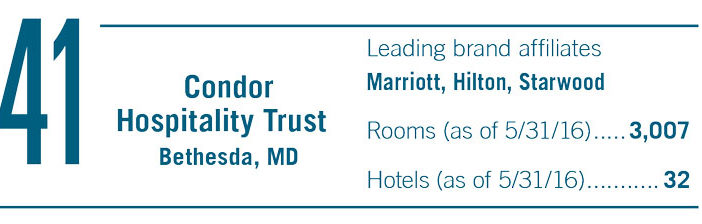

BETHESDA, MD—In the past year and a half, Condor Hospitality Trust Inc., has changed its name from Supertel and moved corporate headquarters here from Omaha, NE, two moves that complement the company’s new investment platform and strategy: divesting its economy segment portfolio for upscale, select-service properties.

Bill Blackham, Condor’s CEO, told Hotel Business that the relocation of the corporate headquarters earlier this year was planned to facilitate two things: the growth of the company and the increased ability to hire individuals with significant hospitality experience or skill sets. “It’s much easier to accomplish our strategic objectives with our headquarters in Bethesda given all of the hospitality and lodging companies that are located in and around Washington, DC,” he explained, noting this also enables Condor to be closer to the action. “Being with our peer group in Bethesda makes it easier for us to connect with people who are coming to the area as they are able to easily stop by Condor without having to make a special trip to Omaha.” While the corporate headquarters have moved, Blackham was quick to note that established teams such as accounting would continue to maintain offices in Nebraska. “We believe we have now enhanced our management team, creating a truly high-energy and experienced group that has great qualities and capabilities—it’s something I’m most proud of,” said Blackham.

This move follows the company’s name change to Condor, which complements the change in the investment platform at the company. “The name change was part of our rebranding strategy, which also involved greater transparency on the direction of the company,” he said.

This move follows the company’s name change to Condor, which complements the change in the investment platform at the company. “The name change was part of our rebranding strategy, which also involved greater transparency on the direction of the company,” he said.

That new strategy is one focused on selling off economy assets and investing in premium, select-service, extended-stay and limited-service hotels that fit the company’s investment criteria. “It is very difficult to compare things on a macro basis but we do believe the new investment strategy is a more favorable direction for the company,” said Blackham.”

Speaking to the company’s progress, Blackham said, “In the 16 months I have been with the company, the legacy hotels, which are in the economy sector, have decreased from 59 to 26 currently. A number of the 26 legacy hotels are either under contract or in the marketing process.”

The expectation is for the company to recycle capital from the sales of the legacy assets into the new investment platform over a period of time. The latest acquisition for Condor is the result of a joint venture with Three Wall Capital to acquire the Aloft Atlanta Downtown, for which Condor will own 80% of the JV. The purchase price for the property-—a 254-room hotel—was $43, 550,000 and the per key acquisition price was some $170,000.

Because of the company’s investment criteria, portfolio acquisitions are not a focus. “We’re very selective in making sure that we are acquiring assets that are either less than 10 years old or have had substantial renovations to bring the hotel to current brand standards within the last three years. Beyond that, we also have target MSAs, preferred attributes, including construction materials, and desired demographic trends from the standpoint of population and job growth,” said Blackham. “It’s very difficult to find even a small portfolio of hotels for sale that meets even a minimum number of our target criteria, so we have pretty much stayed away from portfolio transactions.”

Looking at the current landscape, Blackham said, “A number of our peers are on the sidelines and less active in making acquisitions. We have differentiated ourselves by seeking assets in the top 100 MSAs with the largest concentration expected to be in locations ranked between the 20th largest and 60th largest MSAs. We believe there are fewer parties pursuing this particular strategy. From our perspective, it has been a good time to be an acquirer of hotels. There’s less competition and, at the same time, the quality of the assets coming into the marketplace appears to be improving.”

Blackham was also positive about the lodging industry’s future. “The hospitality market continues to be relatively strong when compared to historical benchmarks. Certainly, the rate of growth of RevPAR has slowed down but even by historical standards it’s still a very favorable environment,” he said, noting that this picture gets even better if you deduct statistics from large markets that are experiencing supply issues, such as New York City. “When you take a look at the residual numbers, it’s actually a relatively favorable marketplace by historical standards, particularly in the secondary markets we’re targeting.”

Reflecting on the company as it heads into the future, Blackham said, “Condor has begun the process to evolve into a credible select-service hospitality real estate investment trust that is differentiated from its peer group in terms of its investment strategy. Anytime you take a platform and change essentially everything about it, including exiting a particular sector while simultaneously entering a new sector, that’s a very challenging time and a very taxing time on the resources of the company. Our focus is on finding the best possible assets so that we can rebuild this company with a very high-quality portfolio that meets our investment criteria.” HB