When is a cranky boiler like the lodging industry?

When you’re running to the thermostat every five minutes to see if it’s moved even one degree ahead.

To say the hospitality industry has been closely monitoring every nuance that points to a pull-away from the crushing effects of the coronavirus pandemic would be an understatement and, in many cases, it’s been two steps forward and one back.

But take heart, owners, operators, developers and investors; the cold, hard facts coming from hospitality’s data-crunchers heading into 2022 show—to quote the late Eagles frontman Glenn Frey—the heat is on.

According to the bulk of the industry’s stats-and-trends trackers, the frost that’s been covering hotel performance since the pandemic blew in almost two years ago was thawing quite nicely in second-half 2021, with conditions forecast to improve for some key metrics in 2022 to pre-pandemic levels for U.S. hotels.

“[Last] year was definitely a turn in the right direction after we saw the lowest performance levels on record during 2020,” said Amanda Hite, president/CEO, STR. “Performance…steadily improved over the course of the year, and we saw normal seasonality return during the second and third quarters.”

As of December, the executive noted leisure travel continued to be the primary driver of demand; however, she observed business travel and groups “are still further off pace, but we anticipated these segments would be slower to return. We expect overall demand and room rates on a nominal basis to near full recovery in 2022.”

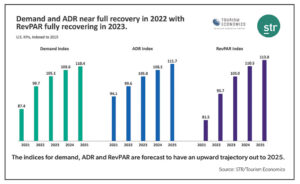

“Normal” also is expected to return to RevPAR by next year, with the KPI fully recovering in 2023, according to STR/Tourism Economics data, with all three KPIs forecast to continue an upward trajectory out to 2025 (see chart, top right).

Similarly, CBRE is forecasting a return to 2019 levels for ADR, demand and RevPAR. “We expect ADR to make a full recovery to pre-pandemic levels in 2022, driven by an 11.2% increase in demand and just 1.2% supply growth,” said Rachael Rothman, head of Hotels Research and Data Analytics, CBRE Hotels. “The stronger demand growth gives properties better pricing power.”

Indeed. Hite noted as Q3 and Q4 2021 were unwinding, many hoteliers were driving top-line performance via ADR. “That is what led us to move the RevPAR recovery timeline up by one year in our latest forecast,” she said. “So long as inflation is a factor and the competition for talent remains strong, ADR is going to be the key piece of the puzzle.”

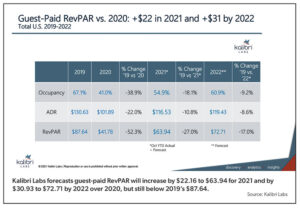

At Maryland-based Kalibri Labs, which evaluates and predicts hotel revenue performance, the thinking is it may take a little bit longer for the recovery “heat” to come up. Cofounder/CEO Cindy Estis Green and Partner/Senior Advisor Mark Lomanno indicated the benchmarking company’s forecast for a U.S. national-level recovery, as defined by RevPAR levels exceeding 2019 levels, “is unlikely to be achieved prior to late 2023 or early 2024.”

“By year-end 2022, both occupancy and ADR will each recover just over 90%, when compared to 2019 levels (see chart, 3A),” said Estis Green. “The combined declines in those two key measures will negatively impact RevPAR levels for all U.S. hotels, as it will only recover to 83% of 2019 levels.”

But while the industry’s recovery temperature may be rising, as with any home, what space you occupy in hospitality’s “house” and where it’s located is apparently determining just how comfortable you might be in the months ahead. The largely branded segments—economy, midscale, upper-midscale, upscale, upper-upscale, luxury—that make up the American lodging industry, together with independent properties, are finding themselves experiencing market-specific conditions when it comes to economic recovery. So while one city may be seeing a resurgence of guest bookings that it expects to continue this year, its counterpart in a nearby state may not have cause for the same optimism.

“Nationally, the recovery will be extremely uneven at both the market and chain-scale levels due to the anticipated nature of lodging demand that will likely exist over the next 18-24 months,” noted Estis Green.

That said, Rothman observed, “The U.S. hotel industry continues to surprise to the upside, fueled by strong leisure demand and a nascent recovery in group and business travel. TSA throughput is running at roughly 85% of pre-pandemic levels, and the markets hardest hit during the pandemic are poised to benefit from the resumption of inbound international travel.”

Just as a number of trickle-down factors emerged from the onset of the pandemic—job cuts, lack of travel, fear of COVID-19—the easing, or even reversal, of those and other aspects at this point in time is seen as catalytic for the nation’s and industry’s recovery. While there’s strength in the forecast numbers presented by STR/Tourism Economics, CBRE Hotels Research and Kalibri Labs, the data looking into the future, of course, remains assumptive. Closer in, several industry association leaders, as well as a variety of owners and operators down in the trenches, are expecting this year to be a mixed bag of positives and negatives. And to add to that mix, at press time new concerns regarding the novel coronavirus and its Delta and Omicron variants were pushing the envelope on uncertainty, putting question marks on any number of prognostications.

Still, from his perspective as President/CEO of the American Hotel & Lodging Association (AHLA), Chip Rogers is “cautiously optimistic” about the state of the U.S. lodging industry.

“While we are trending toward recovery, the situation remains fragile due to lingering COVID concerns, high gas prices and supply-chain issues,” he said, adding, “Labor shortages remain an ongoing challenge and are making it tough for some hotels to hire enough workers to meet demand in key markets.”

To offset this, Rogers said AHLA and the AHLA Foundation are continuing in 2022 to focus on “growing the hospitality talent pipeline and helping members address the labor shortage.”

