The COVID-19 pandemic has taught the hospitality industry a number of lessons throughout its existence, chief among them, perhaps, is to be ready for anything. As the world enters the next phase of recovery, it is probably best to take on the Boy Scouts of America motto “Be Prepared.”

During the latest Hotel Business Hot Topics session, “Hotel operations: Success strategies for the year ahead,” with sponsor support from Hotel Effectiveness, industry experts offered their thoughts on what issues the industry will face—as well as advice to plan for them.

Moderated by Chip Rogers, president/CEO, American Hotel and Lodging Association (AHLA), the group of panelists included Nan Cummings, COO, InterMountain Management; Ron Loman, SVP, operations, Real Hospitality Group; Aaron Olson, SVP, hotel operations (now EVP, operations), Crestline Hotels & Resorts; and Del Ross, chief revenue officer, Hotel Effectiveness.

Rogers asked the panelists what they are expecting for 2022 given all of the variables out there, as well as those that are unknown.

Olson said that much like last year, leisure travel will start to take off again midway through this month with Valentine’s Day and President’s Day weekend. “That was the first big wave of leisure that had hit across the country [last year],” he said. “So, we’re expecting something similar. Most experts are expecting that Omicron cases are going to start coming down somewhere around mid-February, and I think that pent-up demand still exists… We are absolutely optimistic that leisure demand will be just as strong—if not stronger—than last year. We expect to see ADR growth on that.”

One big difference is that we have last year as a guide. “The key is this year, as opposed to last year, is that we trust it,” he added. “We didn’t trust it until it was here. So, from a labor-planning perspective, we weren’t as prepared as we should have been, and I think that goes for most of the industry. This year, we are taking a completely different approach. We are banking on the fact that it’s going to happen. So, all of our plans and processes have been in place for the past few months preparing for that.”

Cummings agreed that they were not prepared for the rise in leisure travel last year. “We were closing inventory,” she said. “It was truly a tidal wave that came that we weren’t anticipating. What we’re doing right now is just monitoring our booking window and group pays and just overcommunicating with operations from our revenue team to the properties about what they are anticipating to come so that we can be prepared.”

Loman said that his company is studying forecasts and data that they have never done before, including from TSA checkpoints, the WHO and searches. “Now, the booking window is so irregular and people are very hesitant to book, but people are still planning,” he said. “They’re still thinking about that.”

He agreed that last year’s experience is helpful. “As we come out of this last variant, it’s very different than when we came out of the first one,” he added. “That’s going to play a key role. We’re seeing the search [data]that’s higher than it was in ’19, ’20 and ’21. In those markets, we know what’s coming… We have got to focus on making sure we have the right rate position strategy, but also the right labor strategy because that’s probably going to be where a lot more of the work is going to come in.”

Ross dubbed the upcoming travel season Revenge Travel 2.0. “It is going to be bigger,” he said. “Part of the reason for that is we now have more than 200 million people who are fully vaccinated in the U.S. Thanks to Omicron, another 40 or 50 million people will have recently had COVID and have at least temporary immunity. So, we have a massive number of people who are feeling bulletproof. Everybody who didn’t take a trip last year, just on optimism alone, is going to feel really good about booking travel—and they’re doing it right now.”

He expects the influx of travelers to “hit us really hard,” adding, “The difference between this year andlast year is that hotels have no excuse for not being prepared for it. Nobody should be complaining about not having enough staff because we need to be modeling this now and starting the hiring and onboarding process now for the spring so that we’re not trying to play catch up all year. This is really important.”

Ross added that using models will help with the increase. “In addition, we need to use weekly dynamic staffing and planning models so that we can actually adjust our staffing with this wildly fluctuating occupancy every single day, so we don’t have to close rooms for sale,” he said. “Most hotels in the U.S., even the ones that were doing well, were closing anywhere from three to five rooms a night that they couldn’t sell because they couldn’t clean them. We need to solve for that by actually just staffing better and having more adequate staffing.”

Those staffing troubles will remain a major concern for the industry. Ross said that while the industry reached a peak in October 2021 of 71% of pre-COVID staffing levels—and he does expect them to continue to rise—he doesn’t expect to see it reach those levels this year.

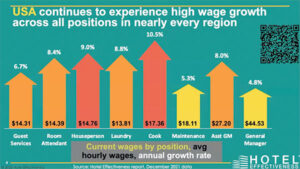

The labor crunch has also meant higher wages, according to Ross, especially for new hires, compared to pre-COVID. “In general, these wages have grown faster than they grew for overall wages,” said. “That is the result of the competition for new staff. And it’s a reflection of the reality that we’re hiring people who did not work in our industry before, and we’re having to attract them with extra-high wages. New higher wages are, of course, below the average wage because tenured people get paid more, but we need to track this because first, we need to be competitive. Second, these new-hire wages will drive up our tenured hire wages and our supervisory position wages.”

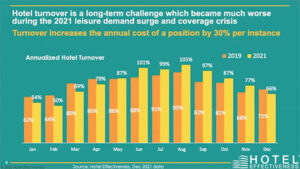

Retaining employees is also a major concern, as Ross reported that turnover among employees is also at record levels, with turnover increasing the annual cost of a position by 30% per instance.

Real Hospitality Group’s Loman said that hiring and retaining employees remains important. “It’s really finding those individuals where we can ignite the passion for hospitality…,” he said. “Training is key as well. A lot of the associates that we do have now have never worked in the hospitality industry…I try to work with our operations teams [to]really focus on right processes because I think if you have the right processes in place, it’ll drive the productivity, guest satisfaction and the guest’s trust.”

Cummings reported that InterMountain has put in place some incentives for retaining and bringing in new employees, including a retention bonus, a signing bonus and a referral bonus, but, she said, the most important retention factor is the company’s culture. “Culture is key,” she said. “We haven’t experienced the turnover that a lot of people have. It’s not because we’re perfect—we’ve certainly made our fair share of mistakes—but it’s just we try to stay consistent and do the right thing. That’s what differentiates us.”

The company has had turnover at the line level, but most of its GMs have stayed—and some of its employees even offered to take pay cuts. “They’ve just done an amazing job getting through these hard times and we continue just to band closer together,” she added. “We’ve been through several ups and downs.”

Another concern that ties into the labor shortage is rising guest expectations, according to Crestline’s Olson. “Guests are paying more for their stays,” he said. “We are well past them being forgiving in terms of COVID reasons for having amenities closed and for not offerings services—guests do not want to hear it. They don’t care that we are understaffed. They want a great hotel experience—and, in many ways, they want an experience that exceeds what they had pre-pandemic.”

He said the company has taken the past few months to focus on the training of employees to get them back into the pre-COVID hospitality mentality. “We have to get everybody retrained,” he added. “We have to get out of pandemic mode where our staff really got beat up. It was rough. We have to somehow get back to hospitality and providing that wonderful, warm, sincere service and an experience that guests can count on.”