NEW YORK—While its sibling segments may get a lot of attention in terms of growth, new brands, social media and consumer consideration, the economy segment is apparently doing just fine, chugging along like the little engine that could—and, actually, contributing significantly to the U.S. lodging industry’s continued revenue growth.

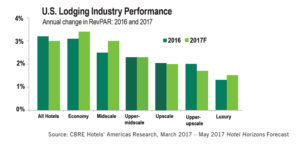

Recent data released in the March Hotel Horizons forecast report from CBRE Hotels’ Americas Research suggests that following seven years of consecutive RevPAR growth, the outlook for the foreseeable future is for more of the same.

However, according to R. Mark Woodworth, senior managing director of CBRE Hotels’ Americas Research, while the upper-price properties led the U.S. lodging industry out of the recession and have continued to achieve occupancy levels in excess of 70%, recently it has been the lower-price properties that have shown the greatest gains in RevPAR.

“In the past five years, RevPAR for U.S. hotels increased at a compound annual growth rate (CAGR) of 5.7%. The only chainscale close to achieving this pace of revenue growth was the economy segment, whose average annual RevPAR increase was 5.6% during this period. That means independent and economy chain-affiliated properties have been the primary drivers of the industry’s recent strong performance,” said Woodworth.

This trend is expected to continue, the CBRE research indicated. For example, from this year through 2021, it’s projecting a RevPAR CAGR of 2.2% for the U.S. lodging industry overall, with the economy chainscale forecast to achieve a 2.8% RevPAR CAGR.

This trend is expected to continue, the CBRE research indicated. For example, from this year through 2021, it’s projecting a RevPAR CAGR of 2.2% for the U.S. lodging industry overall, with the economy chainscale forecast to achieve a 2.8% RevPAR CAGR.

“We recognize that economy properties still achieve the lowest levels of occupancy and ADR, but investors looking for a ‘growth story’ shouldn’t overlook this segment of the industry while some of the other chainscale categories begin to stall out,” said Woodworth.

“In terms of [overall]occupancy, ADR and RevPAR, it really is almost a block-by-block decision whether we’re remaining stable, if we’re growing or if we’re declining,” said Peter L. Nichols, national director/National Hospitality Group, Marcus & Millichap. “A lot of that hinges on the new supply that’s coming into a market… The economy segment, the smaller limited-service properties, have been very consistent throughout the entire cycle. It’s seeing continued, reasonable growth, reasonable occupancies; it’s improving continuously. I don’t see a decline in that sector at all. We didn’t see the rapid growth we saw in full-service, but we didn’t see quite as significant a decline, either. It’s much steadier in terms of its performance, and has been year over year over year.”

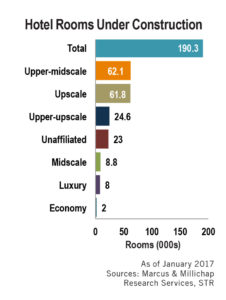

Among the challenges Nichols sees facing owners in the segment is selecting the right brands when doing a new-build, although he acknowledged there’s not much new construction going on in the segment.

“The continued increase of supply is going to put some pressure on the economy sector,” he noted, adding, “So, how do you maintain your property and get all the PIP work done? A lot of work that was deferred is now coming due.”

In contrast, Nichols cited the consistency of the segment as an advantage in that it lacks some of the ups and downs experienced by other segments, therefore, he said, having “far less risk.”

The segment also has more options from a lending perspective when it comes to financing a project.

“Typically, you are not looking at a Motel 6 that’s a $150-million deal,” Nichols commented. “You are looking at a much smaller price tag on it. And, because of that, you can use SBA [Small Business Administration] financing: You can use the 504, the 7(a). I can’t go out and finance a $30-million to $40-million hotel with an SBA loan; it doesn’t qualify.”

Another advantage is the ability to have a higher leverage with an SBA loan, Nichols offered. “Right now, you can push your leverage on an SBA deal if—and there are some big ifs—you’re an experienced operator and if you are willing to personally guarantee the loan. If you’re willing to do that, you could lever up to 80-85% for the right deal. So that allows someone to deploy more capital or the same amount of capital into, maybe, two [or three]assets as opposed to one asset…go into different markets with these economy properties and not put all their eggs in one basket.”

As far as location goes, while being in an urban/primary market likely would result in a higher ADR for an economy property, operational and labor costs could eat at the profit margins and Nichols suggested secondary and tertiary markets would make better fits. “You can be a bigger fish in such markets,” he said, although he cautioned the demand pool for rooms is typically thinner.

As far as location goes, while being in an urban/primary market likely would result in a higher ADR for an economy property, operational and labor costs could eat at the profit margins and Nichols suggested secondary and tertiary markets would make better fits. “You can be a bigger fish in such markets,” he said, although he cautioned the demand pool for rooms is typically thinner.

As for what’s ahead, Nichols indicated 2017 would be consistent with last year. “I don’t know that we’re going to see a huge upswing in the number of transactions, but I do think we’re going to see very solid improvements in the economy and limited-service sectors when compared to full-service. That’s driven by the availability of funding for acquisitions; I think there’s capital out there. If you are disciplined in your investment there are a lot of good markets,” he said.

“The fact is that U.S. hotels are achieving all-time record occupancy levels and near record profit margins,” noted Woodworth. “A lot of money is being made from hotel operations these days. While the prospects for growth in revenues and profits are moderating, opportunities still exist. Investors just need to investigate some of the historically overlooked chainscale and geographical segments to find better returns.” HB