Sounding a similar opinion, Vinay Patel, current chairman of AAHOA (Asian American Hotel Owners Association), feels the industry is poised to grow. ”We have a long runway and we are in for a good, long ride, but it will have challenges as we progress,” he said. “[There’ll be a] lot of unknowns and things will come up, but we can overcome them and we’ll come out on the positive side.”

With close to 20,000 members, many of whom own and operate branded, franchised hotels concentrated across the economy to upscale segments, AAHOA as a group can anticipate a positive by default this year, offered Patel. “The positive is that we are at the bottom and we have nowhere to go but up.”

Also optimistic for 2022 is Andy Ingraham, founder/president/CEO of Florida-based NABHOOD (National Association of Black Hotel Owners, Operators and Developers), who sees “much-needed relief on the way with people getting back to travel.”

However, like his association peers, Ingraham anticipated industry growth “will be slow” as markets recover and tagged 2023 as feasible for greater stability.

With some 2,500 members representing 40,000 rooms largely in the midscale segment, Ingraham was confident both would continue to grow this year.

“Our membership will continue to grow as more African Americans become aware of hotel ownership and investments,” he said. “Many of the hotel companies will continue to expand their D&I (diversity and inclusion) efforts but unless they are prepared to use their capital and credit facilities to help grow African American ownership, the challenges will remain. There will be a lot of opportunities for growth with capital being available and driven by pent-up demand for travel; people will want to get out.”

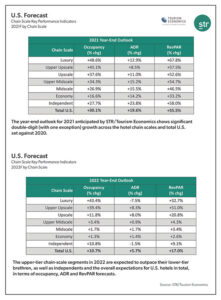

As might be expected, drilling down on key metrics’ performances during the past two years and the outlooks for this year shows deep negatives for 2020 and strong positives for 2021 in terms of STR/Tourism Economics’ U.S. forecast, with 2022 showing continued, albeit slower, positive growth (see chart, above).

According to the companies’ data, occupancy in 2020 declined 33.3% but was forecast to rebound with 30.1% growth at year-end 2021 and push ahead again by 10.7% this year. ADR was down 21.2% in 2020, improving last year by 19.6%, with 2022 forecast to see a 5.7% gain. It is no surprise then that RevPAR took the hardest hit in 2020, dropping 47.4%. That said, RevPAR came back last year with 55.5% positive growth and is forecast to show 17% growth this year.

With the pandemic crisis in full swing in 2020, demand sunk 35.9%, while supply ticked down by 3.9%. STR/Tourism Economics forecast positive growth for demand and supply for 2021 at 36.7% and 5.1%, respectively. Growth will remain positive but slow in 2022, with demand (+13.7%) continuing to outpace supply (+2.8%).

In its proprietary Hotel Horizons Q3 edition issued in December, CBRE Hotels Research forecast similar positive numbers for all U.S. hotels, closing out 2021 with occupancy at 55.7%, a 30.4% improvement over 2020; ADR up 20.1% over the previous year to $120.98; and RevPAR at $67.40, a 56.5% increase over 2020. Demand growth at 32.3% was forecast to far outpace supply growth (+1.5%).

For 2022, the anticipated percentage shifts in CBRE’s National Forecast are not as extreme. Its predictions call for year-end occupancy of 61.2%, a 9.9% increase; ADR moving up by 8.1% to $130.78; and RevPAR pushing up 18.8% to $80.04. While supply growth is forecast to tick downward slightly to 1.2%, demand, while still expected to be robust, slows to about a third of last year’s growth rate at 11.2%.

In its forecast, CBRE expected a full recovery in RevPAR to 2019’s levels in 2023 on a national basis. Rothman cited a number of 2022 catalysts that will provide continued improvement, setting the stage to make that happen. She said these are: “A resumption of inbound international travel, the fact that additional firms plan to ‘return to office,’ the escalations in corporate travel budgets, record levels of nonresidential fixed investment (business investment) and record-level household checkable deposits. In addition, unemployment is now below pre-pandemic levels. Combined, these factors bode well for the continued recovery in the U.S. hotel industry.”

A positive for any industry stakeholder, said STR’s Hite, is that “the desire to travel is as strong as it has ever been. [Last] year showed that people need to connect in person, whether it be family, friends, colleagues or business prospects. The pandemic provided an opportunity for hotels to test new ideas, and travelers have come out with more flexibility when it comes to combining their business and leisure trips.”

STR is forecasting expansion of the economy via increased consumer spending, raising the question if this might allow hoteliers to raise rates faster, as many consumers just want to “get out of the house/virtual office and go somewhere,” with price not a major concern since “they deserve it.”

Hite indicated this was yet another positive for 2022. “In addition to the obvious pent-up demand, the added savings that Americans accumulated over the course of the pandemic have really created the perfect storm for leisure travel, with many willing to pay more for experiences,” she said. “That is important because hotels are pushing rate to alleviate some of the pressures of labor costs on their bottom line.”

AHLA’s Rogers noted that while leisure travel has been “a saving grace” for the hotel industry, “business travel, which predominantly impacts large urban markets, has been slow to return and comprises a majority of hotel revenue. Regardless, there is more to do to bring our industry back to where we were before the pandemic.”

BUSINESS VS. LEISURE

While the industry will likely warm to the positive predictions being advanced, there’s no escaping the cooling effect some of the negatives will continue to have this year, not the least of which revolve around the ongoing pandemic. At press time, the nation (and the world) was experiencing a surge of coronavirus cases driven by the Omicron variant, leading to thousands of airline flights being canceled, hours-long queues of Americans seeking COVID tests—with tens of thousands testing positive—and a reactionary move by many businesses and venues to shutter temporarily or shut down completely, as in the case of many Broadway shows in New York City, thereby impacting one of the destination’s key tourist attractions.

