NEW YORK—There was a time when the line that separated the industry’s upper-echelon of luxury hotels from the segments below it was as thick as the Axminster carpeting found in five-star properties.

But times change and the space once occupied by a privileged few, e.g., Four Seasons, Ritz-Carlton, Mandarin Oriental, Peninsula, Raffles, Rosewood, has become increasingly crowded with a mix of independents, collections and chain offerings.

A glance at the luxury category of STR’s domestic chain scale now finds those “old-school” hotel brands in competition with players that include W Hotels, Andaz, SIXTY Hotels, Viceroy, Edition, Montage, RockResorts, AKA, Loews, InterContinental, Sofitel, Thompson Hotels and the art-driven 21c Museum Hotels, among others. Interestingly, singular, iconic luxury properties in New York like The Waldorf-Astoria and The St. Regis in the past 25 years have served as flagships to brand lines and collections launched, respectively, by Hilton and the former ITT Sheraton (later acquired by Starwood Hotels & Resorts Worldwide, which launched St. Regis Hotels & Resorts; now part of Marriott International Inc.).

The wider swath now cut by the segment incorporating hotel brands that in the past might not have made the five-star cut, coupled with a generational approach right now to having the luxe life and all its trappings—including high-end lodging—has created an interesting paradigm shift for the luxury tier. On the one hand, hotel owners and developers are realizing the opportunities to cash in on the “more is more” attitude of certain consumers, particularly those who are documenting almost every moment of their stays via Instagram, Facebook and Twitter, and are crafting their properties, from FF&E to providing beds and specialty foods for pets, to appeal and cater to almost every whim, and in a way that is immediately “snapable” and out on social media. On the other hand, more and more properties are billing themselves as luxury destinations that are authentic and offer a “sense of place” with a quasi-immersion in the local scene and culture, whether it be urban or outland, to deliver the “luxury” of a unique experience.

All of this effort to capture a market share of guests successful enough to afford luxury hotels, as well as those who are aspirational, has proved successful in itself for the segment.

All of this effort to capture a market share of guests successful enough to afford luxury hotels, as well as those who are aspirational, has proved successful in itself for the segment.

According to CBRE Hotels, the segment is outpacing the national average in terms of occupancy. In its most recent Hotel Horizons report, it noted STR data shows the U.S. lodging industry achieved a national occupancy level of 65.5% for 2016, while upper-price chain scale categories achieved occupancy levels above 70%. And R. Mark Woodworth, senior managing director of CBRE Hotels’ Americas Research, pointed out it was upper-price properties “that led the U.S. lodging industry out of the recession.”

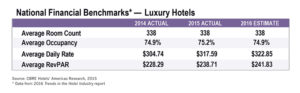

That robustness is expected to shift slightly in the months ahead, judging by the STR/CBRE data. Year-end 2016 occupancy is shown at 74.9%, down 0.3% from 2015, with ADR at $322.85, up 1.7% over 2015’s $317.59 and yielding RevPAR of $241.83, a 1.3% increase over $238.71 the previous year.

While occupancy for the segment may continue to dip, its other fundamentals are expected to show slowing (ADR) and variable (RevPAR) growth. Looking out to year-end 2021, the picture is an interesting one, according to the data forecast by STR and CBRE Hotels’ Americas Research.

Year-end 2017 occupancy is shown at 74.4%, down 0.6% from 2016, with ADR at $329.91 up 2.2% over 2016 and yielding RevPAR of $245.51, a 1.5% increase over $241.83 the previous year.

Forecast in 2018, occupancy is shown at 74.1%, down 0.4% from 2017, with ADR at $337.31, up again 2.2% and yielding RevPAR of $249.91, a 1.8% increase over $245.51 in 2017.

Looking at 2019, year-end occupancy is shown at 73.5%, down 0.8%, twice as much as 2018, with ADR at $342.60 up only 1.6% over 2018, with RevPAR of $251.91, a slowed increase of 0.8% over the previous year.

As the industry enters a new decade, year-end occupancy growth for the luxury tier in 2020 is almost flat at 73.4%, but at a much more shallow 0.1% decrease in growth. ADR again shows a 1.6% increase to $347.94, with RevPAR forecast to bounce back to 1.4% growth, coming in at $255.51.

In 2021, occupancy turns positive again, with 0.5% growth to 73.8% at the end of the year. Meanwhile, ADR is forecast to jump a full 1% over 2020, growing 2.6% to $357.04, and RevPAR surging 3.1% to $263.48. HB