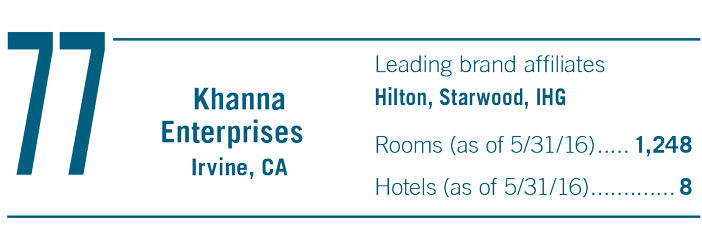

Irvine, CA—Khanna Enterprises, headed by CEO Ravi Khanna, specializes in the ownership and development of hotels. With three locations in the U.K. and five in California, they manage each of their full-service properties with a keen eye that is responsible for a 10% increase in RevPAR in the past year.

“Last year was our strongest year ever for RevPAR—it was a very good hotel year. It has calmed down a little bit, but you have to remember last year was a very good year,” Khanna said of 2014 to 2015’s 14% increase in RevPAR.

The business model is not complex in ideology; however, its intricacies are in the time, patience and strategy such a model takes to develop and execute successfully. “We go for existing hotels in ‘A’ locations in California,” Khanna said, noting that the company changed its portfolio in the U.S. five years ago, selling off all of its limited-service hotels and adding more upscale properties.

With more than half of their eight properties located in California, Khanna called the company’s presence in the state a strategic move. “We are based in Irvine, California so we want to stay close to home. More importantly, we feel real estate values are more solid in California on a long-term basis,” he said. The company’s ultimate goal is to remain in the state and acquire additional properties as time goes by. All of the equity used is Khanna equity, though the company uses local lenders as well.

The approach to each hotel in the company’s portfolio varies slightly, Khanna explained. It will buy existing hotels and renovate and rebrand, or in some cases, keep them as is. Rebranding has been a main focus since 2010.

In 2009, Khanna Enterprises purchased a Joie de Vivre property in San Jose, CA. In 2010, they converted it to an 86-key Four Points by Sheraton. “It has done extremely well ever since we rebranded,” he said of the property. Similarly, they purchased the Hotel La Jolla earlier this year and converted it from a Kimpton property to a 110-key Curio by Hilton.

For the two recent conversions, Khanna said, “The strategy was that we wanted ‘A’ locations, and that was the first prerequisite. Both were boutique properties that had boutique brands Joie de Vivre and Kimpton. We felt both properties were under-performing because the boutique brands only really had a presence in California. They did not have a nationwide or worldwide presence. So we converted both to major branded affiliations first with Starwood and then with Hilton.”

Each property brings a different set of guests and clients for Khanna Enterprises. For the recently converted Four Points property, guests are mostly corporate, transient and stay from Sunday to Thursday. “We get a lot of business through Starwood’s central reservation system. Actually, we get a ton of business,” Khanna said of the property. “We get one of the highest percentages in the system for Four Points coming through Starwood’s CRS.”

After the conversion of the Four Points, Khanna said he saw ROI nearly immediately. “Revenue went up drastically the moment we converted in 2010 and it’s been going up ever since. San Jose is an extremely strong market,” he said.

“For the La Jolla, we just converted, so it is the early days but it is most likely going to be leisure and transient guests. It is going to take time to ramp up customers,” said Khanna.

When choosing which brand to affiliate with, Khanna said, “Every property is different but with the Hotel La Jolla, every brand was interested in converting it. With Hilton, we just felt like they were reasonably flexible and you could convert pretty quickly.”

After assessing various factors, including the brand’s strength, Khanna enterprises decided to rebrand the property into Hilton’s Curio brand. “We felt Hilton was the right fit. We were able to complete the conversion process quickly—in less than 90 days.”

Khana explained another reason Khanna Enterprises decided to go with Hilton’s Curio. “Other brands wanted us to be more flex service, which would have meant eliminating our restaurants and making a breakfast area, and we didn’t want to get into all that,” he said. “We wanted to stick with a full-service. Plus, Curio has a philosophy that allows each property to be independent because Hilton sees the brand as a collection of hotels.”

Khanna explained that being under the Curio umbrella allowed the hotel to keep the Hotel La Jolla name and keep an independent management team. Additionally, Curio had few brand standards and the brand did not limit the hotel’s booking rates.

“Theoretically, you’re supposed to get the best of both worlds because you’re still getting the Hilton reservation system and Hhonors members are staying with you,” Khanna stated.

The property has not yet realized ROI because it’s too early. “We terminated Kimpton in late February and then went independent for 80 days before we converted to Curio. We saw a pretty decent 20% drop in revenue when we were independent—which we knew was going to happen. Now we are above where we were as a Kimpton property but we still have a long way to go,” he said.

Other Khanna properties include a Crown plaza in Sacramento. “It was purchased as a run-down Holiday Inn; we converted it and completely renovated it,” Khanna explained. They also have an existing Joie de Vivre property in Los Angeles, the Custom Hotel.

Of the Holiday Inn and Best Western U.K. properties, Khanna said “We had those properties for about a decade.” The Best Western properties have meeting space and restaurants and are considered more upscale than their American counterparts, according to Khanna.

Asked about the difference in doing business in the U.S. and U.K., Khanna replied, “The basics are the same: guest retention, attracting guests, making sure guests are happy. But the U.S. economy is better and it’s allowed us to expand more here than in England.”

On taking risks and entering vertical markets, Khanna said, “We are very experienced in the hotel industry so we have taken calculated risks and generally they have paid off. In the hotel industry, we don’t see it as risk-taking because we know it so well. That’s one of the reasons we don’t do other markets.”

As for the future of Khanna Enterprises, Khanna said, “We are looking to expand and buy another one or two properties this year but we haven’t singled out anything yet.” HB