If you’ve noted a recent surge in hospitality products and solutions designed to cater to the outbound Chinese traveler, it’s not hard to understand why—this group is increasing exponentially and represents a huge potential avenue of growth for the industry. But why—and how—should you be ready for them?

David Becker, CEO of Attract China, a company dedicated to helping hotels and resorts in the U.S. looking to attract the Chinese traveler, said, “Outbound Chinese travelers are an important target group for U.S. hotels due to the immense size of the middle class, which is reaching one billion. China’s extraordinary economic growth over the last two decades has reshaped almost every industry in the world, and the travel industry is no different. This growth has already driven huge new demand for airlines, hotels and luxury goods retailers, and that number of upper-middle-class and affluent households in China is forecast to double to 100 million by 2020.”

Sharon Wimborne, executive director e-commerce & global marketing at HotelREZ Hotels & Resorts, emphasized the opportunity this gives international destinations. “The Chinese outbound travel market is the number-one market in the world, having already overcome traditional key markets like the U.S. and Germany,” she said. “And, as far as forecasts go, research estimates that by 2020, the number of outbound travelers originating from China is likely to hit the 200-million mark. This is an impressive number, one that hoteliers worldwide simply cannot ignore.”

Peggy Fang Roe, chief sales and marketing officer, Asia Pacific, Marriott International, noted that the number of outbound travelers could be as high as 234 million by 2020. “In Q1 2016 alone we saw a 7% increase in domestic travelers in China and a 25% increase in Chinese travelers staying with us in our international properties,” she said.

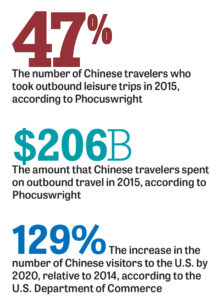

According to China Unbounded: The Rapid Rise of China’s Outbound Millions—research presented by Phocuswright this past spring—47% of Chinese travelers took outbound leisure trips in 2015, and for 23% of them, it was their first trip outside of Mainland China.

According to China Unbounded: The Rapid Rise of China’s Outbound Millions—research presented by Phocuswright this past spring—47% of Chinese travelers took outbound leisure trips in 2015, and for 23% of them, it was their first trip outside of Mainland China.

Jonathan Scofield, senior director of brand operations, Hilton Hotels & Resorts Worldwide, added the Chinese outbound tourism market saw a 12% increase in full-year 2015 over 2014, an increase that’s been consistent since Hilton launched Hilton Huanying, a global program for Chinese travelers, in 2011.

“It’s the largest travel market in the world, growing at an annual rate in excess of 20%, with no signs of slowing down,” said Bruce Bommarito, VP of international marketing, Caesars Entertainment Corporation. “We also know that only 5% of the Chinese market is actually included in the travel market thus far.”

Addressing concerns about China’s economic struggles and how that could affect outbound travel, Wimborne said, “Even though the pace of economic growth is now slower than it was compared to the past decade—during which GDP grew at about 10% every year—China’s consumer expenditure still looks set to witness a healthy expansion in the coming years.”

So where are they going? Fang Roe noted that Japan and other countries in Southeast Asia continue to be popular destinations, as does Europe (particularly the U.K.) and the U.S. According to Phocuswright’s research, the top-visited countries include Thailand, South Korea, Japan, Singapore and Malaysia, with the U.S. coming in sixth.

Becker stressed that the signing of a new U.S.-China Visa Agreement, which reciprocally increased the validity of short-term business and tourist visas and student and exchange visas issued to each other’s citizens, has helped to make the U.S. a more appealing and attainable destination. “Since the signing, the number of Chinese tourists to the U.S. has grown at 20% per year and is expected to continue expanding each year,” he said. According to the U.S. Department of Commerce, by the year 2020, the number of Chinese visitors to the U.S. will have increased by 129% relative to 2014.

Paula Ilabaca, marketing & communications manager at Grand Hyatt New York, said the Midtown property has seen an increase in Chinese guests staying at the hotel. “According to NYC & Company, New York is expecting over a million Chinese travelers by 2018. It’s important to have a product and a hotel they want to come to,” she said, noting that Chinese travelers are also desirable because of their length of stay, which is an average of 11 nights.

Not only are Chinese travelers coming, but they’re spending money. “Sometimes they spend as much as four times more than the average source markets,” said Wimborne. Phocuswright’s research found that Chinese tourists spent $205.7 billion on outbound travel in 2015 with the average spend per trip $2,807; 9% of that was spent on lodging.

Who, exactly, is the Chinese outbound traveler? Becker, quoting research from Gentleman Marketing Agency, said 40% are group travelers in the 40-plus age range traveling once every two or three years; 35% are semi-independent travelers—usually between ages 25 and 35—traveling many times in a year; and 25% are independent travelers between ages 20 and 25.

