Independent hotels, which represent a loosely defined chain scale at best, are expected to post another solid year in 2018, driven primarily by the higher-end properties in the segment. Since many independent hotels are similar to upscale, upper-upscale and, in some cases, luxury hotels, performance for the segment is predicted to roughly mirror those premium-priced chain scales.

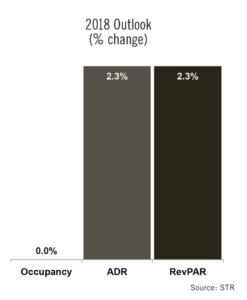

The independent sector is considerably difficult to track, so some firms don’t even attempt it, since property types can range from tiny mom-and-pop roadside motels to trendy, urban, lifestyle boutiques. That said, STR is projecting a slight year-end 2018 occupancy boost of 0.9%, ADR growth of 2.1% and a RevPAR increase of 2.5%.

“We’re forecasting independents kind of like what you would economy in terms of growth rate,” said Bobby Bowers, SVP of operations for STR. “That said, our independent sample is skewed to the upper end. If you look at only independents that report data to STR, I think their performance would be more like upper-upscale, or upscale, where you’re going to see RevPAR growth between 1.5-2% or so, driven by rate.”

Independent hoteliers say the space is a great place to be at the moment, for a number of reasons. For one, consumer preference is continually gravitating toward the independent, boutique-type products in the market, due to a thirst for unique experiences. This puts independent hotels in a prime position to enjoy robust demand that similar branded hotels may not always enjoy.

“Today’s traveler is looking for the experience. They’re looking for authenticity, so for the independent property and segment, there’s a certain traveler that searches that out,” said Doug Rigoni, president & CEO of Coast Hospitality. “They want to have experiential travel, and we’ve heard that, but it’s so true; the large brands have reinvented parts of their companies and have added that whole soft-brand component in order to help answer the need of this traveler with disposable income, who wants to experience the hotel and the location. So, this soft-brand concept has just exploded over the last 10 years.”

“Today’s traveler is looking for the experience. They’re looking for authenticity, so for the independent property and segment, there’s a certain traveler that searches that out,” said Doug Rigoni, president & CEO of Coast Hospitality. “They want to have experiential travel, and we’ve heard that, but it’s so true; the large brands have reinvented parts of their companies and have added that whole soft-brand component in order to help answer the need of this traveler with disposable income, who wants to experience the hotel and the location. So, this soft-brand concept has just exploded over the last 10 years.”

One area, however, where independent hotels are tirelessly working to boost demand—like much of the upper end of the hotel industry—is in the group sector, which continues to hover at levels below what was seen in pre-recession times. Sources told Hotel Business that driving group business will be a major challenge for independent hotels in 2018, and many operators are waiting to see if macroeconomic factors like the new federal tax law will prompt companies to increase the size and frequency of their meetings.

“A lot of our focus is on driving group business,” said Mike Marshall, president & CEO of Marshall Hotels & Resorts. “It’s still building back up in drips and drabs; it’s just a different group business from what it was before. We just don’t see the same corporate group business. Companies know they need to have these group meetings because they need to get the message out; they need to have the networking and you have to have peer-to-peer conversations, which are done better in person. But many companies can’t really afford to do it every year, so they stretch it to every three years, and maybe will eventually go back to every two years. It’s also a lot of work for the people putting these conferences on, and it’s a lot of money. It gets more and more expensive, and it’s not just hotel costs: It’s also the cost of travel and F&B.”

Others also cited the changing nature of independent hotel demand. While group business may still be moving at a crawl, transient demand has become the segment’s bread and butter. That demand sector itself has also been changing, too, in favor of mobile bookings and much shorter booking windows. Rigoni said this comes part and parcel with the profile of the modern independent hotel guest, and will be a driver for marketing and revenue management efforts at independent hotels in 2018.

“We still do our fair share of group business at our group hotels, but it’s definitely more individual traveler demand; that is definitely up across the board,” said Rigoni. “In my opinion, travelers today have a shorter booking window, and they’re doing it on their phones. Everybody is booking rooms on their mobile, and what we’re going to see is more and more travelers who want a choice. That’s the trend for independent hotels: Our travelers want choices.”