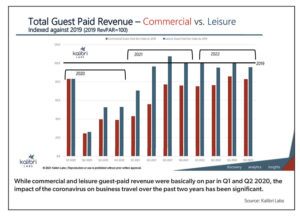

It’s not unreasonable to think the gains made by leisure could be eroded by a prolonged spread of Omicron and stall slowly recovering corporate and group business. However, if the spike in COVID cases plateaus and the variant surge recedes sooner than later, the outlook keeps leisure travel in the driver’s seat for delivering hotel revenue. For example, Kalibri Labs’ forecast anticipates that leisure demand, nationally, will maintain 2019 levels through 2022.

“The recent predominance of the transient leisure traveler will likely continue for the foreseeable future as they will represent about 60% of guest-night stays over the next couple of years,” said Kalibri Labs’ Lomanno. “Historically, this broadly defined demand segment has represented less than 50% of room nights and was at 47% in 2019. These guests returned to the marketplace in numbers rivaling pre-pandemic highs by the summer of 2021 as pent-up travel demand drove many consumers back to hotels.”

These guests over the past year also brought what Lomanno characterized as “an incremental benefit” for hotels: they tended to stay longer.

“In 2019 the average length of stay at hotels had been just under 1.9 nights, meaning that the overwhelming number of hotel stays were one night,” said Lomanno, noting since March 2020, the average length of stay has risen to almost 2.2 nights. “Interestingly, this rise in stay patterns has been almost exclusively in middle- and lower-tier hotels, with virtually no change in upper-tier properties,” he added.

STR and Tourism Economics expect leisure to continue to lead the recovery, basically holding steady from Q3 2021 out to Q4 2022. At the same time, the forecast indicated business travel and group business are trending up to meet it. Making that happen in 2022 will apparently take more than the end of the boom in Zoom.

“The expectation is for corporate travel restrictions to ease, and in 2022, travel patterns should normalize progressively with revised travel policies and budgets,” said STR’s Hite. “That, of course, assumes no major setbacks with the pandemic. Groups have a long way to go and there were still high-profile cancellations during Q3 because of the Delta variant, and now more concerns and cancellations due to the Omicron variant. With that said, there has been improvement in the group segment, and with most recurring events back on the calendar, there should be a slow and steady rise in group activity.”

From Kalibri Labs’ viewpoint, commercial demand (group and transient corporate) will continue to be “much slower” to return to pre-pandemic levels (see chart, page 6A). “As of October of 2021, this formerly dominant demand segment had only returned to about 70% of 2019 levels,” said Lomanno. “Our expectation is that while there will be overall demand growth from this segment in 2022, it will still remain significantly below pre-pandemic performance, and will not return before there is a significant uptick in the quantity of large conventions and groups, as well as the return of corporate-driven business transient travel.”

The company has closely monitored the commercial segments and has made several assumptions about the timing and nature of the return of group and corporate business, according to CEO Estis Green. “Group is gradually growing in all segments, as upper-tier hotels started to see a notable rise in group business during the second half of 2021, although the larger groups and citywide conventions have yet to return, which will place a ceiling on the magnitude of their return to pre-pandemic demand levels,” she said. “Lower- and middle-tier hotels have experienced a higher level of improvement in transient business travel during this time as they are more likely to be located in suburban and rural areas where the nature of the business travel tends to be much more local.”

However, added Lomanno, larger corporate accounts that tend to house their travelers at upper-tier hotels “have been slow to return to their previous travel behavior due to a combination of budget restrictions, concern for employee liability, adherence to sustainability initiatives and the new familiarity and ease of using remote technology.”

Until these types of business travelers return, “hotels in urban locations, especially those in the luxury and upper-upscale chain categories, will struggle to fully recover,” he said.

THE BIG CHALLENGES

In each of their outlooks, none of the data-crunchers ignored the 800-pound mint on the pillow, i.e., the pandemic, which has basically overshadowed everything for the past two years. However, they also acknowledged the many trickle-down negatives, some stemming from the coronavirus—and now its variants—that may continue to create obstacles for the industry this year.

CBRE Hotels’ Rothman ticked off some minuses that included labor-cost increases, supply-chain disruptions, the potential for changes in travel requirements “and potentially any changes to the COVID landscape,” she said.

Similarly, STR’s Hite suggested, “The big challenges right now, especially for owners, are the effects of inflation, labor shortages and subsequent rising wages on overall profitability. Additionally, it is safe to assume there will be some level of pandemic uncertainty for the foreseeable future.”

The executives at Kalibri Labs indicated their forecast assumed commercial business will gradually start to ramp up in major markets in the first quarter and continue throughout 2022, but that there will be some headwinds that will continue throughout the year. These would be created specifically “by large corporate accounts as companies impose stricter guidelines on travel approvals,” said Estis Green. “Sales and account management trips to support clients are a segment of business travel that has already started to return, while intracompany travel for employees to meet with colleagues in other locations may remain in a remote model for some time. A new variable in the forecast is related to the Omicron variant, causing many offices to be slower to reopen, which may further diminish the ability of business travelers to meet in person with clients.”

Added Lomanno: “One major hurdle that will continue to affect and delay the return of large groups, citywide conventions and the large corporate accounts is the persistent nature of COVID-19 and the continued evolution of the variants. Until case counts begin to consistently drop and the major metropolitan areas are able to relax indoor safety measures, that demand is unlikely to return in significant numbers.”