Brand recognition is important for creating awareness for travelers. Ilabaca noted properties like Grand Hyatt Hong Kong and Grand Hyatt Beijing help to attract travelers. “They have beautiful properties, and we want to share our brand with them here in NYC.”

Scofield said Chinese travelers lean toward full-service or luxury brands like Hilton Hotels & Resorts, DoubleTree by Hilton, Waldorf Astoria Hotels and Resorts, and Conrad Hotels and Resorts, noting that the flagship brand “has been a trusted name overseas for decades.”

“Some U.S. chains, such as Sheraton and Holiday Inn, have been in China for 20 years and are well-established and respected brands,” said Becker. “Yet many brands, even those that may have properties in Mainland China, as well as independent hotels, are often invisible to Chinese travelers.”

It’s a strategy Wyndham Hotel Group is thinking about. At the brand’s conference earlier this fall, Leo Liu, president and managing director, Greater China, said that many other brands beat Wyndham to China—but there’s a key difference in strategy. “Other international brands have been involved in China for almost 30 years, where we are only at 10 years, but we are one of the few—if not the only one—offering a vertical portfolio. We have upper-upscale but also the Super 8 brand, which covers a large space of the country. There’s a brand for every need and every segment,” he said. “Also, we’re one of the few, if not the only, international company going to third- and fourth-tier cities. We started with Super 8 but now Wyndham Grand and Ramada are also going to these cities, where other international players are still focused on the first- and second-tier cities.” By going into these destinations, Wyndham aims to create brand awareness for domestic travelers so when they do save the money for an international trip, they think Wyndham.

Reaching Chinese travelers in the right way will become increasingly important in the coming years. “The segment to focus on attracting is millennials. As awareness on the drawbacks of group tours spreads, more and more Chinese travelers are expected to seek customized travel plans in order to have a unique and authentic travel experience,” said Becker. “As early as 2014, both local and international travel firms noticed an increase in the popularity of customized travel itineraries.” With decreased dependence on group travel, it stands to reason that more tourists should be searching out places to stay on their own.

Fang Roe said, “As Chinese travelers increasingly venture abroad to places such as the U.S., young, affluent travelers tend to look for more personalized experiences—as compared to the more traditional way of joining travel tours. It is thus crucial for them to have access to information and services that can assist their journey throughout the entire hospitality ecosystem—from planning a trip, to requesting guest services, to selecting which loyalty program to join.”

“Most Chinese travelers do their travel research and planning online,” said Wimborne. “And while a U.S. consumer will mostly likely turn to Google, TripAdvisor, Booking.com or Expedia for at least a part of that research process, a Chinese consumer will not. This is because the majority of Western-world websites like Google and Facebook are banned from Mainland China. In most cases, a homegrown equivalent will take center stage. For example, Chinese OTAs Ctrip and Qunar take 66% of the entire market share in China; and Baidu, China’s main search engine, holds 70% of all online searches made in Mainland China. From this alone, one can see how targeting Chinese travelers can differ from other markets.”

The first thing a hotel should do is be present online, not only with a Chinese-translated website and booking engine that’s optimized for the main Chinese search engines, “but also being visible on Chinese social media and Chinese OTAs like Ctrip,” said Wimborne, noting her company does that by using Chinese-native content writers and hosting the hotel’s website in Hong Kong and Mainland China.

Becker emphasized, “Americans and Chinese people have different preferences, so translating an American website directly into Chinese will miss the mark. Chinese-facing websites should be tailored to Chinese culture and sensitivities.” He added the country—much like the U.S.—is vast and internally diverse, so hotels should be cognizant of that when creating content.

Echoing Wimborne’s point about social media, Becker said, “It’s now the most popular channel through which Chinese friends, business associates and companies connect with each other. Establishing a presence on China’s social media platforms is the easiest way for American vendors to get in front of their desired audience.”

And the social media platform of choice for Chinese people is WeChat, which is why so many hotels and brands have started or expanded efforts there in recent months. With 806-million monthly active user accounts globally as of Q2 2016 (for comparison, the app surpassed 700 million in March 2016), WeChat brings together messaging, social communication and games, allowing users to share voice, photo, video and text messages across its entire social ecosystem. And, users registered in China—where the majority of WeChat users live—can use the app to make payments.

Hilton, for instance, has a WeChat account providing information about its hotels and special promotions, and Grand Hyatt New York recently launched its own account, run in collaboration with a WeChat digital marketing agency, The Momentum Group. The account includes direct booking capabilities, which will allow its followers to make or modify hotel reservations, and research rates and special offers, as well as a news feed with hotel updates, amenities and other happenings on property.

