ATLANTA—While many movers and shakers at the 29th annual Hunter Hotel Conference acknowledged a shift downward in the industry’s robust performance is inevitable, there was no apparent sag in confidence that industry fundamentals would remain strong in the near term while owners and developers maintain a steady pace of buying, building and renovating hotels.

Founded and organized by locally based Hunter Hotel Advisors, the three-day event held at the Marriott Marquis Atlanta drew a wealth of hotel owners and investors from 40 states and five countries to get a read on the current lodging real estate and finance landscape in an environment changed by increasing interest rates, more consolidation, more brands and competition, and the overarching influence of a new government administration.

Owners’ confidence is as strong as it was last year, said Bob Hunter, CEO of Hunter Hotel Advisors, who co-chairs the conference with his son, Lee, the company’s COO. “Last year, 61% of the owners [who attended]told us they planned to develop a new hotel in 2016,” he said. “This year, our survey shows 60%—statistically the same amount—of owners here today plan to develop a hotel in 2017. That shows a high degree of confidence in our industry.”

In addition, 92% of attendees at this year’s conference indicated they planned to finance something in 2017 compared to 85% last year.

Hunter noted there were 89 hotel lenders at the event. “They want to talk with good borrowers about lending money on good projects,” he said, adding, “Market fundamentals remain strong. There’s an abundance of capital ready to invest; however, there’s a very wide bid-ask spread between buyers and sellers,” which, he felt, needed to be worked through.

Bringing their perspectives on the industry, CEOs on the opening session’s President’s Panel included Keith Cline, La Quinta Inns & Suites; Dave Johnson, Aimbridge Hospitality; Jim Merkel, Rockbridge; Greg Mount, RLHC; and Lance Shaner, Shaner Hotels.

In a snapshot poll, the panelists were asked to give their responses to the following: At this moment, my take on the U.S. hotel industry is: a) Pretty darn good. I wouldn’t change a thing; b) Meh. There are good days and bad days. Just have to stay on top of it; c) Hmm. I’m mulling my options and have my broker on hold; and d) Yikes. I’m getting out and heading for the doomsday bunker.

With 888 hotels open and operating, and 240 in the pipeline, LQ’s Cline opted for staying on top of it. “A strategy to do nothing is a strategy to lose, and the way that we win in this industry is by beating the competition each and every day on every street corner,” he said.

“I think it’s a great time for the industry,” said Johnson, going with the first choice. With many brand products represented by Aimbridge’s 70,000 rooms, he added, “I think we’re a little bit frustrated because most of the brands are public companies and we’re forecasting 2-3% RevPAR growth coming off of five or six years where we’ve had 7-8% growth. So, there’s a little bit of a doomsday attitude out there. But I think in most industries, 2-3% top-line growth would be very satisfying. There’s a little bit of supply concern. I don’t think I’d say I wouldn’t change a thing, but I’ll go with answer ‘a.’”

Like Cline, Merkel went with the second choice, noting from the investment company’s point of view, “things have settled down and the industry reforecasted late last year forward revenues to grow slower. I think it’s just the law of numbers; at some point it’s got to slow down the pace of growth. It’s still healthy, but you’ve got to stay on top it.”

With some 1,200 hotels, RLHC’s Mount concurred, noting, “If you asked me this question pre-election, it might have been different, but right now, you’re seeing unemployment considerably lower than it’s ever been—down around 4.7%—and seeing discretionary spend out there that we haven’t seen in a while,” he said.

Shaner, with 50-plus hotels and eight under development, joined Johnson on the optimism front, checking off the first answer.

