NEW YORK—The still-enthusiastic optimism felt at last month’s New York University International Hospitality Industry Investment Conference, held here, appears likely to continue to reverberate the rest of the year, amplified by increased confidence on the consumer front in June, a positive lender attitude and the gung-ho approach toward expansion being maintained by owners, developers and franchisors.

Looking back to look forward, several industry data trackers cited Q1 as strong in terms of industry fundamentals. In its latest Hotel Horizons report [June/August 2017] CBRE Hotels’ Americas Research indicated a 2.8% increase in demand drove Q1 occupancy to 61.1%, the highest for a first quarter recorded by STR since 1988. In the same period, ADR advanced 2.5%, yielding a 3.4% RevPAR increase.

According to PwC US, lodging demand in Q1 also increased at the strongest quarterly rate since Q1 2015, despite real GDP growth of 0.7% in the quarter.

Q1 also saw the installation of Donald J. Trump as president, and as the year and his administration progress, the lodging industry is facing any number of changes out of Washington, ranging from broad healthcare issues to the newly implemented Travel Ban, the support of upgrading U.S. infrastructure, the threatened elimination of Brand USA and the back-peddling on easing U.S. travel to Cuba, all of which have some degree of impact on the lodging industry.

According to PwC, its outlook is based on an economic forecast from IHS Markit, which expects the administration will attempt “a more modest agenda” this year than initially suggested, which may affect expectations for tax and regulatory reform.

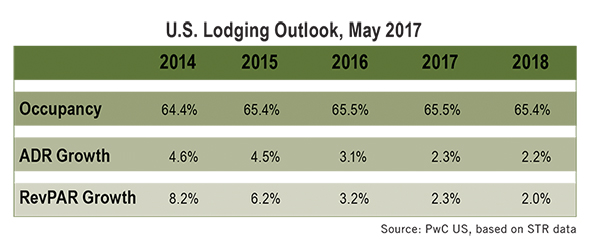

PwC forecasts U.S. lodging performance will “temper” for the remainder of 2017, “as peaking supply growth is expected to place increased pressure on pricing power.”

In the next four quarters, CBRE Hotels’ Americas Research expects occupancy to remain basically flat at 65.6%, with ADR growth advancing 3%, a slight increase over the previous four quarters’ 2.9% growth. RevPAR growth is seen as trailing downward to 3% compared to the previous four quarters, which came in at 3.4% growth.

CBRE goes on to forecast supply growing at 2%, above both the long-run average of 1.8% and the 1.7% growth of the past four quarters. Demand, meanwhile, is predicted to slip 0.1% from the previous four quarters to 2%, putting it on par with the long-run average.

In data from STR showing the supply/demand percentage change as of May 2017 YTD (see chart), supply growth outpaces demand growth in upper-tier hotels, albeit only slightly in the luxury and upper-upscale segments, and most notably in the upscale segment. Demand, meanwhile overshadows supply in the upper-midscale, midscale and economy segments, with demand growth far outpacing supply growth among independent properties.

Further out to 2018, PwC sees a shift in the supply-demand equation to result in a minor annual decline in occupancy, the first since 2009. However, ADR growth of 2.2% is expected to drive an increase in RevPAR of 2%, the slowest growth rate in nine years, noted PwC.

At the in-the-trenches level, Randy Hassen, president, hotel management division for McKibbon Hospitality, sees mid-year offering opportunity, but not without challenges.

“As the hospitality industry continues to evolve with new brands emerging, consolidation and guest preferences changing, management companies are expected to be flexible in their approach. One of the biggest opportunities is breaking into new segments and elevating our guests’ experience at these properties,” said Hassen, who noted a variety of trends continue to influence operations, none of which are expected to fade as 2018 approaches.

“Technology is increasingly impacting how we approach day-to-day business at our properties, from enhancing in-room technology and deploying mobile check-in programs to managing online and social media presence,” said Hassen. “Millennial travelers are looking for spontaneous and unique experiences. Hotel managers are challenged to elevate the guest experience by implementing locally sourced F&B components and adding an enhanced level of service and amenities.”

The McKibbon executive indicated guest expectations are the driving change in the market overall, and hotel owners, brands and managers are having to adapt. The main shift is occurring around guests wanting to experience a city as if they were a local. “As the millennial generation continues to expand their travel, the demand for these programs will only increase,” he said.

Certain priorities on the owner side, however, remain largely unchanged, whether it’s 2017, 2018 or beyond.

“We are focused on revenue and profitability growth, operating award-winning hotels and having an active presence in our communities,” said Hassen.

Heading toward 2018, he cited some concerns to which management companies should be paying attention. “We’ll see more disruption in our markets with new inventory being added, Airbnb’s growth, and cost escalation related to providing the best overall guest experience. With these challenges, it is critically important that we align with our owners’ goals and expectations as we adapt in this ever-changing environment,” he concluded. HB