According to Ilabaca, the reason for joining WeChat was simple: “You have to be where your customers are. We have to know who our guests are no matter where they’re coming from. If this is a tool they use to make themselves feel comfortable, we have to provide that for them.” Having launched in September, the property is working on building its user base. Ilabaca credits the hotel’s sister Grand Hyatt properties in China for aiding that. “They’re helping promote our hotel, our account and get the word out there,” she said. “Hyatt has been very helpful, the Chinese team that’s over there.”

Speaking to the company’s strategy, she said, “Right now, it’s more about information, and once we get a few more people behind us, we’ll start doing more targeted campaigns. The things you can do on WeChat—it’s everything combined into one beautiful large app. You can pay, you can chat, you can check-in, you can ask questions, you can get a car. There’s so much you can do within there. We’re still learning how we can really talk to our guests through there, starting slowly with information and customer service. Hopefully, in the future, we’ll think about things like paying at the restaurants through the app. We provide a great experience and we’re looking to see how we can really cater to their needs, which is at times different than another traveler.”

For its part, Caesars is also focused on WeChat. While the company has had an account for a while, it recently launched a hotel-booking function on the WeChat platform. The first phase, which began in September, focused on connecting the nearly 24,000 rooms across the nine Caesars Entertainment affiliated resorts in Las Vegas to Caesars Entertainment’s official WeChat account. Over the next two years, the company plans to add its entire portfolio of U.S. resorts throughout 13 states to WeChat Booking. Users can book rooms in Chinese currency with WeChat Pay. The final bill will be settled in U.S. dollars on a dynamic daily rate. Once reservations are confirmed, users will receive a confirmation message through WeChat. Any reservation can be canceled 72 hours prior to the arrival date.

“OTAs and group sales are a big part of what Caesars Entertainment already does to engage travelers with our brands. By targeting Chinese travelers through their mobile devices and the WeChat platform, we’ve had the opportunity to connect with them in ways we’ve not yet experienced. Going from B2B to B2C and connecting directly with the end consumers has had an incremental impact on our bookings,” said Bommarito. “We know it will take time to enter and establish our platform with the Chinese travel market. In order to keep users engaged with our offerings on WeChat, we plan to keep the account vibrant, allowing us to create better brand awareness with our users and potential guests.”

“As Chinese travelers take their travel aspirations further, we need to grow with them and understand what they want and how we can meet their needs,” said Fang Roe. “Through a partnership with the Hurun Research Institute, we developed the Chinese Luxury Traveler 2016 report, which allowed us to uncover some of the biggest trends driving the new generation of travelers, including how this dynamic group seeks personalized luxury experiences and bespoke, digital services. We found Chinese travelers are very tech-savvy and young affluent travelers in China prefer electronic and digital guest services.”

As such, Marriott has also bolstered its technology. “The Marriott Mobile App, which was launched in 2014, offers personalized, unobtrusive services, and allows our guests to make direct bookings, mobile check-in and checkout, and service requests directly via their device,” said Fang Roe. “Particularly for Chinese travelers, we are communicating with guests more seamlessly on Weibo and through our travel partner WeChat. Additionally, in 2016, we rolled out Alipay payment acceptance at select hotels in China and we will soon make this available across Asia to offer guests a more convenient payment experience. This is another key initiative that fits the needs of Chinese outbound travelers, as local payment solutions are one of the most requested features.”

In August, IHG similarly signed a global partnership with Alipay, China’s leading third-party online payment solutions company, giving Chinese guests the ability to pay via Alipay on all of IHG’s online and mobile channels, as well as across its hotels globally. The partnership will initially apply to IHG’s existing 270 hotels in Greater China, as well as a number of properties around the world that participate in its China Ready Program, and global rollout will begin next year.

Attracting Chinese travelers to your hotel is one problem solved; then, once here, how do you cater to these guests to create the optimal experience for them? “Chinese travelers expect certain comforts within their hotels and hotel rooms,” said Scofield, noting that among all participating Hilton Huanying properties, the company has seen a 12% year-over-year growth in Chinese visitors in the past year. “Our Chinese guests report an enhanced experience with Hilton Huanying and, over the past few years, have demonstrated loyalty to these properties,” he added. Currently, there are more than 130 participating properties in 32 countries and 80 cities popular among Chinese travelers, including 40-plus properties in the Americas.

“While some hotels make a point to treat every guest the same way, Chinese travelers, many of whom may be traveling to the States for the first time, respond well to the simplest efforts—handing the room key with two hands; [noting]the number eight is considered lucky because it sounds like the word for prosper or wealth,” said Becker. “By comparison, four sounds like the word for death.”