There’s also one overriding aspect coloring—with a very broad brush—the pace of the industry’s advancement this year, and it was tagged succinctly by AAHOA’s Patel.

“The negative is the uncertainty. Things are moving fast and obstacles come up quick, like the variants,” he stressed. “And [they’re] not easy to manage because they come up so fast.”

CHAIN-SCALE POSITIVES

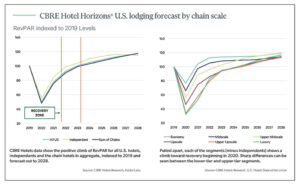

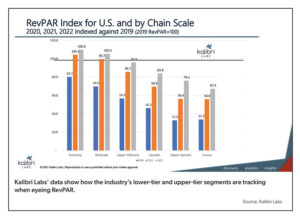

Statistically, CBRE Hotels, Kalibri Labs and STR/Tourism Economics are bullish in their predictions for RevPAR recovery for the segments, including independents. In its December “U.S. Hotels State of the Union” report, data from CBRE Hotel Horizons show the positive climb of RevPAR for all U.S. hotels, independents and the chain hotels in aggregate, indexed to 2019 and forecast out to 2028. Interestingly, independents are predicted to achieve a pre-pandemic 100 RevPAR Index first this year, compared to the others, which are anticipated to hit the mark closer to 2023. Pulled apart, each of the segments (minus independents) shows a climb toward recovery beginning in 2020. Sharp differences can be seen between the lower- and upper-tier segments, with economy and midscale back to a 100 RevPAR Index in 2021 and upper-midscale forecast to hit the mark later this year/early 2023. For upscale, upper-upscale and luxury, it looks like 2024 will be the year all three will cross the 100 RevPAR Index threshold.

“We expect the highest-price-point properties to experience the strongest growth rates on average, as the lack of corporate and group travel have impacted them the most,” said CBRE Hotels’ Rothman. “That said, the lower-price-point hotels (economy and midscale) will grow the least, as they will have already made a full recovery. We expect supply growth to be muted across the industry owing to projects being furloughed during the pandemic and rising labor- and construction-cost increases.”

The executives at Kalibri Labs also expected economy and midscale chains to be fully recovered at the end of last year, and set to exceed those levels this year.

“These segments will benefit from strong demand in rural areas and small towns, where a disproportionate number of their hotels are located,” said Lomanno. “In addition, a more leisure-dominated demand mix and those guests’ propensity to stay longer will benefit these hotels as well.”

And when it comes to business-travel recovery, lower- and middle-tier hotels are expected to outpace the upper-tier in reaching 2019 RevPAR levels by the end of this year, according to the company.

“The upper-tier hotels that are more highly dependent on a commercial base will see corporate and group growth in 2022, but depending on the market, most may not have a return to full 2019 RevPAR until 2023-2024, with a few select major urban markets that may even have a slightly more protracted recovery,” said Estis Green. (See chart, page 8A.)

ECONOMY

So what of the thousands of U.S. hotel owners and operators who populate the chain-scale segments of the industry? Are they seeing the year ahead as a glass half-full or half-empty, and what factors could change these perceptions?

For economy-segment hoteliers Asmita Amin and Gregory Trzaska, each of whom own and operate a pair of Americas Best Value Inn properties—she in Minnesota, he in Ohio and Florida—their chief concerns this year center on people: not having enough to staff their properties, and when they do get quality candidates, not having enough money to meet updated wage standards.

“Throughout this pandemic, it has been extremely difficult filling all hospitality positions,” said Trzaska, a 22-year industry veteran, noting often the search for employees was to no avail. “Months would pass without any applicants responding to job postings. If an applicant would respond, follow-up and scheduling interviews just didn’t pan out.”

Amin pointed out lack of labor, together with supply-chain woes, is causing permanent damage in some cases. “The economy segment is really struggling finding labor and businesses have been shutting down because of [the]labor shortage,” she said. “Also, some businesses, especially in the economy segment, may not be able to pay $15-$20 an hour to each employee, which can be one of the biggest concerns.”

Trzaska said with many states passing yearly minimum wage increases, hoteliers in the segment must seek ways to offset the additional overhead cost. “I am looking at technology, cross-training and continual education/certification programs to ensure that my employees are both productive and provide an exceptional guest experience,” he said.

Both hoteliers are in push mode for 2022; Amin is concentrating on pushing occupancy, while Trzaska is pushing rate.

Amin’s tactic, she believes, will “slowly” lead to increasing rates. “Economy properties were impacted a lot during the pandemic,” she said. “If the focus is more on rate, then the recovery would be tough as we have to face the competition in our respective markets. To stay in competition and to recover, the best option is to focus on occupancy, which will lead to rate increase.”

In contrast, Trzaska will zero in on rate while “maintaining great value” relative to his competitive set. “Focusing on rate forces a property owner to bring value to the guest,” he said. “We continually reinvest in our property to ensure that our guestrooms and amenities meet or exceed our guests’ expectations. We also focus on employee training and teambuilding exercises across all departments to ensure each employee understands and is cognizant on how their role and actions impact each department and the overall guest experience.”

STR/Tourism Economics forecasted the economy segment will display the least amount of KPI growth among the chain scales and independents at year-end 2021, anticipating a 16.6% improvement in occupancy, 14.2% gain for ADR and 33.2% increase for RevPAR. By the end of this year, “normal” segment growth becomes apparent in their forecast for occupancy (+1.3%), ADR (+1.4%) and RevPAR (+2.6%). (See charts on page 9A for full U.S. Forecast for 2021 and 2022 chain-scale KPIs.)