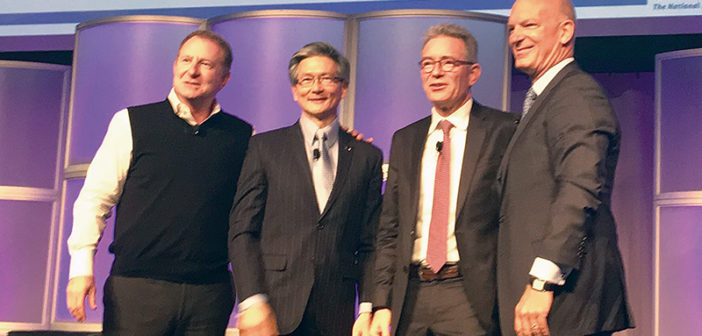

LEFT TO RIGHT: On the President’s Panel: La Quinta’s Keith Cline, Aimbridge Hospitality’s Dave Johnson, Rockbridge’s Jim Merkel, RLHC’s Greg Mount and Shaner Hotels’ Lance Shaner.

The executives ran through a roster of industry concerns/issues, not the least of which was consolidation, with the Marriott/Starwood merger still a topic of interest as it plays out.

Shaner, whose company has 30-plus Marriott products, estimated it would take three to five years before the deal gets fully sorted out. “Our biggest concern and question is the impact when it’s fully integrated,” he said, noting as an owner, the company maintains quality standards doing PIPs every seven years. “The challenge of management will be maintaining that consistency and integrating a large company. What do you do with all the brands? Some of them, I expect, will go away,” said Shaner. On the plus side, he said Marriott’s increased scale would give it greater clout with entities such as OTAs.

At the opposite end, Cline delivered some insight regarding La Quinta’s plan to separate its real estate business from its brand and management company. “We really believe this is the next logical step as we execute our strategies,” he said. “Moving the real estate into an independent company…unencumbers the brand and management company to pursue strategies that are more asset-light in nature. From an investor perspective, it gives shareholders and equity analysts a chance to evaluate both of these businesses independently.”

Mount, whose RLHC acquired Vantage Hospitality Group in Q3 2016, felt the M&A trend would continue, and Aimbridge’s Johnson, whose firm acquired Evolution Hospitality two years ago and snagged Pillar Hotels & Resorts last year, agreed consolidation would continue, particularly on the brands side. “Why do we continue to bulk up? I believe scale is going to be a fantastic edge in our space,” he said.

Brands and their proliferation also were top of mind. Rockbridge’s Merkel averred hotels are consumer products and “consumer preferences change… What we’re trying to do is align our hotel with the consumer demand that we’re seeking in that particular market. Sometimes there isn’t brand differentiation, there’s a lot of brand blur. And sometimes there’s already a brand there and you can’t choose that brand, but you have an alternate brand. That’s that beauty of the brands. They keep finding white space for new brands.”

Mount noted RLHC is “really focused on building our platform for our brands going forward and, by the way, we’re in the process of stratifying those and actually reducing the number of brands we have so we can be focused and authentic in what we’re doing.”

From his perspective, Shaner said, “There’s too many brands… The expansion of the brands really is by franchise companies. From their perspective, it just allows them to license more properties. That’s what that’s all about.”

C-suite executives on the panel “A View from the Top” also looked beyond the industry’s buoyancy to provide a 30,000-ft. view of the ideas and concerns that may shape the future.

Moderated by Kirk Kinsell, principal of Panther Ridge Partners LLC, an investment and advisory group, the panelists included David Kong, CEO, Best Western Hotels & Resorts; Liam Brown, president of franchising, owner services and MxM select brands, North America, Marriott International; and Rob Sarver, chairman/CEO, Western Alliance Bancorporation.

Being six months post-Marriott/Starwood merger, Brown’s outlook is remaining steady for Q2 and the remainder of the year: “Our perspective would be the first quarter gives us no reason to think our guidance for the year is any different. Our guidance is between 0.5- 2% RevPAR growth. January was pretty good, mostly due to the fact that we had an inauguration in Washington, DC, which was large exposure. February and March is much as we thought it would be. GDP continues to grow, albeit slow and steady, and from a RevPAR perspective, we’re not anticipating any change in our guidance.”

