NEW YORK—One of the most desirable locations for hotels in the U.S., New York City is also one of the most watched markets in this industry. New research from Morningstar Credit Ratings LLC studies the city’s ballooning supply, particularly in relation to the $3.6 billion in commercial mortgage-backed securities (CMBS) loans backed by Manhattan hotels.

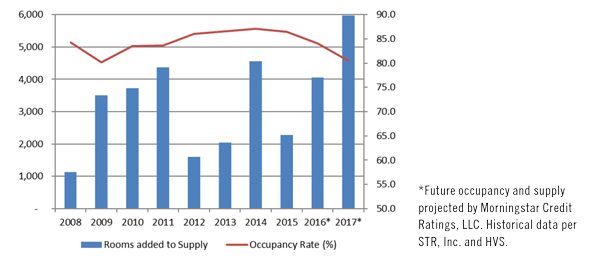

Certainly, the fact that NYC has been experiencing a huge growth in supply is not surprising. “The construction of hotels in Manhattan is very impressive; the numbers are very large, not just in absolute terms, but relative to the total supply of hotel rooms in Manhattan,” said Brian Snow, CFA, VP, CMBS, and one of the authors of the study. Since 2009, Manhattan has delivered 18,569 hotel rooms, a 26.3% increase to existing supply, per data from STR, Inc. Additionally, projects underway this year and next will add a little more than 10,000 more rooms, with 10,000-15,000 more anticipated 2018-2020, according to Morningstar’s analysis of market data.

Morningstar attributes this rapid growth in supply to three factors: public policy, capital market trends and EB-5 funding. In 2006, then-Mayor Michael Bloomberg called for a goal of 50 million tourists by 2015, and Morningstar noted that public policy in recent years has aligned to welcome tourists and hotel development alike. According to NYC & Company, the city achieved this goal, attracting 58.3 million tourists in 2015, and is expected to attract 59.7 million this year.

With regard to market trends, Morningstar noted that to be profitable, a developer needs a project’s market value to exceed the cost and, according to Real Capital Analytics, Inc., this occurred: The average price for Manhattan hotels sold in 2005 was approximately $482,000 per room for the trailing four quarters through the end of the first quarter of 2006. That average price increased to $775,000 in 2015, amounting to a cumulative 60.8% price increase. RCA’s data also indicates capitalization rates declined to 4.9% in 2015 from roughly 7.7% in 2005, but Morningstar projects this will stabilize over the next 12 months, and could increase over time.

As for EB-5 financing, Morningstar found that hundreds of millions of dollars have been used for NYC projects, much of which came through two of the largest hotel developers: the Lam Group and the McSam Hotel Group. Snow also noted that there could be shifts when it comes to this: “EB-5 funding has been very important in providing cheap capital to hotel developers, and it’s up for renewal. Changes to EB-5 could have a material impact on the ability of developers to get money to build hotels.”

While new supply has increased tremendously, Snow noted that Manhattan has traditionally been under-supplied when it comes to hotel rooms. “Manhattan has become more popular as a destination for tourists, and after many improvements to the international economy, you had so many foreign tourists coming to NYC from places like China,” said Snow. “There’s been tremendous growth in demand, so yes, the supply was always lagging.” For instance, according to the company, the number of visitors to NYC has grown at an annual rate of at least 3% since 2009.

However, that tide is turning. The growth rate of domestic and international visitors has decelerated. According to NYC & Co., the year-over-year increase for domestic visitors fell to 3.4% in 2015 from 4% the previous year; for international travelers, it went from an increase of 4.3% to 2.5%. According to STR, the 2015 growth rate in occupancy dropped below 2% for the first time since the recession.

Snow noted, “The way it often works is by the time you start really building new supply, it’s after the peak in demand growth.”

However, he added that demand can be hard to predict. “So far, demand growth still seems to be chugging along at a slow pace… but the thing about demand is you don’t have a lot of lead time to understand what will happen to demand next year,” he said. “People book vacations maybe six months in advance. If there’s any major economic hiccups, hotels will feel the impact before other commercial property types.”

So what does increasing supply and decelerating demand mean? Morningstar projects that over the next two years, occupancy will fall to 80.5% and ADR will slip to 4.4%, resulting in a 10.9% decline in RevPAR over the period, based on the assumption that demand growth will slow to less than 3%.

How will CMBS-backed hotels fare in this environment? As of this April, Morningstar found only one defaulted loan—the $33.1 million Shoreham Hotel loan—and one other loan that had been specially serviced. However, it identified 14 loans that total $730.9 million (or 19.9% of the total Manhattan exposure) with increased default risk. With increasing supply and an expectation for demand to drop, the company noted the cash flow of many of these hotels would drop, elevating the risk of default. “Regarding hotel mortgage loans with low DSCR, you can’t say for sure that any particular loan will default, but if you have 14, you know there’s a good chance that a good number of them will default—you just don’t know which ones,” said Snow, noting that loans in NYC tend to be large. “For those CMBS deals, a $100-million loan defaulting could have a big impact on the credit quality of the CMBS security.

“If we get to 2017 and hotel fundamentals and the economy are bad, and financing liquidity dries up, then you could have problems, but right now it’s just a cautionary outlook that this could be a problem,” continued Snow. “This is a trend we’re observing and we’re going to continue to monitor.” HB