“Economy was the segment that was able to remain closest to its normal performance levels during the worst days of the pandemic,” said STR’s Hite. “With less road to travel on the path to recovery, economy properties will see more muted growth in 2022.”

For Amin, the idea of building her hotel portfolio this year via her Raoji LLC is not a consideration. “I would not invest in any other property until I see a good future,” she said. “I do not think it’s a wise decision to invest in any new property when we have faced [such]struggles during [the]pandemic.” She did feel the passage of the $1 trillion national infrastructure bill “would increase travel, which can bring the economy back to normal.”

Trzaska had planned to build a new economy property but has postponed the project “because of all the uncertainty,” he said. “For 2022, I will just focus on fully renovating one of my existing properties. I think that there will be more capital available for economy projects [this]year, however, lenders will still be cautious and very conservative in their underwriting process for new projects.”

Like Amin, he felt there would be a positive impact from the infrastructure bill in “creating jobs and relieving some distribution bottlenecks.” Another plus he cited was the increase in vaccinations against the coronavirus and its variants. “As more individuals get vaccinated, a sense of confidence will return to travel and we will see more national and international travel with longer lengths of stay,” he said.

Both hoteliers expressed confidence in the segment for 2022.

“Now since the economy is open, travel, sports, weddings, etc., are slowly coming back to normal, the businesses are coming to their normal operations,” said Amin, who also praised her revenue management platform. “I get lots of guidance as to what the current market trend is and what will help me increase my occupancy. [The] revenue management program helped me to come back to normal operations.”

“I believe that the economy segment is more resilient in economic downturns and has overall more flexibility in the market,” said Trzaska. “In strong economic times, our segment can really push rate, while conversely, in poor economic times, focus on occupancy. There will always be a demand for cost-effective, comfortable and clean accommodations.”

MIDSCALE

Climbing the lodging ladder one rung, midscale figures for year-end 2021 forecast by STR/Tourism Economics put occupancy growth at 26.9%, ADR advancing 15.5% and RevPAR at 46.5% growth compared to 2020. And as with all the data forecast for this year, the numbers bode a return to reality with positive, albeit conservative, growth. Occupancy and ADR are anticipated to be on par with each other at 1.7% growth, with RevPAR coming in at 3.4%, according to the companies.

“Midscale hotels have always been highly dependent on leisure travelers, which left them well-positioned to manage the pandemic,” said STR’s Hite. “Blue-collar workers and guests using extended-stay hotels also have helped performance in this segment. The midscale segment will see slightly more supply growth than economy, but not enough to soften performance.”

Continuing to concentrate on midscale properties is one of the key portfolio growth vehicles for members of NABHOOD, according to the organization’s Ingraham. “[It’s] primarily through acquisition and some new construction that involves PPP [Paycheck Protection Program, an SBA-backed loan established in reaction to the impact of the coronavirus to help businesses retain employees],” he said.

Metropolitan areas stand to see more interest from members, the CEO noted, saying, “The urban cores have more minority elected officials that are insisting on minority involvement.” However, he felt 2022 will still raise concerns for portfolio expansion: “In spite of the market being flush with capital African American owners will still lag behind all other groups in accessing capital.”

Out in Seattle, Andy Cho, president/CEO of S1 Hospitality Management LLC, only has midscale properties in his current portfolio, which includes Red Lion Inn & Suites, Best Western Plus and Quality Inn. His outlook on 2022 sees lenders becoming more “friendly” than in the past two years. “I faced the challenge of refinancing my Best Western Plus that was due October 2020 [and]I saw less capital all 2021,” he said. “But [now]I have been getting calls from some of the lenders who were not interested until the summer of 2021, which is a great sign.”

Cho is intent on pumping up his portfolio of hotels (three owned, one managed) this year and is sticking to midscale. “We are growing our number of properties by acquisition, and I am currently under contract with one projected to be acquired at the end of Q1,” he said, noting, “Construction costs have gone up too much and with the issues with the supply chain, developing a new hotel is becoming more expensive and harder.”

Also in that category is Cho’s concern for staffing this year as the labor shortage continues, along with more possible travel restrictions and shut downs. He added the segment also “is price sensitive with not much room to increase ADR.”

Still, the hotelier remains confident about being in the segment this year citing, like others, the passage of the national infrastructure bill.

“The midscale segment has always been the choice of construction travelers due to price, parking and complimentary hot breakfast, and an increase in their travel can only be a good sign for the segment,” Cho said. “The new infrastructure bill is something we are looking forward to and [we]have already started our marketing [to]construction companies.” Toward this, he added his properties would be pushing occupancy rather than rate “as we feel the market has more growth in occupancy as we have seen increases in construction workers’ demand.”

UPPER-MIDSCALE

At the top of the lower-tier segments, upper-midscale is forecast by STR/Tourism Economics to close out 2021 with a 34.3% increase in occupancy, more than double the growth rate of ADR (+15.2%). RevPAR, meanwhile, is expected to show a 54.7% change. This year, occupancy is forecast to improve 3.4% with only a slight uptick (+0.9%) in ADR growth, yielding a 4.3% gain for RevPAR.

Commenting on the segment, AAHOA’s Patel switched hats to describe why he, as president/CEO of Virginia-based development and management company Fairbrook Hotels, is confident for 2022.

“It’s a great product for the consumer; they pretty much get everything they need,” he said. “For the owners, they can deliver [the experience]in a very efficient manner. Plus, it’s easier to operate, especially in today’s labor market.”