Best Western’s first quarter is shaping up much better than estimated, according to Kong. “When we started the new year, I didn’t know what to expect,” he said. “Thankfully, the RevPAR growth is up by almost 3%. I was looking at advance bookings through the summer months and I was very encouraged by that, up by about 12%. I’m very encouraged about the rest of the year.”

While seeing some positive signs, Sarver pointed to the new White House administration and whether policy will impact the hotel business. “We’ve seen the loan pipeline pick up and there’s optimism, but will it be confirmed and executed by the new administration? I’d like to see what will happen with tax reform and infrastructure spending, so I’m cautiously optimistic,” he said.

Sarver noted there also have been some surprises: “The stock market’s reaction was stronger than I thought. Everybody got optimistic after the presidential election. Are all those campaign promises happening, and how will it affect the market? When you look at newspapers, what’s being talked about will not drive employment growth and that is what drives travel. It’s a wait-and-see situation. Republicans have to prove they can get things done.”

“Scale wins at the end of the day,” said Brown. “We’re currently digesting an elephant [Starwood]. From a practical and tactical standpoint, we’re getting our arms around the business. We believe with the acquisition revenue and cost synergies, the merger is a great value proposition in the customer and business view. We will have a clear value proposition for each brand and there are big opportunities from a cost revenue standpoint. It’s a great deal for owners and guests.”

While M&A is altering the lodging landscape, Kong noted the pace and scale of change, in general, is always on his mind. “It’s the competition in loyalty programs, product experience, etc. OTAs are constantly evolving and Airbnb is not standing still. They’re going into the luxury segment and becoming more formidable,” he noted. “Google is monetizing search engines and there is this siphoning off to the OTAs. If we’re not advertising on Google, the business lands somewhere else. It makes it expensive to operate and tougher to compete. We must pay attention to customization. People want options. It’s all an effort to make sure our brand has different experiences and price points the customers are looking for.”

Hailing from Google Inc., speaker Rob Torres, industry director/travel, painted a picture of “The Future of Travel Booking,” highlighting several initiatives the search conglomerate is investigating. With the rise of voice-activated personal assistants, Torres noted the next big shift in how people accomplish a task-filled schedule would center around machine learning, the ability of a computerized assistant to aid with chores, including planning travel, activities and experiences, based on cumulative data and preferences.

“Technology has truly changed travelers’ behavior and how they plan and purchase travel,” said Torres, noting consumers who once relied on sources such as travel agents to gain knowledge are now largely doing it all themselves. “The digital world has changed everything. In the digital world, the average hotelier has 10 times more digital touchpoints than [he/she] has physical touchpoints,” added Torres.

Barry Sternlicht was the recipient of the eighth annual Hunter Conference Award for Excellence and Inspiration.

Another speaker, Barry Sternlicht, chairman/CEO of Starwood Capital Group, delivered the keynote address before receiving the eighth Hunter Conference Award for Excellence and Inspiration. The industry icon offered his views on a variety of topics ranging from his early days, doing deals and creating concepts at Starwood Hotels & Resorts Worldwide to global economics, the environment and some of his current hotel activity. In addition, he delivered anecdotes and one-liners about his encounters with famous friends, including one now living in the White House, and even offered some advice.

“My mom said, ‘Everyone has 24 hours in a day. How you choose to spend them is up to you.’ It’s been a fun time. I think it’ll be a really exciting next decade. I think anytime the government gets involved, there’s opportunities. And this government seems like it’s going to get involved in a lot of stuff. One last thing: My greatest accomplishment at Starwood Hotels was building a company with a good soul. This is a great industry. It’s a fun business. People who want to do this should do this. If you’re not going to smile every day and leave your cares at home, this isn’t the place for you. In a world that’s so divisive, there’s no more important industry for teaching global tolerance, the value of diversity, in times today where we seem to be really divided. This is an industry that knits the whole thing together and I’m proud to be a part of it,” he said. HB

Corris Little contributed to this article.