Wimborne agreed. “There are some things that can be deemed culturally sensitive that hotels and their staff should take into account when welcoming Chinese guests,” she said. “One is placing guests in certain room numbers or floors. In Chinese culture, the number 4 is considered bad luck, so assigning room numbers 4, the 14th floor and so on, to a Chinese guest should be avoided at all times.”

One major challenge with all international guests is communication. “First and foremost, there is a language barrier we hope to take down as much as possible within our properties,” said Scofield. “Chinese travelers will be greeted with a written note in Simplified Chinese, and Mandarin language assistance, with many properties employing Mandarin-speaking team members. Our guest-facing staff members are constantly trained to better understand Chinese culture and, in turn, better serve our guests. Over these past few years, we’ve built upon our learnings to develop a thorough and comprehensive curriculum for our team members.”

Fang Roe added that Marriott’s Li Yu program was exclusively designed to help Chinese travelers who want to take their travel aspirations farther afield while also enjoying a relaxing holiday. “In addition to our Mandarin-language services available via WeChat, the entire suite of Li Yu services allows Chinese guests to take advantage of the exclusive hospitality offerings in ways that fit into their lifestyles and travel preferences. Other Li Yu services include Chinese-language hotel and destination guides, and TV and newspapers straight from China.

In-room amenities are equally important. “Chinese travelers also expect to maintain their culture within guestrooms,” said Scofield. “That’s why at each Huanying property, you’ll find tea kettles, jasmine tea, slippers and a dedicated television station in Mandarin.” And, of course, food should be a consideration. “Our breakfast experiences add value to each Huanying stay,” said Scofield. “We offer Chinese culinary utensils including chopsticks, Chinese spoons and a soy sauce dish, as well as a variety of Chinese food staples including congee, fried rice or noodles, hard-boiled eggs, dim sum, tea and soy milk.”

Similarly, guests staying at Marriott’s Li Yu properties can expect “complimentary Chinese tea and teaware, and food and beverage options that highlight local ingredients while catering to Chinese tastes,” said Fang Roe. Li Yu is currently available at 41 properties globally, including two properties in the U.S.—the New York Marriott Marquis and Waikiki Beach Marriott Resort & Spa—both of which are popular travel destinations for Chinese travelers. “We will continue to introduce the service in more properties around the world,” said Fang Roe.

Other amenities included in some of these programs—or requested by Chinese travelers—include free WiFi; China UnionPay acceptance; a smoking room; minibar cup noodles; toothbrush and toothpaste; local phone cards; and power adaptors.

Traditional foods for breakfasts, like these offerings from Hilton, are important to Chinese guests.

Becker added that catering to the Chinese guest isn’t just a focus for big brands like Marriott and Hilton. “All ranges of hotel can cater to Chinese travelers. For example, featuring Chinese staff and media, the Titta Inn, a budget hotel in L.A., is known for being especially friendly to Chinese travelers,” he said. “But boutique hotels like The Paul in Manhattan’s Nomad neighborhood to major players like the Sheraton NY Times Square Hotel, have turned to Attract China for bilingual travel maps to meet guest needs.”

“While the initial aim might have been to attract corporate travelers in key cities like New York, Paris or London, as the fast-growing Chinese middle class becomes more and more empowered, a new breed of leisure tourists are starting to venture further abroad, looking for more exotic and less-obvious destinations,” said Wimborne. “In fact, travel is now listed as one of the top aspirations for China’s ‘billion boomer’ generation. These younger generations are wealthier and better educated than the older generations, and also have a bigger sense of adventure, trying to blend in with the foreign culture they are visiting. This makes it imperative for the independent hotels to start claiming their share of the market too, leveling out the playing field with the big chains, whilst capitalizing on the local/authentic aspect of their businesses.

“Although still appreciative of culturally sensitive aspects like Mandarin-translated information and Asian-style breakfast options, the younger millennial generation of Chinese travelers are considering ever more the authentic local experience when visiting a particular destination abroad,” she continued. “So expect Chinese travelers to inquire more and more for the greasiest hot dog in New York, the best escargot restaurant in Paris or the grubbiest pub in London.”

“The bottom line is that every hotel type should be looking to attract Chinese tourists,” said Becker. “Many slow periods or off-season months for U.S. hotels, especially after the winter holidays, are prime travel for Chinese tourists… Hotel brands have a once-in-a-lifetime opportunity to shape perceptions of where to stay with a huge and growing audience. Rather than sitting on the sidelines, it is more important to get started and to look at this market as a long-term commitment rather than a toe-dip that needs an immediate return on investment.” HB