Currently, half of the Fairbrook Hotels portfolio is composed of upper-midscale properties, including Comfort Inn & Suites, Country Inn & Suites, Hampton Inn & Suites and Holiday Inn. Plans call for adding a dual-brand property in Herndon, VA: an upper-mid Home2 Suites and an upscale Hilton Garden Inn.

In terms of growth in the segment right now, Patel sees the best path as acquisition. “[It’s] the best option due to how quick you can get started,” he said. “Construction is still a good option, but due to rising costs it makes it challenging.”

There is one encouraging aspect for upper-midscale this year, Patel added. “Lenders are slowly opening up, but with restrictive terms. You have to have a good track record,” he advised.

UPSCALE

At the bottom rung of the upper-tier segments, upscale in 2021 is anticipated by STR/Tourism Economics to advance occupancy by 37.6%, with ADR at less than a third of that growth rate (+11%) and RevPAR at a 52.6% growth increase. For 2022, the segment’s occupancy is forecast to grow by 11.8%, while ADR will see a positive 8% change. RevPAR is forecast to show a 20.8% gain, according to the companies.

“Select-service hotels faced additional headwinds in 2020 and 2021 in the form of continued strong supply growth, and pipeline figures suggest that growth is set to continue through 2022,” said STR’s Hite. “The demand mix for upscale and upper-midscale hotels is more equally weighted between leisure and business demand than other classes, which further slowed the rebound in that [select-service] segment of the marketplace,”

Since its founding in the early 1990s, Equinox Hospitality has gone through several major industry disruptors and now, almost 30 years later, the San Francisco-based owner/operator is looking at 2022 and considering how it’s going to come out the other side, particularly when it comes to its upscale properties.

Principal/EVP Adam Suleman said his key concern is how long it will take to recover from the pandemic.

“2020 was the worst year on record for the vast majority of hotels in the world,” he said, noting last year provided “a glimmer of hope as vaccines became more prevalent, there was more data on the virus, usage of PPE, etc.” But, he added, there also was the emergence of the variants, political division, COVID-19 “hot spots” and what he termed “massively prevalent” misinformation.

Suleman is “cautiously optimistic” regarding the segment, citing pent-up demand for leisure transient travel. “And this segment perfectly aligns with that set of travelers,” he said. “Moreover, in our own properties, we are seeing stronger recovery of corporate and group travel, which also tremendously benefits the upscale segment. Hence, I am hopeful that 2022 will be a very positive and profitable year for many owners who have struggled during the pandemic.”

In order for that to happen, according to the EVP, “The country and the world will have to make a lot of progress against COVID-19, which is certainly stating the obvious,” he said. “I am concerned about the massive political discourse we see day to day, misinformation, the growing federal debt, inflation and the global supply chain. If large strides in science and vaccinations are made, which I believe the scientific community is currently doing, then the American lodging market as a whole should do well given we are such a consumer-based economy, and more specifically, in the upscale segment, as pricing becomes less of a concern given all the recent economic hardships many people and companies have faced. This will, no doubt, spark more leisure transient travel, group bookings and corporate travel—all vital to upscale brands.”

In looking ahead, Suleman first glanced back to find focus, noting many owners and operators have had to do more with less over the past two years. “FF&E reserves have been allocated to survival, labor was significantly cut despite the SBA’s PPP program, CapEx projects have been put on hold due to cash-flow drops, the unknown timelines of COVID-19, etc.,” he said. “Moving forward, the single key to me is pushing rate. If this can be achieved, the upscale segment will be very well served. I do believe the demand exists for travel as we are seeing increased travel rates via TSA data. Therefore, I don’t believe occupancy will be the issue. Rather, strategic revenue management to help properties yield the highest flow-through possible will be what separates ‘good’ performance from ‘great’ performance.”

Equinox Hospitality is planning to grow in the segment in 2022, with a focus on acquisitions/conversions rather than incur the costs of ground-up projects and what Suleman described as somewhat difficult construction financing.

“There are certainly quality construction deals, but one has to be careful [of]certain markets as COVID has changed the domestic and global hotel landscape,” he said. “The markets that I tend to pursue are ones with diverse demand generators, i.e., a strong mix of leisure transient, corporate and group business.”

Suleman anticipates there’ll be a “massive amount of capital waiting to get in the dog fight” of hotel deals and projects as the months roll on in the industry’s recovery, given the dearth of activity these past two years and the exceptional pre-pandemic wealth creation spawned by a decade’s worth of lodging industry profitability.

“This year should, no doubt, make for an interesting year with regards to all hotel projects, but especially upscale, as many upscale brands are so attractive to institutional investors,” said Suleman.

UPPER-UPSCALE/INDEPENDENTS

Upper-upscale in 2021 is forecast by STR/Tourism Economics to grow occupancy by 45.1%, with ADR growth the lowest of the chain scales at +8.5% and RevPAR showing a positive 57.5% change. This year, the segment’s occupancy is anticipated to grow by 39.4%, while ADR will see 8.3% growth. RevPAR is forecast to show a 51% gain, according to the companies.

“Upper-upscale hotels are the most reliant on the return of groups, thus they saw some of the worst pandemic declines and highest volume of property closures,” said Hite. “While most segments will be challenged to grow rates in 2022, upper-upscale hotels have the most room for improvement and should benefit from the slow and steady return of business and group travel.”

Pete Sams, COO, Davidson Hospitality Group, acknowledged that that return is top of mind for the Atlanta-based operator this year.

