworth believes that, operationally, the industry will be flat to gaining. “I can’t come up with a believable argument that we’re going to be going down,” said Woodworth. “So, for me, the choices are really: Are we going to begin seeing a plateauing of the industry metrics or can we continue to expect some level of growth? Everything still seems like they’re in the 4% to 5% RevPAR growth maybe for this year and even going into next year. So that’s suggesting some level of up.”

He continued, “When I try to answer the question, I generally think more in real terms. I think we’re probably going to be in the 4% to 5% inflation range for a while, coming down fortunately from where we had been. In real terms, that says that’s more of a leveling kind of experience. It’s my guess for the rest of the year that we’re not likely to see a lot of real growth, but that—absent some something falling out of the sky type of event—it should be a fairly even keel for the balance of the year and moving into 2024.”

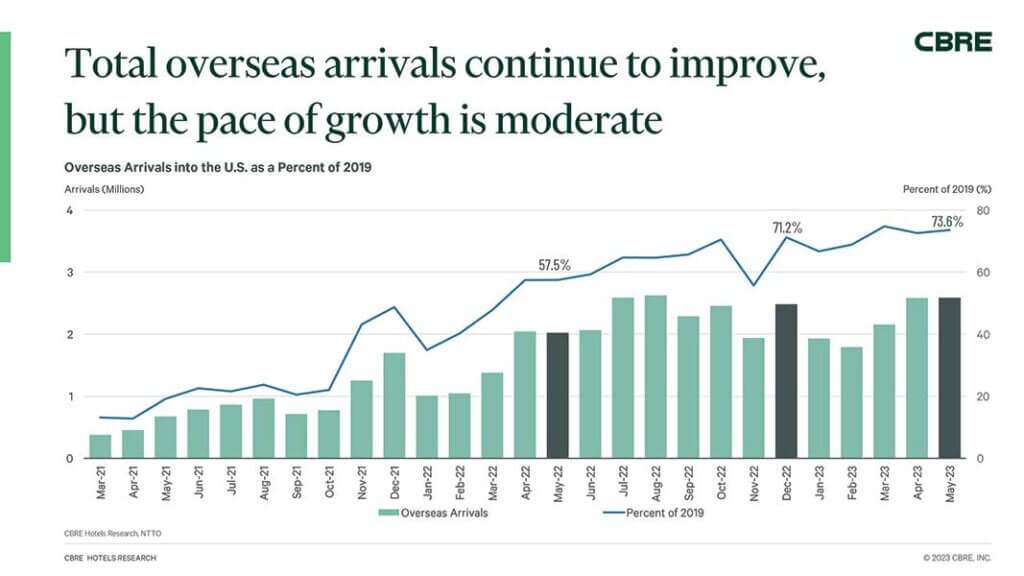

An encouraging sign is that international travel to the U.S. has increased significantly, reaching 73.6% of 2019 numbers in May.

“I’m hopeful that we’ll continue to see a recovery in inbound international travel as flights are added back from Asia-Pacific and China,” said Rothman. “It may just take some time. The good news is we’ve made a full recovery in the lodging industry without that, so that’s just one more leg of growth ahead. And international travel used to contribute significantly to the overall U.S. economy, and it has not yet made a full recovery. So, to me that’s a growth driver that lies ahead for the back half of ’23 and into ’24, which is a reason we should all be optimistic.”

Looking beyond the next couple of years, Woodworth is very bullish on the industry for the second half of the decade. “By the time we get into the third and fourth quarter of ’24, people are going to start looking very positive in terms of road ahead,” he said. “I think the fundamentals—once you get beyond 2024—are very favorable,” he said. “And we could be looking at growth levels that I’ve only seen one or two times in my entire 40-plus year career. So, I think the back half of the 2020s, the industry could see some of the best times we’ve ever seen.”