“Our concerns relate to the anticipated return of group and, to a lesser extent, business travel, both of which are critical to our performance in this segment, particularly in our urban centers,” he said. “While 2022 group pace is currently encouraging as we turn the year, we remain susceptible to cancellations related to either Omicron or the ‘next’ unknown variant.” Such shifts would stand to impact Davidson’s portfolio of 76 hotels, of which only about a half-dozen are not in the upper-upscale segment.

Taking a proactive approach to recovery in the new year, Sams said the 47-year-old company sees several reasons for optimism and are reflected in its current budgets, not the least being that momentum for both group and business travel (versus 2021).

“While we project neither will reach 2019 levels in 2022, we have forecasted group to reach 80% and business travel just over 50% of 2019 levels,” said Sams. “We see pent-up group demand as the next wave of recovery.”

The COO observed that more and more travelers are taking measures to guard against the coronavirus and many are ready to get back to business. “The shortfalls to 2019 in group and business travel in several of our key markets, particularly our leisure destinations, are offset by leisure travel that exceeded 2019 levels [last]year and we expect more of the same in 2022,” said Sams.

Such confidence begged the question if Davidson would continue to aggressively add hotels as it did last year.

“I just had a great conversation with Steve Margol, our chief investment officer, on this very topic,” said the COO. “We will, indeed, focus on continuing to expand our presence in upper-upscale. We added 23 properties in 2021, the vast majority of which were in the upper-upscale segment, in both urban and leisure/resort markets, [and]we see 2022 as an opportunity to expand further in these.”

Sams added the company expects there to be ample opportunities to acquire in the space “as certain owners are going to want to sell properties that sit in legacy funds or otherwise have had an extended hold period due to an inability to sell over the past few years.”

Industry veterans will recall the upper-upscale segment was carved out during the 1990s to better categorize independent and chain hotels that weren’t quite at the luxury level, but were a distinct step above upscale properties. While the segment descriptor still covers independents, their KPIs have long since been separately tracked.

According to STR/Tourism Economics’ forecast for independents at year-end 2021, the segment will enjoy a 27.7% gain in occupancy, a 23.8% increase in ADR and 58% positive growth in RevPAR, second only to RevPAR gains made by luxury segment properties last year. This year, the picture shifts in terms of the segment’s ADR growth, which the companies anticipate will slide downward (-1.5%). Occupancy, at a 10.8% gain, will be the driver behind anticipated RevPAR growth of 9.1%.

Sams noted Davidson Hospitality Group has 21 independent properties in its portfolio and that the overall “lift” in terms of recovery will be via pushing occupancy. “We expect to carry forward the strong rate performance in leisure [from]2021, but fill in open occupancy in the non-leisure shoulder seasons with group and business travel, thus bringing down overall annual ADR, but lifting RevPAR with occupancy,” he said, expressing confidence in the segments DHG is in.

“Travelers are interested in great and differentiated experiences, experiences best provided in your upper-echelon segments,” said Sams. “The growing trend toward combining business and leisure (bleisure) as many learn to work remotely also is best conducted in higher-end locations with multiple restaurants, bars and activities available. Travelers are willing to pay a premium for best-in-class travel and we are very much looking forward to meeting these needs in the year—and years—to come.”

Also bullish on independents—with a caveat—is Equinox Hotels’ Suleman. “I do like independent hotels in key markets, [and]we have done several since we’ve been around,” he said. Such markets have to have a variety of demand generators between leisure transient, corporate and group business, he noted, plus have a higher barrier to entry.

Furthermore, Suleman noted, “The average millennial traveler tends to seek out unique experiences, and independent hotels certainly add to that sense of mystique.”

Not as enthusiastic about such properties as a growth vehicle this year is NABHOOD’s Ingraham. “Independent hotels will not be a big priority for African Americans because they don’t [command]the awareness and presence of franchise hotels,” he said. “Name recognition and market awareness mean rooms revenue.”

LUXURY

Longtime industry players also will remember a time when luxury properties were considered impervious to many of the tribulations foisted on the “lesser” segments by outside influences, its guest population not really concerned with “those things” for the most part, content to check in as usual to their favorite, cherished five-star hotels and resorts.

But just as the changing concept of what constitutes luxury nowadays causes César Ritz to spin, the segment over time is no longer unassailable by outside influences. Witness luxury’s fall during the pandemic’s first nine months, a decline as spectacular as some of the properties that occupy its space (see chart, page 7A).

In its Hotel Horizons National Forecast, CBRE Hotels Research tracked the segment’s annual growth in occupancy, ADR and RevPAR, comparing 2020 against 2019. At the end of 2019, the luxury segment was enjoying 70.4% occupancy, an ADR of $304.51 and RevPAR of $214.49. In 2020, luxury occupancy plunged to 26.6% by year’s end, a downward shift of negative 62.3%; ADR declined 15.2% to $258.24; and RevPAR fell 68% to a mind-boggling $68.64.

“Luxury properties saw some of the steepest declines during the worst days of the pandemic,” said STR’s Hite. “While the segment still has the furthest to go in recapturing occupancy, it has been able to lift topline performance through ADR. While a shift toward higher-spending leisure travelers has enabled that improvement, further recovery for luxury properties will be tied to corporate travel and international arrivals.”

Luxury figures for year-end 2021 forecast by STR/Tourism Economics put occupancy growth at 48.6% and RevPAR at 67.8%—both metrics showing the strongest advances of all the chain scales—with ADR expected to gain 12.9% compared to 2020. This year, occupancy and RevPAR are forecast to have positive but more conservative growth at 43.4% and 32.7%, respectively, and ADR growth is expected to slow and enter negative territory (-7.5%), according to the companies.

The executives at Kalibri Labs anticipated the rebound for luxury as well as upper-upscale hotels will take “much longer’ with a return to historical levels ‘likely two to three years” away.

“In 2021, both chain-scale segments will only recoup a little over 50% of their 2019 RevPAR levels and about 75% by year-end 2022,” said Estis Green, reiterating their recovery is going to depend on the return in significant numbers of large groups/citywide conventions, large corporate account business travelers and international arrivals.

CBRE Hotels Research puts those RevPAR numbers for luxury and upper-upscale at $112.30 and $79.12, respectively, for 2021; $178.25 and $110.57, respectively, for 2022.

“At this point in time, demand growth is expected to remain muted over the next six months,” added Lomanno.

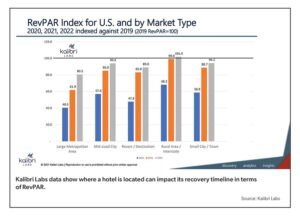

While recovery is happening, where a property is may change how quick that occurs.

“From a location-type perspective, we expect wildly different recovery timelines based on where hotels are located,” said Estis Green. “Not surprisingly, hotels in rural areas and small cities and towns will rebound the fastest, with both having achieved 2019 levels by the end of 2021 and will show more improvement in 2022. Large metropolitan areas and mid-size cities will be considerably slower to recover for many of the same reasons that will affect luxury and upper-upscale properties.” (See chart, page 13A.)

THE GOOD, THE BAD AND THE GOVERNMENT: A SNAPSHOT

Just as almost everyone has an opinion/theory/attitude about the coronavirus that has produced this global economic mess, so too are there a plethora of viewpoints on what’s going to be among the pros and cons facing industry players in 2022 and what role the government still needs to play as lodging faces challenges that keep morphing.

“The positives are that hoteliers are resilient and, with recovery will come back better than ever,” said Rogers. “The negatives are that it’s going to take some time to get there. When adjusted for inflation, revenue per available room will likely remain below 2019 levels until at least 2025.”

“Inflation has been worse than initially expected,” said STR’s Hite, “but big picture, the U.S. economy remains on solid footing and should create mostly favorable conditions for the hospitality industry in 2022. Labor shortages and wages are likely to remain an issue while many hotels work to get back to their pre-pandemic levels of profitability.”

For CBRE Hotels’ Rothman, the positives are: “Improving demand, low (and declining) unemployment, the potential for the resumption of inbound international travel, and a return to office to catalyze further growth, strong pricing power and muted supply growth,” she said. “The negative are labor shortages and cost increases.”

“The negatives for us will be the same as we have always faced: access to capital, barriers to the executive suite and not enough money in the industry being spent with minority companies,” said NABHOOD’s Ingraham. “In many areas where you have many hotels, African American executives will continue to be invisible. A great example is the Miami South Florida market. There are [fewer]than five African American general managers in the market.”

With the rise of the Black Lives Matter (BLM) movement and a greater push by the industry to level the playing field, from first hires to the C-suites, Ingraham was asked how he sees this playing out in 2022.

“Well, the big question is whether BLM is a movement or a moment,” he said. “The industry has done much but can do so much more. The time of window dressing is long past and sound bites make good PR. The major issue that will continue to face the growth of our industry is access to capital and entry to the C-suite.”

All three association executives indicated the government, despite its previous and ongoing efforts, needed to better understand the industry’s recovery challenges.

“The issues are many and the government does not quite understand our industry,” said Ingraham. “Therefore, we are going to have to step up our lobbying activities as an industry and make every effort to get our employees to add their voices to our efforts.”

“The government needs to understand that the hotel industry recovery is choppy and based on location and type of business,” asserted AAHOA’s Patel. “The leisure market has recovered well, but the corporate business traveler is behind, so the perception may be that the industry has recovered, but government needs to understand that all markets have not recovered and still need help. We need to do a good job in making sure we are communicating this to our legislators.”

AHLA’s Rogers said he and his members have been in continuous communication with lawmakers and policymakers at every level, including those in the administration during the pandemic. “Thanks to those efforts, at the federal level, AHLA helped save our industry an estimated $50 billion,” he said. AHLA was able to successfully advocate for its members’ bottom lines by helping broaden the Paycheck Protection Program, expanding SBA’s Economic Injury Disaster Loan program, freezing federal per-diem rates and securing employee retention tax credits.

“But our industry remains at a pivotal point,” stressed Rogers. “The pandemic wiped out 10 years of job growth in the hotel industry, and unless Congress passes common-sense, industry-specific relief for hoteliers and their employees, COVID-related travel reductions will continue to threaten the livelihoods of hundreds of thousands of hotel workers.”

Hotel Business asked AHLA President/CEO Chips Rogers: What are you/AHLA determined to see accomplished by 2023?

“We’re proud of the leadership AHLA has displayed during the pandemic, and we’re going to continue to provide that as we move the industry toward recovery,” he said. Key aspects of this effort include:

• Continuing to educate policymakers about the policies needed to help hotel workers recover and strengthen our industry;

• Educating the broader business community about the benefits of business travel to help bring it back to pre-pandemic levels;

• Communicating a unified message to the public about the safety of hotels in the COVID era;

• Educating stakeholders on how the industry is adapting to meet the changing needs of travelers; and

• Continuing to prioritize human trafficking awareness training as part of the AHLA Foundation’s No Room for Trafficking initiative.

“Additionally, the new AHLA strategic plan is nearing completion and, once finished, it will guide the organization’s focus for the next five years. Labor and workforce, alternative accommodations, community benefits of hotels and sustainability will all be front and center as part of this plan,” he noted.